Why official UK data are less reliable and what this means

A series of problems have undermined confidence in the accuracy of official economic statistics for the UK. When using Office for National Statistics data, it’s important that users make allowance for the increased uncertainty about their reliability.

What you will learn:

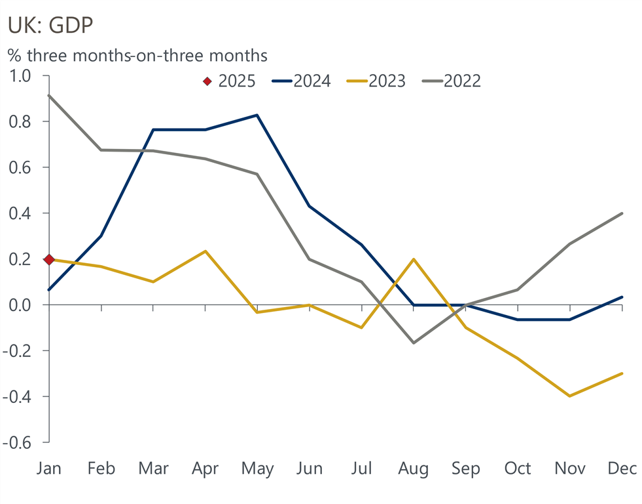

- As well as the well-publicised problems with the ONS Labour Force Survey and population estimates, trade and producer prices releases have had to be postponed recently. Other problems are emerging that are yet to be officially acknowledged, including volatility in GDP and retail sales data that are indicative of problems related to seasonal adjustments.

- Big structural changes, such as rapid adoption of AI, are increasing the challenges statisticians face. In future, official data series may be less reliable, more volatile, and more prone to revision.

- We also advocate users consider a wider variety of sources, such as our sentiment-based nowcasts, to understand where the risks in official data lie.

GDP data is consistently showing a Q3 slowdown after strong H1s

Our own macroeconomic forecasts are dependent on these ONS series as inputs – a key principle of our methodology is to use official data as it’s published to maintain consistency. However, we aim to be clear in our accompanying commentary if we believe there are doubts about the validity of the data, and to use an array of alternative data – including those we have developed with Penta and Data City – to assess where the risks lie.

Tags:

Related Reports

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More

How much could trade policy uncertainty hurt the outlook?

If there’s one thing more damaging than tariffs themselves, it’s the sharp rise in trade policy uncertainty.

Find Out More

No shelter from the external storm for CEE economies

The small, open economies of Central and Eastern Europe (CEE) are struggling against three external headwinds simultaneously: stuttering German industry, protectionist US trade policy, and overcapacity in China's manufacturing sector.

Find Out More

Blanket tariffs from Trump drag down industrial prospects | Industry Forecast Highlights

The impact of global tariffs, a high degree of policy uncertainty, and higher for longer interest rates are expected to hit industry—we have pushed down our 2025 global industrial production growth forecast by 0.5ppts since our Q4 2024 update.

Find Out More