Research Briefing

| Feb 24, 2025

‘Tis the US tax-refund season

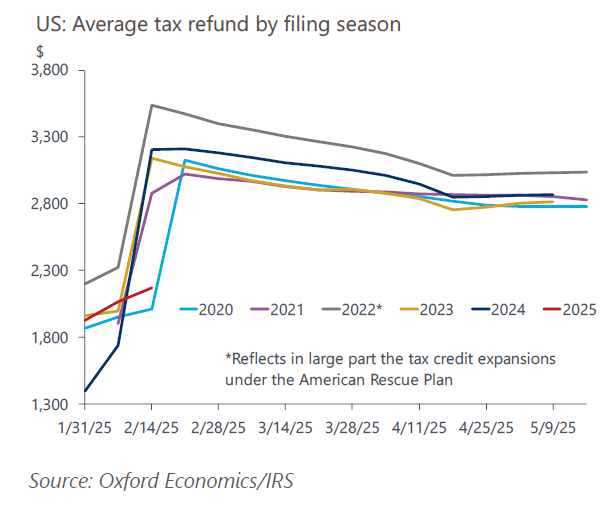

For many households, tax refunds represent the biggest cash-flow event of the year. It’s early, but we think this will be a favorable tax-refund season for filers.

What you will learn:

- Last year, annual tax-code adjustments were more generous than usual as wage growth slowed. This raised the risk of more households overwithholding their taxes and being owed a refund upon filing this year.

- Historically, February is the most important month for refunds. A larger refund issuance relative to prior years correlates with stronger retail sales during that month.

- The boost to February retail sales is even larger for certain categories such as general merchandise stores and used-car dealerships. This speaks to the tendency of low- to moderate-income households to file early.

- Of all categories, used-car sales appear the most responsive to swings in refund issuance, and the impact of the refund season is visible in the seasonal pattern of wholesale used-vehicle prices.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

Global Industry Model

An integrated model covering 100 sectors across 77 countries and the Eurozone.

Find Out More