Driving into uncertainty: How Trump’s tariffs could derail Europe’s automotive powerhouse

By Clarissa Hahn

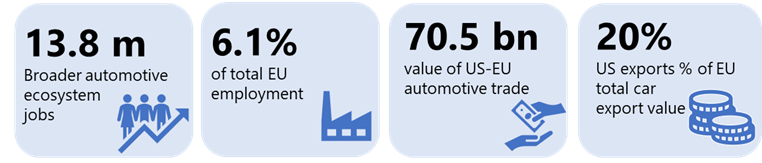

The US-EU automotive trade is an important pillar of the European automotive industry’s success. In 2023 European car manufacturers exported €56 billion worth of vehicles and components to the United States, accounting for 20% of the EU’s total automotive export value. This makes the US the number one export destination for EU-made cars, leaving the industry highly vulnerable to tariff threats from a second Trump administration.

This is no small issue for the EU. The bloc’s automotive sector supports 13.8 million jobs, including in direct and closely allied supply chains. Any disruption to this key industry would have significant implications for the broader European economy.

Eurozone automotive industry factsheet

Tariff threats from a second Trump administration

Protectionist policies appear to be a high priority for a second Trump administration. We anticipate that Trump will impose 25% tariffs on motor vehicle imports from the EU, a significant increase from the current tariff of 2.5%. This would raise the cost of European cars in the US market, making them significantly less price competitive against American and non-EU alternatives. The result? A sharp contraction in EU automotive exports to the US, the primary market for EU-made vehicles.

Unpacking the numbers: GTAP analysis in action

Using the GTAP model, widely regarded as the gold standard for trade analysis, we can isolate the impact of changes to tariff regimes on a set of countries and industries within a static general equilibrium model. We leveraged the GTAP model and analysed trade impacts to inform our latest industry baseline forecasts and account for the impacts of Trump 2.0’s protectionist policies.

Here we focus our analysis on US-EU bilateral trade, evaluating the implications of 25% tariffs on the EU automotive industry.

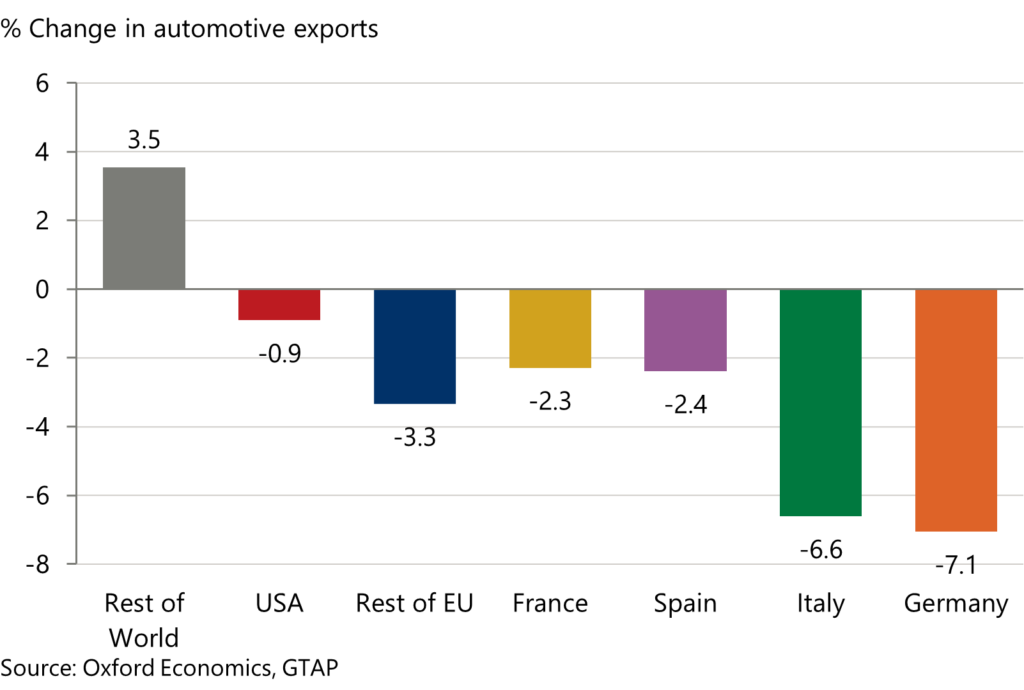

EU automotive exports to decline as a result of Trump tariffs

The German and Italian automotive industries stand out as the most exposed to this tariff threat. Our estimates suggest that German and Italian automotive exports could fall by 7.1% and 6.6%.

In contrast, Spanish and French exports are projected to experience smaller declines of 2.4% and 2.3%. These disparities highlight the uneven impact across European motor manufacturing industry, with German and Italian firms particularly vulnerable due to their greater reliance on the US market. 24% of Germany’s and 30% of Italy’s extra-EU automotive exports go to the US, compared to just 6% and 5% of their Spanish and French counterparts.

Unlock exclusive economic and business insights—sign up for our newsletter today

Dampened exports have a direct impact on total automotive production

European motor vehicle manufacturers may attempt to redirect exports to other regions, but they would face significant challenges. Differences in market demand and consumer preferences, logistical barriers, regulations and rising competition from other players based in places like China and South Korea mean it is unlikely that lost US sales can be fully offset in the short term.

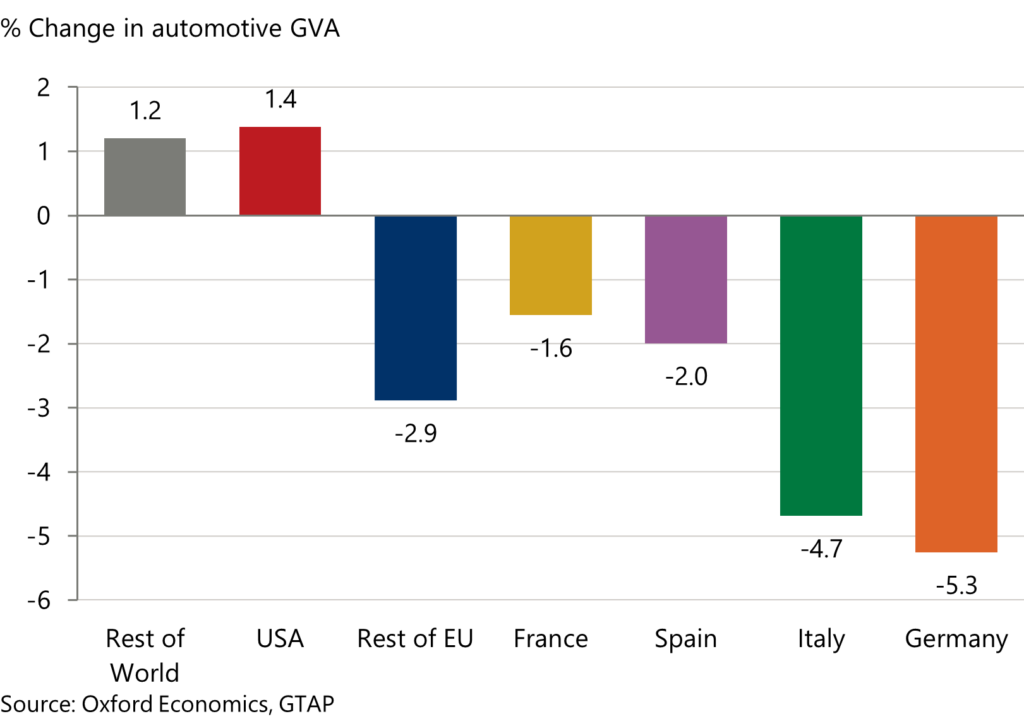

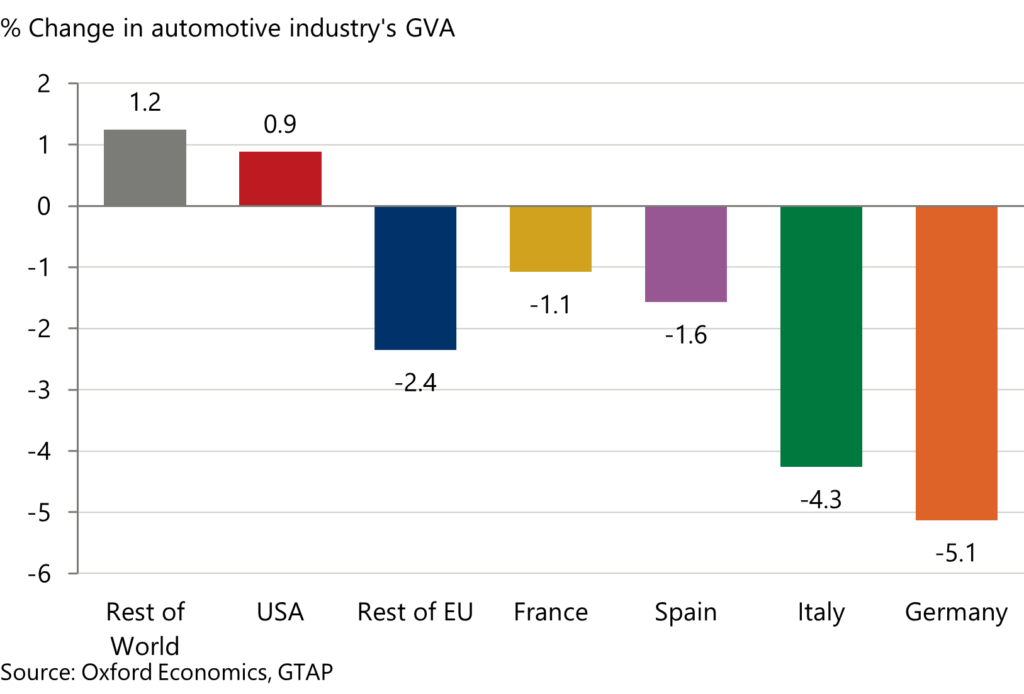

The broader implications of the tariff-induced slump in exports to the US are stark for the EU automotive industry. Exports to the US represent 15% of European automotive output, leaving the sector particularly vulnerable. As a result, our estimates suggest that the EU’s automotive production would decline across the board, with the most significant damage in Germany and Italy where we estimate gross-value added (GVA) would fall by 5.3% and 4.7%. This would deliver a substantial blow to a sector that not only sustains millions of jobs, but also contributes to a large proportion of the bloc’s GDP.

One might think that US-based automotive manufacturers would come out winners is such a scenario, since EU tariffs would reduce cost competition. But automotive supply chains are global, so increases in other tariffs will raise input costs, offsetting some of this advantage, as would retaliatory tariffs by other countries.

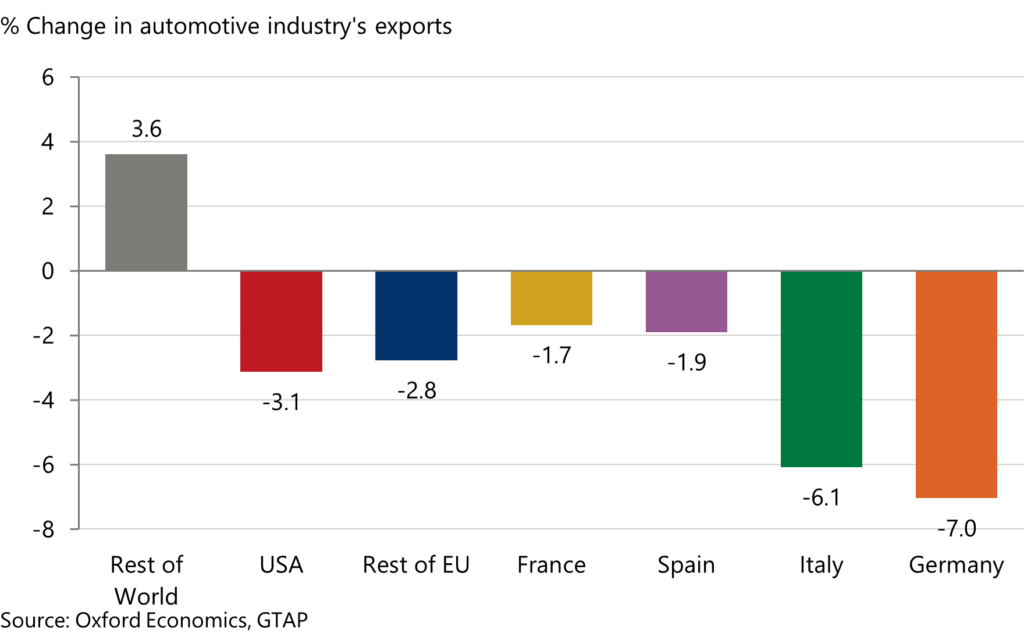

EU retaliatory tariffs will hurt US exports

In a second modelling exercise, we considered a scenario where the EU retaliates on the US with a mirrored 25% tariff on imports of US motor vehicles. This represents a 15% increase from the current levied 10% tariff. Our analysis shows that US automotive exports would decline by 3.1%.

EU retaliatory tariffs will hurt US exports…

Unlike the EU, the broader US automotive industry would remain largely insulated, and the industry’s gross value added would rise regardless despite the retaliation. Vehicles exported to the EU account for just 2% of total US automotive output, underscoring the industry’s limited reliance on European markets. In contrast, the EU automotive sector is far more dependent on US demand, highlighting the asymmetry in trade vulnerabilities.

… but total US automotive production will be resilient

The combination of reduced export demand, higher input costs, and shrinking profit margins represents a perfect storm for the EU automotive industry. As one of Europe’s most critical sectors, the stakes are high—not just for motor manufacturers, but for the broader economy. Among the 13.8 million European jobs tied to the industry, 11.2 million are employed in indirect roles in the broader EU automotive ecosystem. When one factors in the ripple effects—jobs created indirectly through supply chains and spending from employee wages, the economic stakes become even higher.

Navigate the impact of “Trump 2.0” on your business

While the exact nature of Donald Trump’s future policies remains uncertain, significant policy shifts could dramatically reshape the industry landscape and impact your business. In such unpredictable times, it is essential to unlock insights, monitor risks and identify opportunities to stay ahead.

At Oxford Economics our advanced modeling capabilities allow us to simulate the impact of bilateral tariffs on over 60 tradeable products across more than 100 countries. If you’re looking to understand how tariffs in a “Trump 2.0” scenario might influence your business, fill out the form below to connect with us. Our team of industry economists are dedicated to providing tailored analysis to support your strategic planning and decision-making.

Get in touch

If you would like to learn more about our unique bespoke industry solutions, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Tags:

Related Reports

US Rolls Up Welcome Mat for International Travel

Research Briefing Driving into uncertainty: How Trump’s tariffs could derail Europe’s automotive powerhouse Trump tariffs set to raise effective rate above 1930s levels.

Find Out More

US auto tariffs would slam Canada’s motor vehicle industry

US President Trump ordered a 25% tariff on autos and auto parts, starting on April 3.

Find Out More

US – Tariff Monitor Trump hits the gas on auto tariffs

President Trump ordered a 25% tariff on autos and auto parts, starting on April 3.

Find Out More

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More