APAC’s consumption recovery will slow into 2023, but not reverse

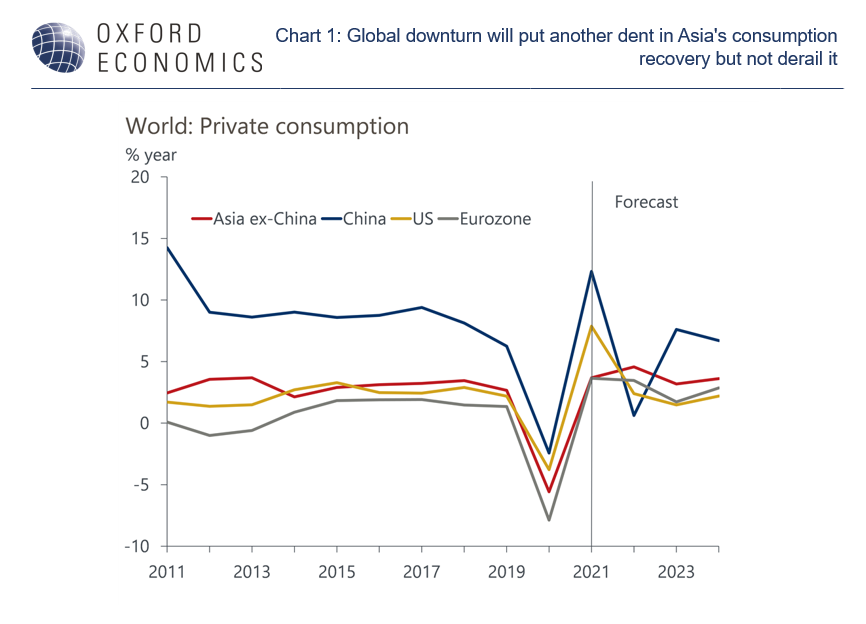

The pace of Asia’s household spending will likely lose steam from here as tailwinds from re-openings ease, real income growth slows, and sentiment weakens amid a challenging global backdrop. Within the region, we think downside pressures are more pronounces for northeast Asian as compared to India and Southeast Asia.

Still, with most of the continent finally treating Covid as endemic, we expect private consumption growth to remain resilient in 2023 and generally outperform other regions.

What you will learn:

- An important reason for our outlook is that real incomes are expected to rise in Asia in 2022 and 2023.

- With household savings rates still above pre-pandemic levels, consumers also have the scope to save less. In general, we expect savings rates to fall below 2019 levels next year.

- Finally, the policy backdrop is expected to stay supportive. While rate hikes have picked up recently, the pace of tightening is not nearly aggressive enough to cripple spending or topple growth.

- That said, we must note that growth resilience in the short term does not improve Asia’s medium-term outlook. It only prevents it from worsening. Within the region, we think downside pressures are more pronounced for Northeast Asia vs. India and Southeast Asia.

Tags:

Related posts

Post

Downside risks for Asian industrial real estate markets

The 'liberation day' tariffs have been postponed, but the existing tariffs and those likely forthcoming present significant downside risks for most Asian industrial real estate markets. Reduced business investment, weaker confidence, and risk-off sentiment alone will inflict a demand shock on industrial and logistics operators, with expansion plans likely on hold.

Find Out More

Post

Opportunities in Singapore could mitigate hit from US trade barriers

The slew of tariff proposals coming out of the US has added much uncertainty to the highly export-reliant Singapore economy. Given its status as a major shipping hub, potential gains from trade rerouting will probably offset some of the negative impacts of increased tariffs. The upshot is that although Singapore's prospects are dimmed, they remain relatively promising.

Find Out More

Post

The Economic Impact of the On-demand Service Industry in Indonesia

This report examines the contributions of the on-demand service industry to Indonesia’s economy, quantifying its economic impact and highlighting the socio-economic value the industry creates for gig workers and small businesses.

Find Out More