APAC central banks look to anchor expectations rather than follow Fed

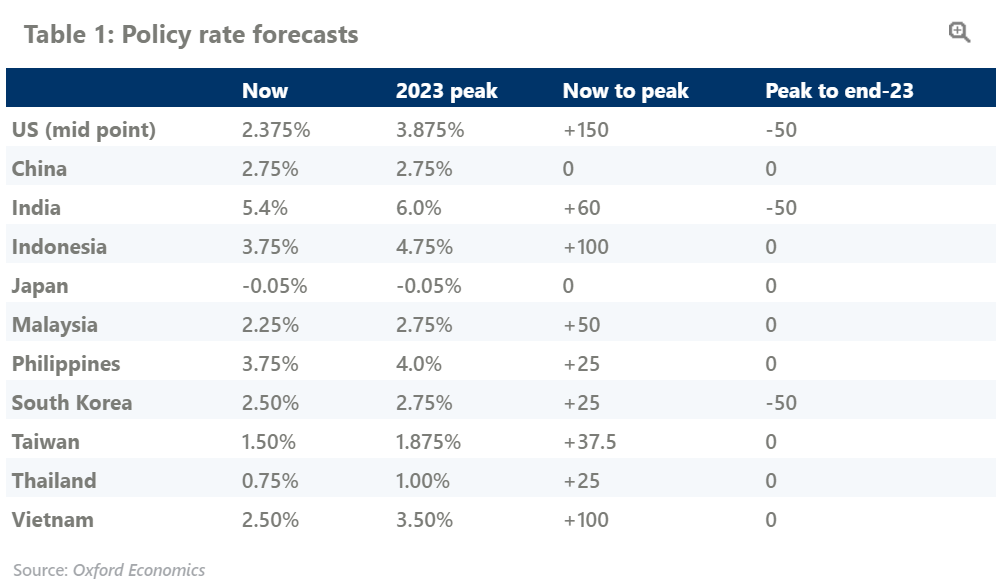

Bank Indonesia finally raised its policy rate late last month, and a few weeks later Bank Negara followed with its third increase since May. The central banks of South Korea, India, and the Philippines have been increasing the policy rate for some time now. So, considering the economic conditions and the various challenges that central banks are currently facing, what is the likely outlook on interest rates?

What you will learn:

- The strong US dollar – a product of these shocks – has resulted in several Asian currencies weakening, despite an improvement in trade balances. Many Asian economies, and especially energy exporters such as Indonesia and Malaysia, could have absorbed the Fed’s hikes without raising rates, but the continued strength of the US dollar (or local currency weakness) has taken away that cushion.

- In an extraordinarily challenging time for policymakers, they are wrestling with conflicting objectives. While the medium-term goal will be to promote growth as there is still significant slack in most economies, the near-term imperative is to keep inflationary expectations anchored. Given this short-term goal, policy rates have risen across Asia, as the space in fiscal policy to control the rise in domestic energy prices has largely run out.

- Except for Hong Kong, regional central banks do not need to fully follow the US Fed’s rate increases. There is little demand-side inflationary pressure, except perhaps in South Korea and Singapore.

Tags:

Related posts

Post

Trump tariffs to shake up Asian manufacturing in 2025

The new US tariffs add an additional layer of drag on Asian manufacturing activities. India will be one of the least affected countries.

Find Out More

Post

The risks to Asia from Trump’s tariff plans so far

We think the immediate tariffs on China will have spillovers to some other Asian economies, while the threat of reciprocal tariffs has raised the odds that of the rest of Asia will also be slapped with higher tariffs.

Find Out More