Quantifying the impact of climate on customers

Leveraging industry-specific climate forecasts to future-proof revenue.

Download PDF

Whether for regulatory compliance, risk management, or business planning purposes, firms—large and small—increasingly recognise the need to map out and understand how climate change and mitigation policies will affect them. While companies’ understanding of their direct carbon footprints, green and brown financial asset holdings and supply chains is expanding thanks to increasingly available tools and resources, one crucial aspect often remains unexplored: their customer base.

Failing to comprehend how climate change will affect customers can leave companies exposed. Companies operating in multiple geographies could find that demand in key countries is slowing because of the imposition of heavy-handed policies aimed at transitioning away from an outdated, dirty fuel mix. Companies whose clients span multiple sectors could find that key sources of revenue dry up as certain industries struggle to adapt or could miss out on growth opportunities if they are not targeting sectors primed for growth in a green transition.

The Challenge

The Climate Change and Environment Director of a major multinational services sector company wanted to understand the potential climate and transition risks associated with their existing customer base. Although numerous publicly and privately available resources provide forecasts about how climate change and the green transition may affect global or regional economic growth, the company lacked the internal expertise and data to model net zero scenarios in-house. They also needed assistance connecting external high-level forecasts to the potential performance of the industries in which their client base operates.

The company asked Oxford Economics to undertake bespoke analysis to evaluate the expected aggregate performance of its client base in a green transition climate scenario, to gain access to the industry-specific growth forecasts for the regions relevant to its client base, and to translate the modelling results into meaningful insights.

The Solution

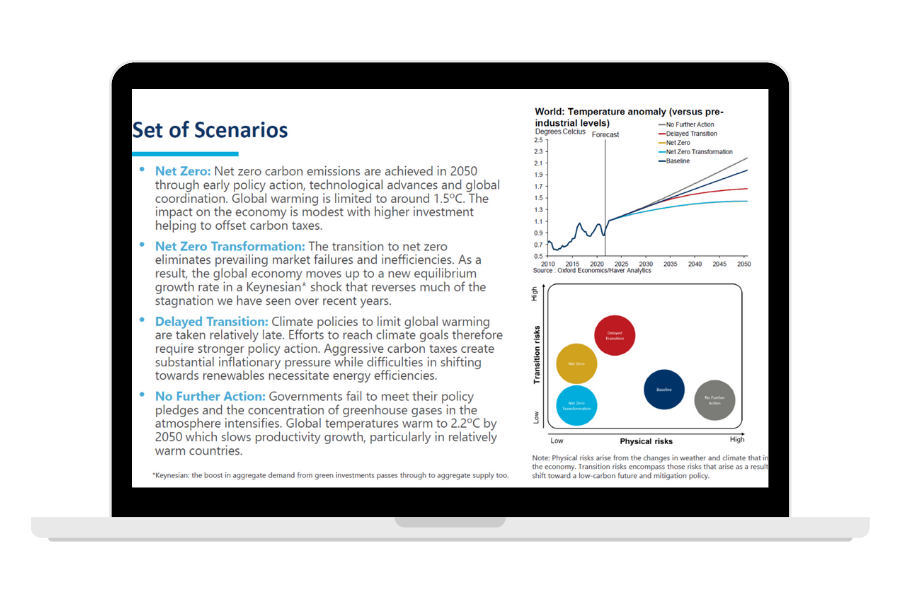

Oxford Economics has a unique suite of models and expertise related to industry and climate. We can evaluate sectoral performance across various climate change scenarios using our Global Climate Service and Industry Climate Service, allowing us to understand better the business outlook and key risks facing sectors, companies, suppliers and customers. This is done by building comprehensive climate change scenarios that look at potential economy-wide outcomes and examining how changes in demand, policy, and pricing across countries and sectors will affect different industries’ outputs.

Using this framework, we analysed the client’s customer base, sorting firms by region and sectors of operation. We delivered a comprehensive review that included:

- A series of bespoke sales indices that evaluated the potential impact of a green transition on the client’s customer base. The sales indices were constructed by using our real sectoral growth forecasts to estimate revenues of each of the individual companies that make up the customer base through 2050 in our baseline forecast and in a climate transition scenario. The indices showed the collective performance of the customer base, split out by country and sector.

- An analysis of the customer base that broke down its exposure to climate risks, organised by country and sector. This analysis included a breakdown of how the customer base was more, less, or equally exposed to climate-related risks than the economy as a whole in order to help establish a baseline to compare against.

- Recommendations on how the client could lessen exposure to transition-related risks among its customer base and how it could tailor its customer acquisition strategy to take advantage of potential opportunities.

The Result

The bespoke analysis focused on the client’s customer base helped the client understand the climate- and transition-related risks embedded in its current revenue streams, what steps it might take to mitigate these risks, and how it could take advantage of potential opportunities. The company is using the results from this analysis to inform an Annual Report for their Task Force on Climate-Related Financial Disclosures (TCFD) disclosure.

Contact us to explore how we can help you

Related services

Industry Consulting

Help you quantify key correlations for sales and market demand forecasting and more generally support your overall decision-making process.

Industry Climate Service

Assess the impacts of climate change and mitigation policies for more than 100 sectors.

Global Climate Service

Assess the impact climate change will have on all facets of your business – now and in the future.

City Climate Scenarios

Make data-driven, locally tailored climate-related decisions with confidence.