CECL 2024 Q4 scenarios: A land of contrasts – regional dynamics in the US economy.

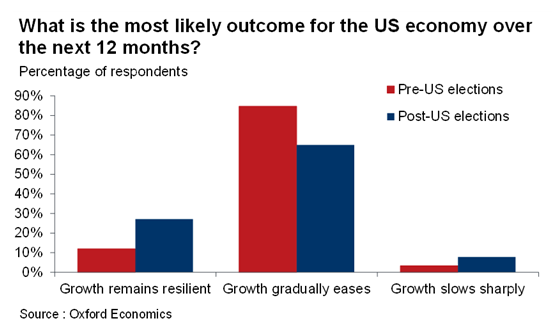

Our short-term outlook for the global economy has a seen a small upwards revision due to the expected loosening of US fiscal policy by the new Trump administration. As a result, clients responding to our latest Global Risk Survey remain confident in the strength of the US economy. More than 1-in-4 respondents now expect resilient US growth in the year ahead – more than twice the level prior to the US elections. However, the Trump administration’s plans to impose large-scale protectionist measures and cut down on immigration will hinder the economy’s medium-term outlook. Regional dynamics will play a key role in determining how federal policy changes affect different states.

As the second Trump administration unfolds, geopolitical tensions and volatility in global trade flows are set to rise yet again. In such periods of heightened uncertainty, highly open and export-intensive states might be particularly vulnerable to large fluctuations in growth. For instance, a state like California, with its high reliance on exports and large gig-economy is particularly sensitive to global instability.

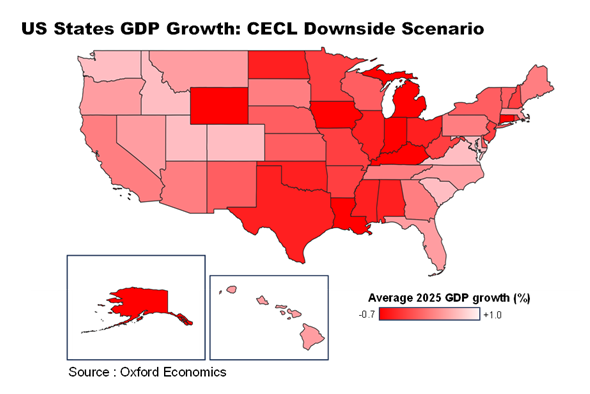

Our CECL scenarios capture these state-level nuances in a granular way by leveraging nation-wide scenario projections and combining them with state and region-specific dynamics such as demographics, sectoral breakdowns, and policy risks to generate results that are consistent at the state and metro level.

Our CECL downside scenario models a concerted global slowdown, which triggers a significant reduction in global trade flows and large sell-off in asset prices. Therefore, even though our downside scenario does not assume specific risk themes or policy changes, it captures the risks from the anticipated tariff policies of the new US administration.

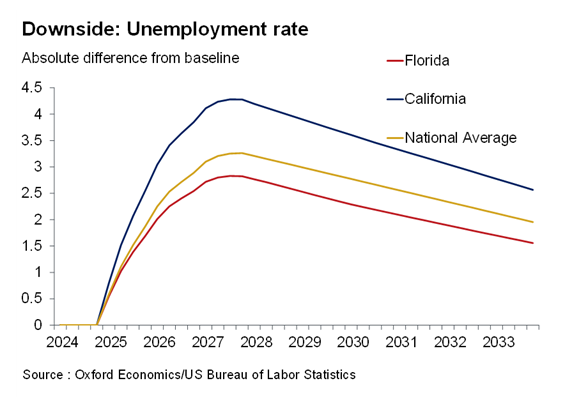

We find that states with highly diversified economies fare better than those with highly concentrated or open economies. For example, Washington, known for its highly productive tech sector alongside its agricultural, aerospace, and healthcare sectors tends to perform better in an economic downturn than states like Ohio in the mid-west which depend mainly on traditional manufacturing and suffer from structurally lower growth. Similarly, Florida, with its large retiree population and reliance on labour-intensive domestic sectors like hospitality, retail, and healthcare, maintains more stable growth and labour markets relative to California.

Unlock exclusive economic and business insights—sign up for our newsletter today

Since our CECL scenarios are developed from uncertainty distributions which are based on three decades of forecast errors, they inherently capture the broader risk spectrum associated with a second Trump presidency. For example, our distributions capture important periods of heightened economic volatility such as the Global Financial Crisis, the Covid-19 pandemic, as well as the volatility from the first Trump presidency.

We construct the alternative scenarios using our industry-leading Global Economic Model. Through our US States and Metro model, we also generate consistent projections for 50 states, 382 metropolitan areas, 31 metro divisions and the District of Columbia. Our approach therefore provides our clients with a robust and objective methodology to calculating their expected credit losses and helps them navigate risks within the US economy.

Find out more about our IFRS 9, CECL and US States and Metro Service.

For more insights on the 2024 US Presidential Election, click here.

To discover how we can support you to navigate uncertainty with confidence, request a free trial.

Author

Sai Deeksha Palepu

Senior Economist

+44 203 910 8052

Sai Deeksha Palepu

Senior Economist

London, United Kingdom

Deeksha is a Senior Economist within the Scenarios, Stress Testing and Modelling team, with a particular focus on our IFRS 9 service. She also works on stress tests, climate scenarios and bespoke modelling projects for clients. Deeksha holds a First Class Honours in Economics from the University of Bath and an MSc in Economics from University College London.

Subscribe to our newsletters

Subscribe to our newsletter to get our insights straight to your inbox. Additionally, you can check ‘Talk to us’ box to have our team contact you about a free trial of our services and how we can support you.

Tags:

Related Reports

US Rolls Up Welcome Mat for International Travel

Research Briefing CECL 2024 Q4 scenarios: A land of contrasts – regional dynamics in the US economy. Trump tariffs set to raise effective rate above 1930s levels.

Find Out More

US auto tariffs would slam Canada’s motor vehicle industry

US President Trump ordered a 25% tariff on autos and auto parts, starting on April 3.

Find Out More

US – Tariff Monitor Trump hits the gas on auto tariffs

President Trump ordered a 25% tariff on autos and auto parts, starting on April 3.

Find Out More

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More