Blog | 20 Nov 2024

3 Key Takeaways from Trump Tax Cuts on US Consumer Spending

Alex Mackle

Corporate Advisory Engagement Lead

At Oxford Economics, we have been closely monitoring the potential impact of President Trump’s proposed income tax cuts and increase in import tariffs on the US economy. Our latest forecasts shed light on how these changes could affect consumer spending. Here are three key takeaways from our research on the potential impacts on the US consumer:

1. Short term boost to consumer spending

Cuts to personal Federal income tax are expected to strengthen overall consumer spending in 2026/2027. Lower personal income taxes will increase disposable income, leading to a boost in consumer spending. Despite the potential increase in prices due to higher tariffs on imported goods, our modelling shows that the positive effects of tax cuts are likely to outweigh the negative impact of tariffs, which under our current forecast assumptions would be more limited than the most extreme tariffs suggested in the election campaign.

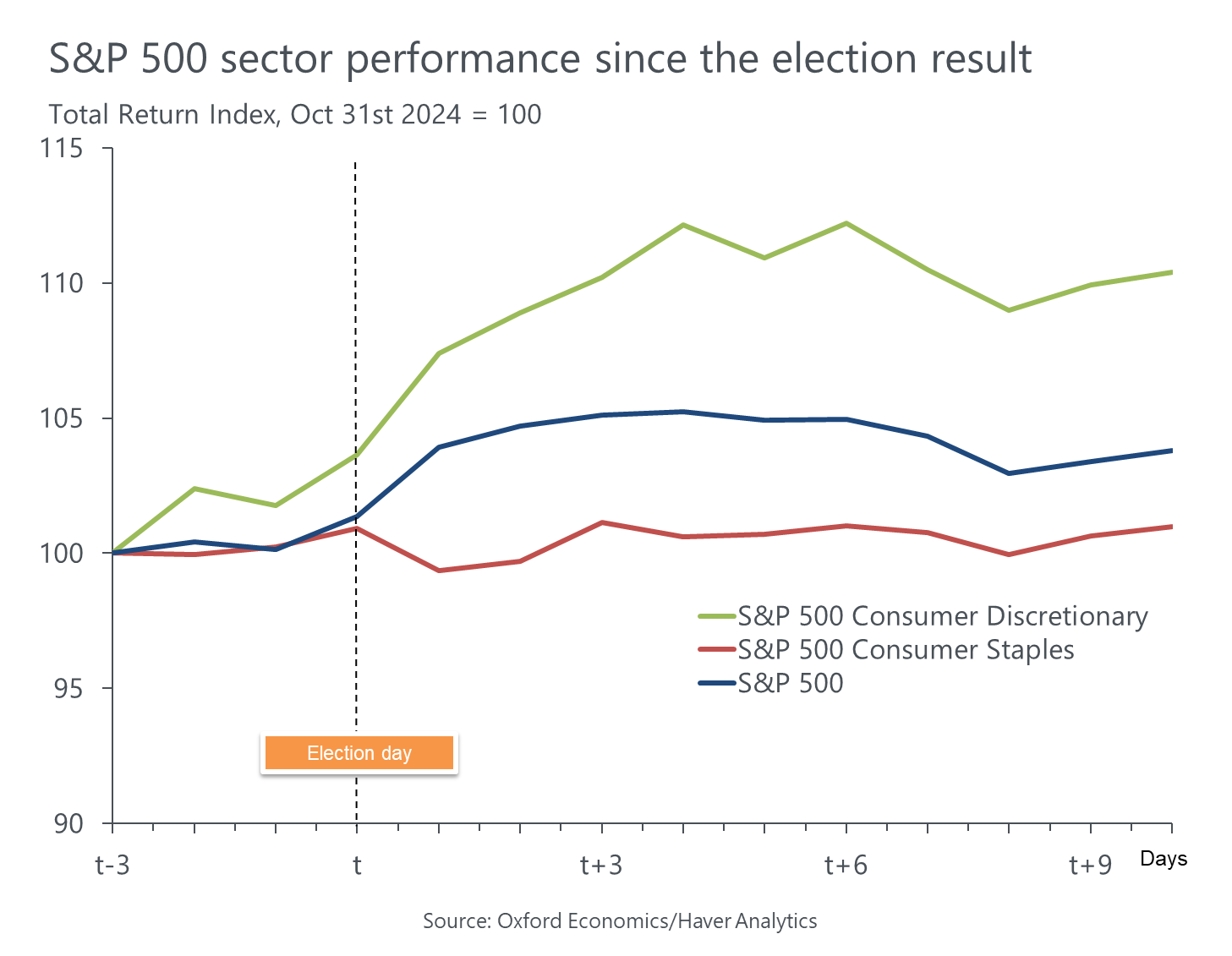

2. Discretionary spending will see the largest benefit

President Trump’s policies are, however, regressive, and would largely benefit higher income households. By lowering Federal income tax, higher earners will see a larger increase in after-tax income, while increased tariffs will raise prices for all consumers. Discretionary consumer spending, which is driven by higher-income households, is therefore likely to benefit more from the tax cuts. We can see some early signs of this in how markets have reacted to the election.

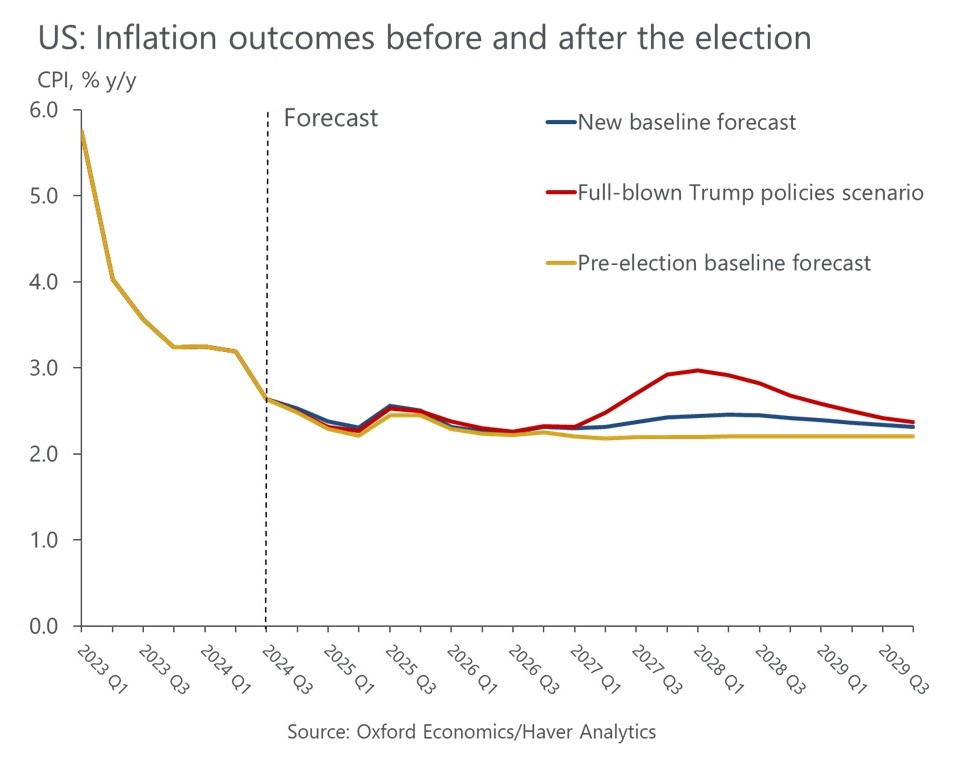

3. Higher tariffs would weigh further on consumer spending

There is a risk that President Trump may implement higher tariffs than currently assumed in our forecast. Under this scenario, consumer spending could weaken significantly due to a greater inflationary shock and a reduction in real household incomes. This would lead to a decrease in overall consumer spending levels and prompt consumers to be more price-conscious in their spending.

In conclusion, while the Trump tax cuts are expected to provide a boost to consumer spending, the potential impact of higher tariffs remains a key concern. Understanding the balance between tax cuts and tariffs will be crucial in determining the overall effect on the US consumer.

Join our mailing list for the latest updates from Oxford Economics as we track the evolving landscape of the US economy under President Trump’s administration, straight to your inbox.

Author

Alex Mackle

Corporate Advisory Engagement Lead

Alex Mackle

Corporate Advisory Engagement Lead

New York, United States

Alex Mackle is a Corporate Advisory Engagement Lead in the US Macro Consulting team based in New York. Alex focuses on scenarios and stress testing, as well as CECL/IFRS9 scenarios. He also frequently gives training sessions on the Global Economic Model, focusing on scenarios and stress testing capabilities.

Prior to joining the US Macro Consulting team in 2017, Alex worked in the Scenarios team in London, contributing to the Global Scenario Service and various stress testing exercises. He has also worked on several modelling projects, including a macro model for the Central Bank of Oman.

Tags:

You may be interested in

Post

All US metros worse off from recent tariff announcements

President Trump's recent tariff announcements, and the global response, have meant a fast-changing policy landscape with significant effects on our global, national, and subnational outlook.

Find Out More

Post

US auto tariffs would slam Canada’s motor vehicle industry

US President Trump ordered a 25% tariff on autos and auto parts, starting on April 3.

Find Out More

Post

Which regions are most exposed to the 25% automotive tariffs?

While the automotive tariffs will likely lead to some production being reshored to US plants, they will also raise costs for US manufacturers and households.

Find Out More