Weak US consumer sentiment needs a careful eye, not panic

As consumer sentiment deteriorated, concerns about the outlook for consumer spending increased. While there’s a statistically significant relationship between sentiment and consumption, the economy has withstood shocks to sentiment without falling into a recession.

What you will learn:

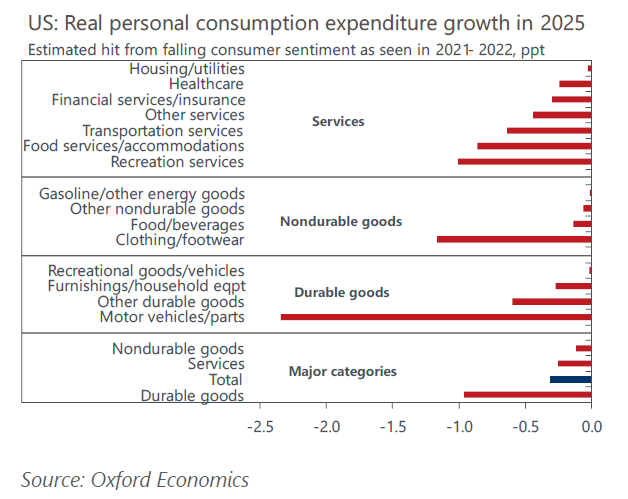

- If sentiment were to decline in the same way as it did during the 2021-2022 inflation surge, it would only reduce consumer spending growth by 0.3ppts this year. Nevertheless, some spending categories would be hit much harder than others.

- Spending on motor vehicles, apparel, and discretionary services is the most sensitive to sentiment shifts, while the consumption of necessities like housing, food, and gasoline tends to be unresponsive. All told, 70% of consumer spending is largely insensitive to sentiment shocks.

- It is tough to interpret consumer sentiment readings during heightened policy uncertainty, but there are a couple of indicators to help gauge the risk of consumers heading for the bunkers.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More