Trump policies could be a circuit breaker in global electronics supply chain

Electronics and high-tech manufacturing, such as semiconductors, is one of the most globally integrated manufacturing supply chains. This has created large efficiency gains and cost savings for corporates in this sector, both in the US and around the world, but also leaves them highly exposed to the rising risk of a major hit to their profits from protectionist policies under the incoming Trump administration.

US-China technology decoupling already underway

The effort to cut off Chinese access to advanced chipmaking technology has received bipartisan support in the US, and the trend is set to only accelerate under the Trump administration.

We expect 30% tariffs to be implemented on most of the Chinese goods as the US turns more protectionist. However, semiconductor imports from China will be unaffected by the new tariff as the Biden administration had already imposed a 50% tariff on Chinese semiconductors, expected to come into effect in 2025.

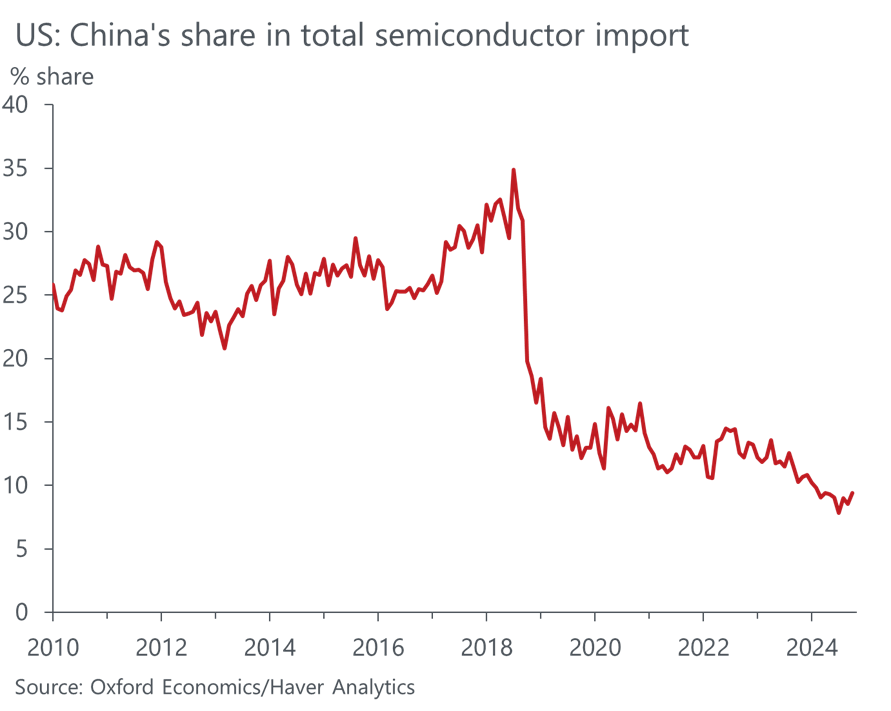

Semiconductor exports from China to the US have declined in importance since 2019 following President Trump first wave of anti-US tariffs, with the import share in the US declining from 30% to below 10% (Chart 1). Moreover, monthly data show no apparent signs of firms frontloading shipments ahead of the tariff coming into effect, suggesting they may have already successfully diversified away from Chinese chips.

Chart 1: China’s share in US semiconductor import has dropped dramatically since 2019

But China is also a major producer of other types of electronic products such as computers, office equipment, telecommunication equipment and consumer electronics. Additional tariffs on these products—expected to begin from 2026—will be a huge blow to China. Semiconductor exports account for only around 10% of total Chinese electronics exports to the US, so the new tariffs will arguably have a bigger impact on non-semiconductor electronic goods mentioned above.

In the near term, any downward pressures from higher tariffs will be offset by the US fiscal loosening, which will lift investment and benefit the capital-intensive electronics sector. We expect US real GDP growth will be 0.3ppt higher in 2026 than the previous baseline. Fiscal loosening will take the form of preserving the expiring provisions of the Tax Cuts and Jobs Act, restoration of the business tax provisions and the immediate deduction of R&D expenses. Higher spending will also lift the economy, particularly on defence.

Further US-China decoupling, for example, through the imposition of higher tariffs, will likely lead to higher domestic production in the US by both foreign and domestic firms. Already, such moves are underway thanks to the 2022 CHIPS and Science Act. TSMC is set to start chip production at its Arizona fab in 2025, with the plans for second and third fabs in place. Although there has been delay, Samsung Electronics is also set to produce chips in the US.

Our baseline scenario assumes that the CHIPS and Science Act will remain intact under the Trump presidency, but its repeal is a downside risk to US electronics production. President-elect Trump has criticised the Act in the past, opting for higher tariffs to bring production capacity onshore. There is wide bipartisan support for the Act, so it may be tricky for the next administration to scrap it. That said, among the 90% of the funds allocated under the Act, only a few of them have been finalized. The rest of them still faces the risk of reversal if the incoming president decides against it.

Chinese retaliation to add to supply pain

There are significant downside risks to the outlook.

First of all, China is likely to retaliate to higher tariffs, and the countermeasures could include embargoes of critical minerals used in chipmaking. Recently, China announced an embargo of critical minerals including gallium and germanium in response to tighter export controls of chips and related equipment by the US. These minerals were already subject to export restrictions even prior to the latest announcement so the incremental impact will likely be manageable. But the embargo nonetheless implies what China could do to disrupt production in the US, as China accounts for a lion’s share in the production of these minerals.

Unlock exclusive economic and business insights—sign up for our newsletter today

What’s more, the recent directive covers transshipment, essentially extending embargoes to firms in third countries that subsequently export Chinese minerals to the US. Such an approach mirrors measures taken by the US in the use of its own chipmaking technology, further dividing the global supply chain.

Indeed, further disruption to the global electronics supply chain remains a possibility. The strategic importance of electronics, particularly semiconductors, has led both the US and China to lean towards internal-looking policies, and other economies are increasingly required to take a side.

This raises risks for US allies. Should other Asian economies, who play a major role in the electronics supply chain, face tariffs from the US, the sector output would take a huge hit (Chart 2).

Chart 2: Asia plays an important role in the global electronics supply chain

Trump has openly criticised Taiwan for “stealing” the US semiconductor industry, which indicates even pro-US TSMC may be subject to tariffs. Even if there are no tariffs, the Trump administration can use the threat of tariffs as a tool to ramp up domestic production capacity. Higher tariffs would be a significant blow not only to Taiwan but to the entire world including the US, as Taiwan accounts for 90% of global advanced chip manufacturing. One of our latest GSS scenarios analyses the risk of wider global trade war, in which case the global electronics sector would be hit hard (Chart 3).

Chart 3: Further protectionist measures across the globe will hit the high-tech goods sector hard

Further protectionist measures could benefit local chip manufacturers in the US such as Intel and GlobalFoundries, but the net effect would be highly disruptive. So-called fabless companies such as Nvidia, AMD and Qualcomm, as well as giant tech companies like Apple will need to find alternative manufacturing sites outside of China or pay large tariffs. This will hit their profitability dramatically as production will have to migrate towards a higher cost location.

To learn more about our December industry forecasts and how we factor in the influence of Trump 2.0 policies, download our report.

To discover how we can support you to navigate uncertainty with confidence, request a free trial.

Subscribe to our newsletters

Subscribe to our newsletter to get our insights straight to your inbox. Additionally, you can check ‘Talk to us’ box to have our team contact you about a free trial of our services and how we can support you.

Tags:

Related Reports

Global industry braces for mixed impact from Trumponomics’ triple whammy

Fundamental forces including demographics, Ai, geopolitics and climate change play a key role in building resilience into long-term CRE investment strategies. Our research shows that advanced economies are generally better positioned for the critical megatrends. Australia, Singapore and the UK are the top three most resilient CRE markets, each with unique strengths.

Find Out More

Rough road ahead for US Construction under Trump 2.0

The construction sector has experienced wild ups and downs in recent years, a trend that looks set to continue under the next US administration.

Find Out More

Metro-level implications of a second Trump administration

The three major policy proposals planned for the second Trump administration—expansionary fiscal policy, lower immigration, and tariffs—will have mixed implications for the US economy over the next few years, and the impacts on metro areas will vary significantly.

Find Out More

Industry Forecast Highlights: Industry dynamics driven by Trump 2.0 policies

Our latest global industry forecasts reflect the impact of a second Trump presidency on industrial sectors. The US industrial forecast is now upgraded over the next two years, reflecting the impact of corporate tax cuts, with capital goods sectors expected to benefit most.

Find Out More