A higher 10-year will dampen the US CRE pricing recovery

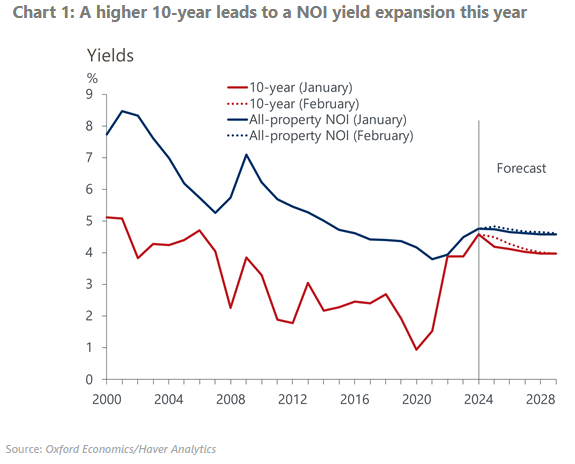

We expect the 10-year Treasury yield to be elevated over the near term as tariffs and other factors keep the inflation outlook higher. A higher-for-longer 10-year will force net operating income (NOI) yields up slightly over the forecast period and dampen the US CRE pricing recovery over the next two years.

What you will learn:

- We anticipate all-property net operating income yields to be 6bps higher and capital values to grow by 0.5% in 2025, compared to 1.6% in our previous forecast.

- Industrial and residential capitalization (cap) rates and NOI yield spreads to the 10-year, despite recent expansions, are now close to or below zero. Between 2022 and 2024, the modest rise in NOI yields in conjunction with a stark increase in the 10-year caused the spread to narrow. These narrow spreads point to more room for expansion in 2025.

- Despite a slight expansion in NOI yields this year, our expectation for fewer rate cuts would keep swap rates elevated and the property-yield inversion to cost of debt wide, likely eroding real estate investor confidence and keeping transaction volumes modest this year.

- Weaker economic growth would affect real estate, putting pressure on occupier performance and likely limiting development supply in the near term. Resuming rate cuts this year followed by lower bond yields should help NOI yields stabilize and slightly compress in 2026.

Tags:

Related Posts

Post

Downside risks for Asian industrial real estate markets

The 'liberation day' tariffs have been postponed, but the existing tariffs and those likely forthcoming present significant downside risks for most Asian industrial real estate markets. Reduced business investment, weaker confidence, and risk-off sentiment alone will inflict a demand shock on industrial and logistics operators, with expansion plans likely on hold.

Find Out More

Post

Real Estate Key Themes 2025: A tentative revival for CRE growth

After a year of transition in the commercial real estate cycle in 2024, we believe CRE is poised for a tentative revival in values.

Find Out More

Post

The impact of Trump’s presidency on US commercial real estate

The policy implications from a second Trump presidency are expected to affect US commercial real estate (CRE) through curbed immigration, tax cuts, and increased tariffs. However, CRE's relative pricing to bond yields will probably most influence values in the short term.

Find Out More