Euro-dollar has hit the floor, but don’t expect a bounce

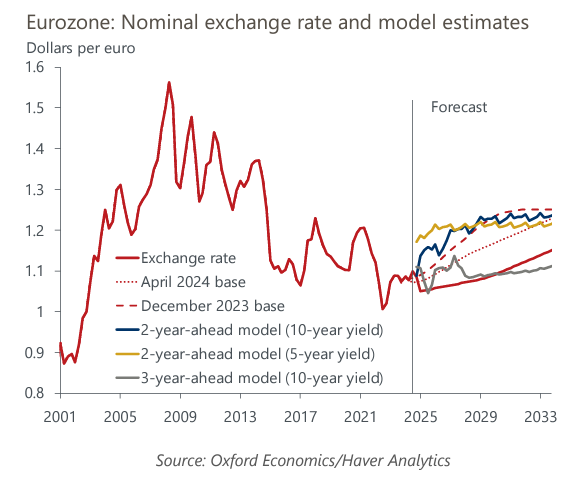

We expect the euro to stabilise against the dollar and trade around its current levels over the next year. Economic fundamentals point to some support to the currency after the sharp, recent depreciation, but heightened uncertainty continues to pose a key downside risk.

What you will learn:

- The euro’s recent depreciation reflects both external and domestic factors. Trump’s election increased uncertainty, which is typically dollar-positive, and widened interest rate differentials due to expectations of looser fiscal policy in the US. And an unfavourable growth gap reduced the eurozone’s attractiveness for international investors.

- Economic fundamentals point to no further weakening. We expect the real bond yield differential will become less negative and stronger growth should attract capital flows into the eurozone. However, the euro will struggle to meaningfully recover due to headwinds dissipating only gradually and a persistent productivity gap versus the US.

- Still, exchange rates are not solely driven by fundamentals. For instance, if we were to see a rise in risk perception, blanket tariffs on the EU, renewed distress in energy markets, or a worsening in France’s political turmoil, the euro would likely depreciate.

Tags:

Related topics

Europe: What Trump 2.0 means for Central and Eastern Europe

Central and Eastern European economies are among the most exposed to the impact of Trump policies due to their large, export-oriented manufacturing sectors and sovereign currencies.

Find Out More

Eurozone: Pension system sustainability hinges on unpopular reforms

Increased spending to meet the needs of an ageing population jeopardises the sustainability of Europe's public pension systems, based on current legislated measures.

Find Out More

The Economic Impact of the EU Tyre Manufacturing Industry

This report assesses the impact of the tyre manufacturing industry on the EU economy through an economic impact assessment, trade analysis, and analysis of the tyre manufacturer's R&D spending in the region.

Find Out More

Industry Forecast Highlights: Industry dynamics driven by Trump 2.0 policies

Our latest global industry forecasts reflect the impact of a second Trump presidency on industrial sectors. The US industrial forecast is now upgraded over the next two years, reflecting the impact of corporate tax cuts, with capital goods sectors expected to benefit most.

Find Out More