A capital is born: The impact of Indonesia moving its capital city

- Indonesia is planning to move its capital from Jakarta to Nusantara, as Jakarta faces the threat of sinking beneath the waves without urgent intervention.

- This relocation will boost the country’s construction outlook, with the total construction work done in Indonesia expected to grow by an average 8.5% p.a. over the four years to 2028.

- We do not expect the moves to establish Nusantara as the new capital to lead to a mass exodus from Jakarta.

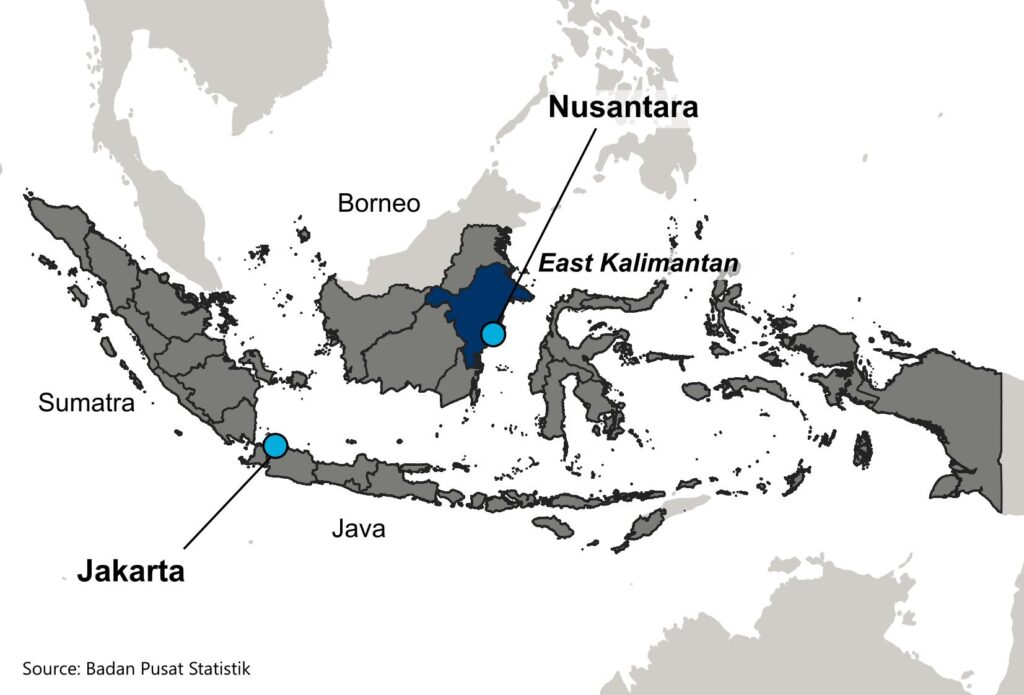

Indonesia’s President Joko Widodo is expected to mark the country’s 79th anniversary of independence this month by hailing the official relocation of the country’s national capital away from Jakarta. The new capital will be a city named Nusantara, still under construction and located over 1,000km away from Jakarta in East Kalimantan province on Borneo Island. At an expected cost of construction of $35 billion and a population projected to reach nearly 2 million by 2045, the new capital city will be the new base of the country’s president and the government’s administration and ministries.

Chart: Indonesia’s new capital will be located over 1,000km away from the current capital Jakarta

Why is Indonesia moving its capital city?

The idea of moving Indonesia’s capital away from Jakarta has existed since the first days of Indonesia’s independence.

The primary driver for this move is the potentially irretrievable impact of land subsidence in Jakarta, caused by rapid urbanisation and excessive groundwater extraction. Jakarta is one of the fastest sinking cities in the world. Many commercial and residential areas, especially in the north of the city, have already been destroyed due to flooding which has also been exacerbated by climate change. Some areas are sinking by as much as 25cm per year and estimates suggest large swathes of the city could be fully submerged by 2050.

Unlock exclusive economic and business insights—sign up for our newsletter today

Other motivations for the relocation are related to spreading the distribution of wealth and activity more evenly throughout Indonesia, the economy of which has historically been centred on the island of Java.

However, the relocation plan has long been politically and logistically contentious. Plans for Nusantara, first announced by President Widodo in 2019, have been no exception, notably with regards to the impact of building a new city on an undeveloped area of ecological importance. The government’s funding strategy of relying on private investment to fund 80% of the construction costs has also been called into question.

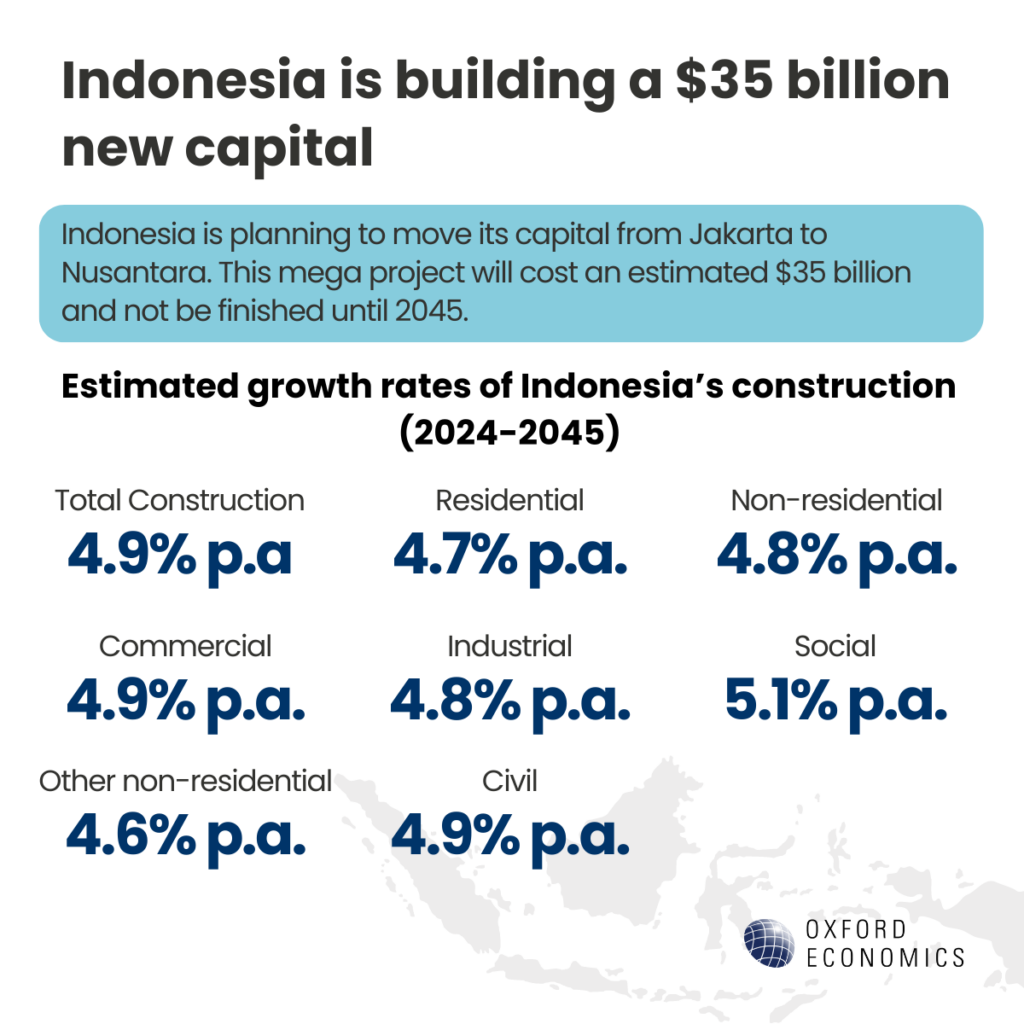

Building a $35 billion new capital

According to the plan announced previously, building the new capital, Nusantara, will cost an estimated $35 billion and will not be finished until 2045.

This mega project is expected to boost the nation’s construction outlook significantly. We forecast the total construction work done in Indonesia will grow an average 8.5% p.a. over the four years to 2028. Activity is anticipated to ramp up over the forecast horizon, supported by a strong project pipeline, primarily from developments around the capital relocation. This major infrastructure project is a driver for increased fixed capital expenditure from both the private sector and foreign direct investment (FDI). This will stimulate construction activities across all segments:

/list

- Residential construction: Government and private developer initiatives for new residential areas in Nusantara, along with the country’s “One Million Houses” programme will help drive the growth. Residential building work done is forecast to grow an average 4.7% p.a. from 2024 to 2045.

- Non-residential construction: A strong pipeline of projects connected to Nusantara will support social building (+5.1%), along with commercial (+4.9%), industrial (+4.8%) and ‘other non-residential’ (+4.6%) building from 2024 to 2045.

- Civil engineering construction: Civil engineering work done is forecast to lift 6.7% in 2024, down from a previously expected 6.9% growth, as some projects continue to be postponed and delayed. Nonetheless, activity is forecast to grow, with the government remaining steadfast with its infrastructure objectives, continuing to promote significant spending in this sector, particularly in relation to the construction of Nusantara.

However, there remains significant downside risks should continued construction delays see activity pushed out further along the forecast horizon.

Beyond benefitting construction prospects on a national level, we expect the new capital’s construction and relocation of the central administration to provide an economic benefit to the East Kalimantan province. Indonesia’s Ministry of National Development Planning expects it will create between 4.3 million and 4.5 million jobs in East Kalimantan by 2045.

Despite this, it is important to highlight that we do not expect this relocation to represent either a significant threat to Jakarta’s economic importance or a reprieve from its problems.

Jakarta will not be replaced, neither its role, nor its problems

Jakarta is Indonesia’s economic capital and is the primary location for Indonesia’s high value services such as finance, business services, and information and communications (IT). Public administration represents around just 4% of economic output and employment in Jakarta. Although we would expect public administration activity to slow down or even shrink in Jakarta, we do not expect this to lead to a mass relocation of other activities. There may be some relocation of businesses and their workers that need to be in close proximity to the political establishment, but the majority will likely gain more from the agglomeration effects of being within the established commercial zones of the former capital.

Hover over the chart to check the value

Historical examples of capital moves to pre-planned cities, such as the relocation of Myanmar’s capital to Nay Pyi Taw from Yangon in 2006, also suggest that relocating the government administration does not normally lead to a substantially negative economic impact on the previous capital.

Hence, we would expect Jakarta to continue to develop as Indonesia’s economic and business centre of gravity despite the loss of central government representation.

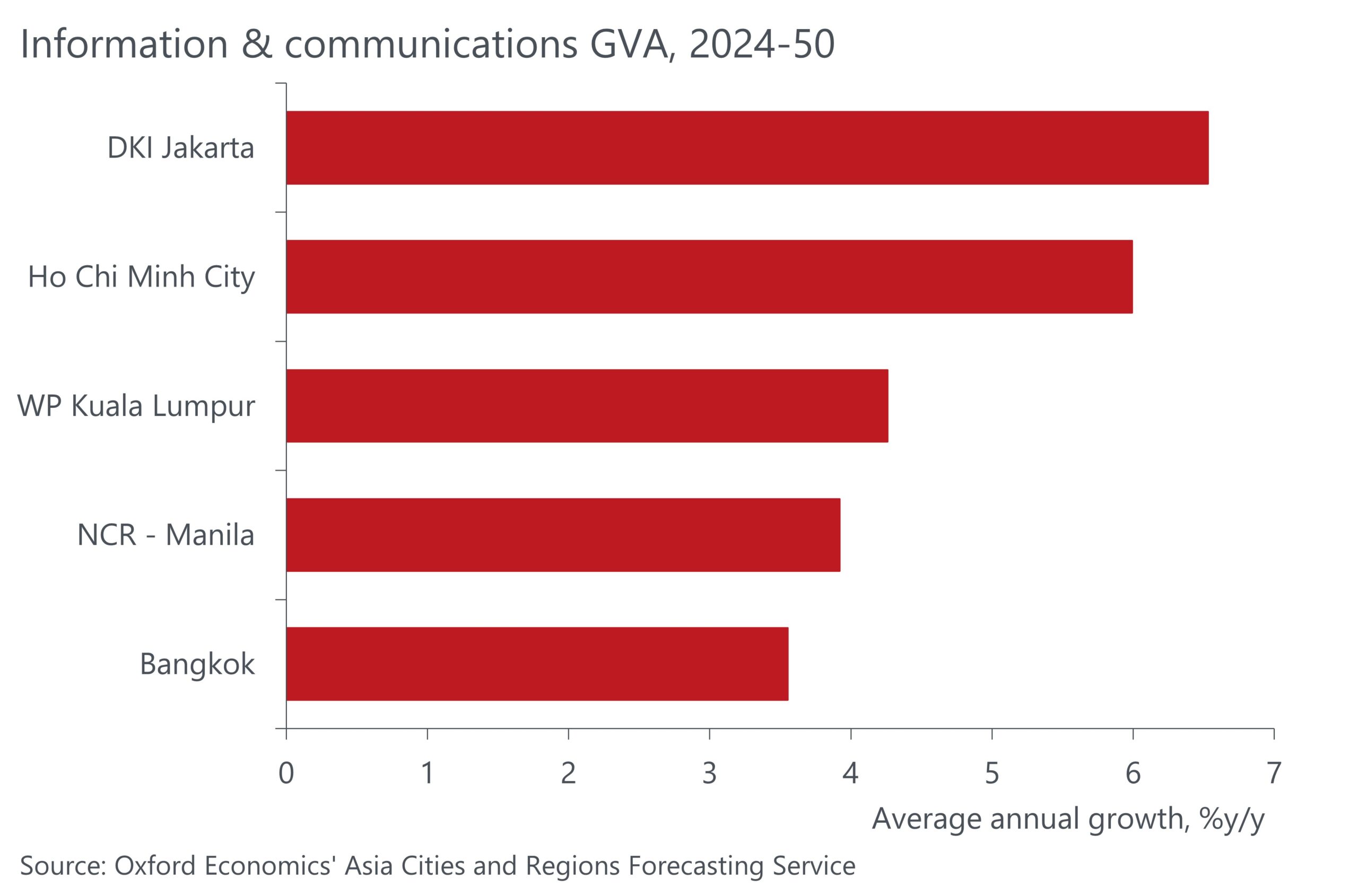

Jakarta has been experiencing fast economic development through the expansion of its private services sectors and has the fastest growing IT sector among the major cities in Southeast Asia and indeed one of the fastest growing across Asia-Pacific more generally. Forecasts from our Asia Cities and Regional Forecasts Service show that in real terms by 2050, we expect its economy will be almost three times as large as it is today, while its population will peak at close to 11 million. Moreover, according to our own projections for Jakarta’s wider functional urban area, which includes Jakarta province and its satellite cities, the city is expected to have a population of more than 40 million by 2050, vastly dwarfing the projected population of the new capital.

However, Jakarta’s continued development does mean the capital relocation is unlikely to provide much reprieve from the environmental and infrastructure pressures it faces.

The national and provincial authorities are certainly aware of the issues and have pledged funds towards Jakarta’s urban regeneration, including improving public transportation and water management. Even the long gestating and often-shelved plans for constructing a giant sea wall have recently been revived.

Certainly, a major effort is required to arrest the city’s subsidence. If the situation becomes more acute, then a much greater displacement of people, businesses, and economic activity could become unavoidable.

Subscribe to our newsletters

Subscribe to our newsletter to get our insights straight to your inbox. Additionally, you can check ‘Talk to us’ box to have our team contact you about a free trial of our services and how we can support you.

The analysis and forecasts in this blog are backed by our Asia Cities and Regions Service as well as Asia construction service. Leveraging our modelling infrastructure, we apply a consistent set of high-level assumptions about the trends and risks in the broader environment across all our forecasts. This approach ensures we provides you with holistic and unified insights at the national, subnational and industry level, saving you from the hustles of collecting information from multiple sources. Additionally, our forecasts are further fine-tuned by experts who specialises in specific areas, ensuring they reflect the nuances and realities of different regions and sectors. To unlock the power of our insights to support your investment and business operations, request a free trial by clicking here.

Tags:

Related Reports

25% auto tariffs especially painful in Japan and South Korea

Using economics to improve business dialogue with governments in Asia