Don’t write the Eurozone consumer off just yet

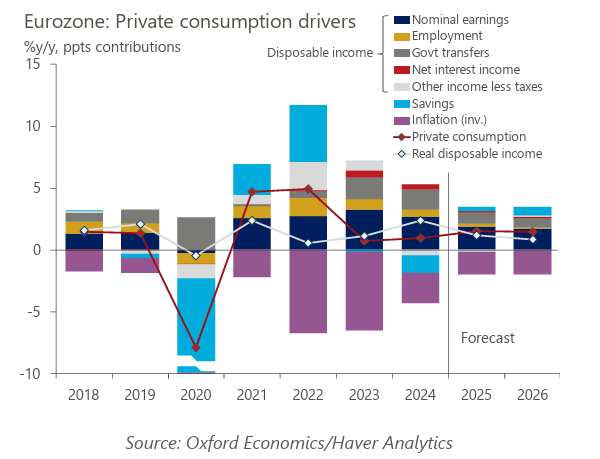

Eurozone growth in 2025 will rely on consumers. There were positive signs in H2 last year, with consumers starting to deploy their real income gains and the impact of lower rates feeding through. However, we don’t think solid H2 outturns signal a sustained increase in momentum. Instead, we expect spending growth to stabilise around the current pace, totalling 1.5% in 2025.

What you will learn:

- The key risk to spending growth stems from the labour market: employment remains steady but firms curtail hiring plans, and households’ fears of unemployment rise. This could trigger a build-up of precautionary savings.

- Tariffs will have moderate aggregate effects on consumer spending. The direct impact through higher prices will lower purchasing power. Indirect effects will mainly work through the labour market, with sectors hit by tariffs likely to shed jobs.

- The diverging economic performance of the Eurozone’s Big Four economies is largely driven by consumer spending. We expect a more synchronised pickup in 2025, but substantial gaps will remain, with Spain leading and Germany lagging.

Tags:

Related Content

The European housing market has turned a corner, but challenges remain

The housing market across most of Europe has now improved, but has it reached the tipping point?

Find Out More

Labour’s plan to build more homes is encouraging, but do not expect it to profoundly reform the market

In a previous research briefing we looked at the macroeconomic implications of a new Labour government. Here, we delve into one of the UK’s most persistent political issues—housing—and explore what changes a Labour government might bring to regional development.

Find Out More

Why rate cuts will do less than rate hikes

Rate cuts by the European Central Bank over the course of 2025 may not boost growth to the same degree that the central bank's aggressive rate-hiking cycle in the wake of the pandemic constrained it. This reinforces our view that quarterly eurozone growth will remain broadly stable at last year's humble pace.

Find Out More

Rebalancing Canada’s housing market will take a decade

In this month’s video, Tony Stillo outlines why we think it will take another decade to build enough homes to restore housing affordability across Canada.

Find Out More