Research Briefing

| Dec 5, 2024

January poses a triple threat to US imports

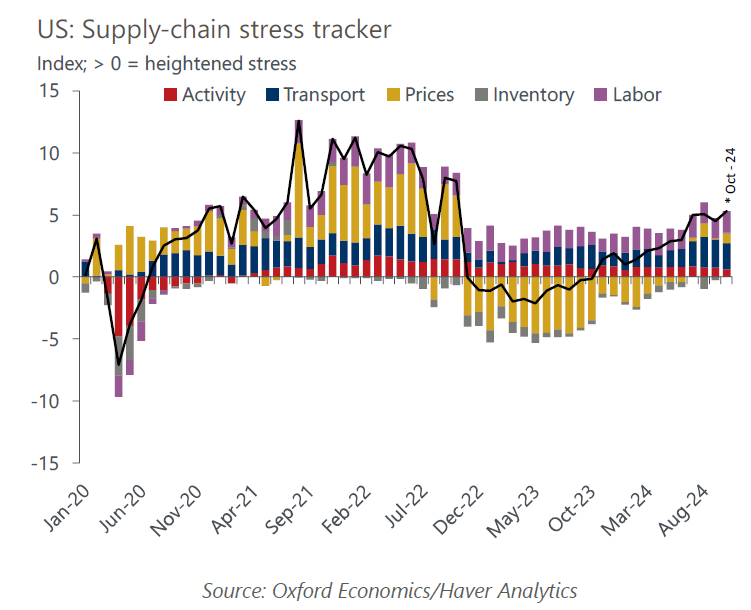

Our supply-chain stress index rose in October, reaching its highest level in two years. The gain this month was primarily concentrated in the prices index, which reflects an increase in inbound air freight prices.

What you will learn:

- Supply-chain stress now lies at its highest level in two years, adding some downside risk to our forecast for manufacturing industrial production in the near term, while the inflation risks are less concerning because of noticeable disinflation that the US is importing from China.

- Some of the added supply-chain stress is self-inflicted. We identify three reasons why retailers and manufacturers will likely frontload shipments ahead of January: a second potential port worker’s strike, new tariffs under the Trump administration, and the Chinese Lunar New Year.

- Another wave of frontloading would raise congestion issues at West Coast ports again and could delay deliveries to manufacturers. However, the inflationary risks remain low.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

Industry Scenarios

Quantifying the impact of policy changes and other risk events on industrial sectors.

Find Out More