Industrial electricity prices to ease in 2025, but uncertainty is high

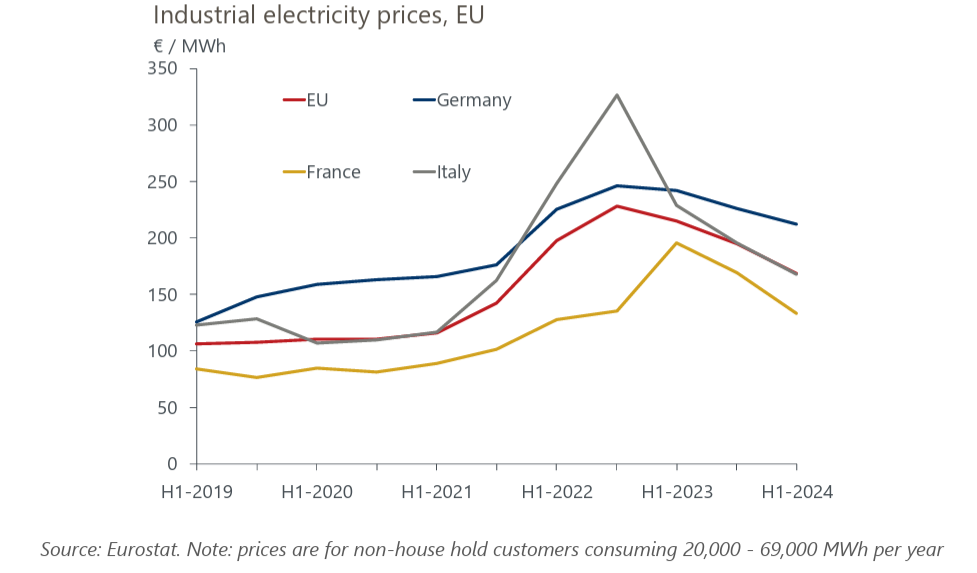

Despite the recent uptick in wholesale electricity prices, we expect to see industrial electricity prices in Europe fall slightly through 2025. The declines will be driven partly by the delayed pass-through to industrial retail prices of wholesale electricity price declines experienced last year.

What you will learn:

- Across Europe, we think the scope for industrial electricity price reductions in 2025 are greatest in Germany. A relatively high share of long-term contracts in the German electricity sector, together with recent reductions in electricity taxes, means more energy price declines will feed through this year as new contracts are negotiated.

- Declines in industrial electricity prices through 2025 should reduce cost pressures in highly energy-intensive sectors where output remains weak, allowing for a partial output recovery.

- There is a high degree of uncertainty in European energy markets, and risks to prices are tilted towards an increase. While our baseline forecasts suggest wholesale prices will recede through the year, should they remain higher-for-longer, it could push up industrial retail prices later in the year and therefore delay the recovery for energy-intensive sectors of the economy.

- Even with the declines in our baseline, European electricity prices will remain structurally elevated relative to the pre-energy-crisis period. As a result, some sectors like, chemicals, face permanent output losses.

Tags:

Related Content

China coastal tech exporters vulnerable to new Trump tariff

The United States has introduced an additional 10% levy on Chinese imports as part of the opening round of the Trump 2.0 tariff regime. While certainly not as severe as some of the tariff threats made against China by President Trump in the run up to his inauguration, we nevertheless expect the additional tariffs to affect the country’s economic performance—with coastal tech manufacturing hubs particularly vulnerable.

Find Out More

Autos and machineries in Japan are most vulnerable to US tariffs

Our analysis of industry and trade structure between the US and Japan reveals the auto and non-electrical machinery sectors are most vulnerable to tariffs by the US. For both sectors, the US accounts for a sizeable share of total exports as well as gross output, and particularly so for auto.

Find Out More

Lower-income states and metros face the greatest burden from impending tariffs

Tariffs act as a regressive tax on households as they are applied to imported goods, many of which fall into the category of non-discretionary spending on such things as clothing, food, and energy—necessities most households cannot go without.

Find Out More

Eurozone is likely next in the tariff war

We have incorporated a 10% blanket tariff by the US and immediate retaliation by the EU in our forecast for Eurozone GDP growth, which is now 0.3ppts lower for 2025 and 2026.

Find Out More