Japan’s BoJ outlook update – Rate hike is now more likely in January

We now believe that the Bank of Japan will wait until January to hike the policy rate. We previously assumed a 60% chance of a hike at the meeting on December 19, but recent media reports signal that more board members will likely prefer to wait to see more data to confirm the momentum of wage-driven inflation and US policy developments.

What you will learn:

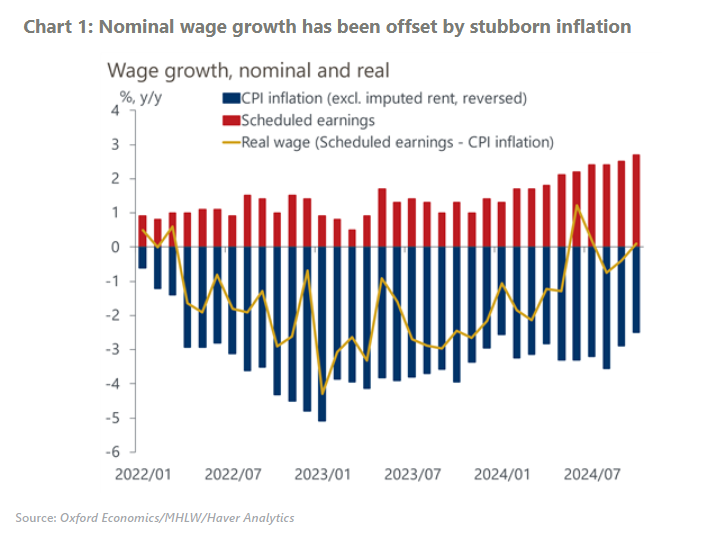

- Recent data show that the Japanese economy is on-track to achieve 2% inflation driven by wage rises, but there are also some weak spots. Nominal wages have risen at the rate consistent with target inflation in the medium-term, but high inflation has yet to generate any sustained increase in real wages. If lacklustre consumption fizzles out as a result, then inflation could fall back again.

- Yen weakening has become less of a threat, which will also allow the central bank to move more cautiously. We previously assumed the BoJ would move sooner than later to demonstrate its strong appetite for policy normalization to check the rising threat of further yen weakening triggered by Trump’s win in the US elections.

- Next month, we will slow the projected pace of rate hikes in our baseline after examining the outcome of the December meeting. After the expected hike in January, subsequent hikes will likely be in July 2025, instead of our previous projection of May, and the spring of 2026 before reaching a terminal rate of 1%. The pace could be affected by the yen’s developments.

Tags:

Related Posts

Post

Japan Key Themes 2025: Rising threats from external uncertainty

A secular labour shortage will continue to raise wages and inflation in a sustainable and irreversible manner in Japan.

Find Out More

Post

Adjusting our assumptions toward stronger US tariffs

In the second release of the November baseline, we updated our tariff assumptions, but the impact on GDP, inflation, and interest rates was small.

Find Out More

Post

Growth forecasts trimmed on review of Trump 2.0 impact

We have revised down our global economic forecasts slightly from our snap post-election assessment. The broad picture is little changed, though: a Trump presidency should have a mild impact on topline macro variables, while the effects on individual sectors and financial markets will likely be larger.

Find Out More