The Green Leap: Dismayed battlelines drawn at COP29

COP29 concluded with the announcement of a new core climate finance target to assist developing nations. Although a step in the right direction, this new funding target was slammed by many as insufficient. In this Research Briefing, we do a postmortem of the COP29 agreement and its implications for Africa, with a focus on the new collective quantified goal on climate finance and the potential of a global carbon credit market.

What you will learn:

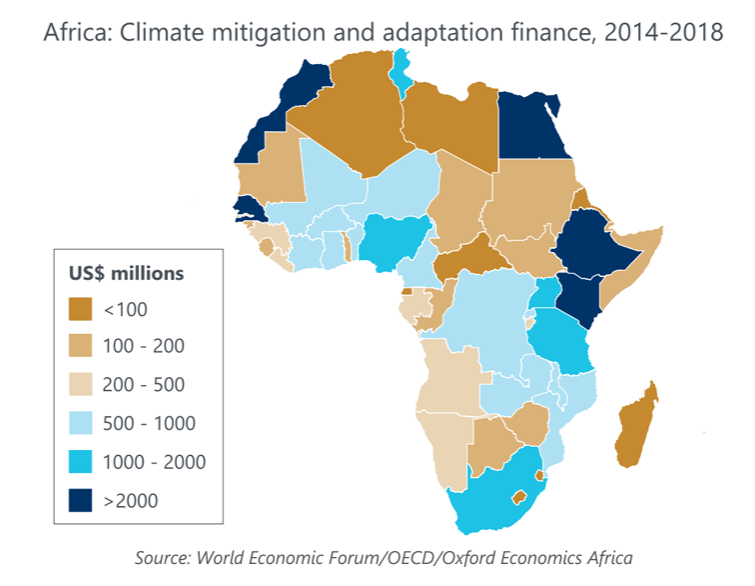

- With wealthy nations now agreeing to a US$300bn per year core finance plan, the deal also calls for both public and private funders to upscale funding to US$1.3trn per year by 2035. In comparison to Africa’s climate funding needs, the implementation of the continent’s nationally determined contributions requires an estimated US$2.5trn over 2020-2030. Although the core financing goal could cover Africa’s annual climate financing needs, this would require that nearly all of the funds be directed to the continent, which will not be the case. Funding through the loss & damages fund also remains inadequate, with total pledges now sitting at just over US$750m. Put into perspective, weather, climate, and water-related hazards caused more than US$8.5bn economic losses in Africa in 2022.

- One potential avenue for Africa to access much-needed climate finance is through the global carbon credit market, which was advanced at COP29. Carbon credits allow countries and companies to offset their carbon emissions by investing in projects that reduce or remove emissions elsewhere. For Africa, this could mean benefiting from the continent’s vast natural resources. However, challenges such as high certification costs, underpricing, and weak infrastructure for monitoring emissions could hinder the full realisation of this potential.

- In addition to financing rifts, the re-election of Donald Trump as the 47th US president casts another layer of uncertainty at COP29. His return to the White House and his “America First” policy may be a setback for climate progress. For Africa specifically, a Trump presidency could result in one less traditional donor nation to the continent’s pool of funds, which is already vastly inadequate.

Tags:

Related Services

Post

The Green Leap: COP29 to reframe funding support

The latest nationally determined contributions (NDCs) contain astonishing funding requirements. The funding needed to adapt to climate change and mitigate carbon footprints by 2030 equates to roughly 90% of each country's current GDP for South Africa and Nigeria, according to their NDCs.

Find Out More

Post

CNBC Africa: Africa Risk-Reward Index shows megaprojects & tech growth

Jacques Nel, Head of Africa Macro at Oxford Economics Africa joined CNBC Africa to talk about the recent Africa Risk-Reward Index.

Find Out More

Post

Ghana: Election scenarios 2024

This Research Briefing presents two scenarios for Ghana’s December 7 general election, based on our assessment of the election manifestos of the New Patriotic Party (NPP) and the National Democratic Congress (NDC). We compare the macroeconomic forecasts associated with each scenario to explain the probable interplay between politics, policy, and macroeconomics in Ghana following the election

Find Out More

Post

Kenya: Populism to austerity, Ruto’s struggle to balance the budget

Kenya has been facing a tumultuous month from an economic and political perspective, but our baseline scenario assumes that the East African nation is not headed towards a fiscal cliff.

Find Out More