Reciprocal tariffs another tool to extract policy concessions

US President Donald Trump has announced or threatened a range of fresh tariffs in recent weeks. While we expect the overall macro impact to our global forecasts to be modest, the impacts for specific countries and industries will be meaningful.

What you will learn:

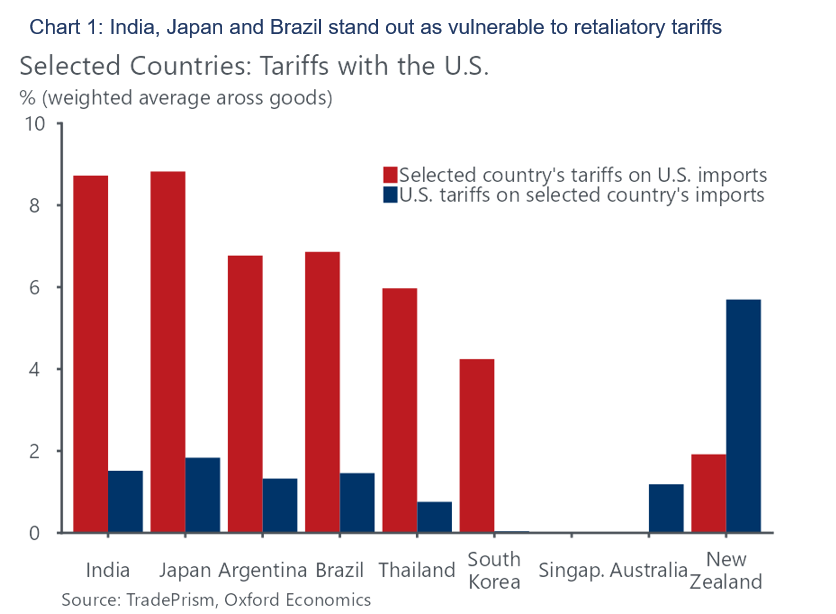

- The recent announcement that the US would raise tariffs on imports from other economies to match the rates that US exporters face (reciprocal tariffs), could see very large tariff increases on the likes of India, Japan, Brazil, Thailand and Vietnam.

- To some extent these tariffs are an attempt to extract policy concessions from targeted countries so we don’t think the threat of retaliatory tariffs significantly alters the global outlook.

- Our previous analysis of the impact of tariffs on global trade flows, highlighted Singapore as the country which would capture the greatest share of US imports in the coming decade. Given that Singapore imposes no tariffs on the US this finding is likely to be strengthened further by the imposition of retaliatory tariffs as trade in Asia reroutes.

With TradePrism, you can assess the impact of the latest tariff changes on global trade, identify trade rerouting trends and the countries most affected, and gain forward-looking projections covering 46 major economies. Know more about TradePrism.

Tags:

Related Services

Post

Trump’s tariffs pose uneven subnational risks across the EU

Trade tensions between the EU and the US are escalating. Aggressive protectionist policies have been a key instrument for Trump in the opening months of 2025, and the president has indicated that both blanket and sector-specific levies on EU good exports could be imposed within the coming weeks.

Find Out More

Post

Tariffs hurt, even if some are just threats

Tariffs don't have to be imposed to wreak economic harm – threats are enough. So the recent flurry of announcements by the US, followed in some cases by swift postponements, are already increasing trade uncertainty and making it less likely that companies will invest.

Find Out More