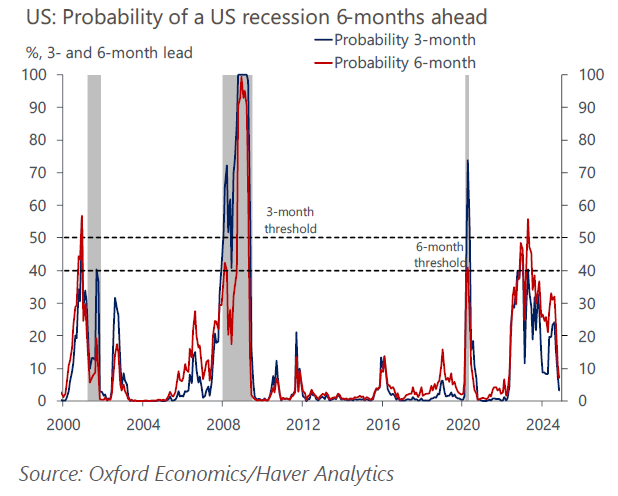

Recession Monitor – US recession odds continue to fall

Our probability of recession models are approaching their zero bound and are at their lowest levels in more than two years, as leading indicators signal an encouraging outlook.

What you will learn:

- Revisions to personal income data showed lower-than-estimated savings by consumers, but we aren’t overly concerned. Consumers haven’t shown a corresponding slowdown in spending, while healthy balance sheets and strong wage growth remain supports.

- A larger correction in financial markets could dent spending from households due to the wealth effect. We’ve modeled the impact of a 20% decline in equity markets, and while the impact to consumption wouldn’t push the economy into recession, GDP growth would slow markedly and the unemployment rate would move to 4.5% in the first half of next year.

- A cautious signal from the Federal Reserve toward rate cuts next year, alongside rising risk premia from investors, sent yields 30bps higher along the curve last week. Higher interest rates will weigh on the housing market, temper the rebound in manufacturing, and reduce the incentive to build inventories ahead of potential tariffs.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

Megatrends Scenarios

How we help Comprehensive actionable insights with forecasts to 2050 for 85 countries Visualise the key features of our different scenarios, including impacts on GDP, demographics, prices & wages, productivity, interest rates and asset returns. Long-run forecasts and scenarios Quantify risks to the global economy across a wide range of macroeconomic and financial indicators, giving you the insights needed to...

Find Out More

Service

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More