Blog | 19 Apr 2023

ASEAN Tigers to bite back in construction market at a challenging 2023

April Skinner

Senior Economist, Asia Construction, OE Australia

2023 is expected to remain challenging for global construction activity, with growth expected to edge into negative territory. In our recent Research Briefing, we explained how large changes in interest rates signal eventual turning points in construction activity. We expect residential building activity in advanced economies continues to be hampered by higher interest rates and construction costs, while in China the real estate downturn has further to run. Non-residential building activity will also fall as recessions in a number of advanced economies weigh over global demand. However, a sizeable backlog of work will prevent a sharper downturn in actual activity levels and strong infrastructure investment will continue to partially offset the falls in building construction work.

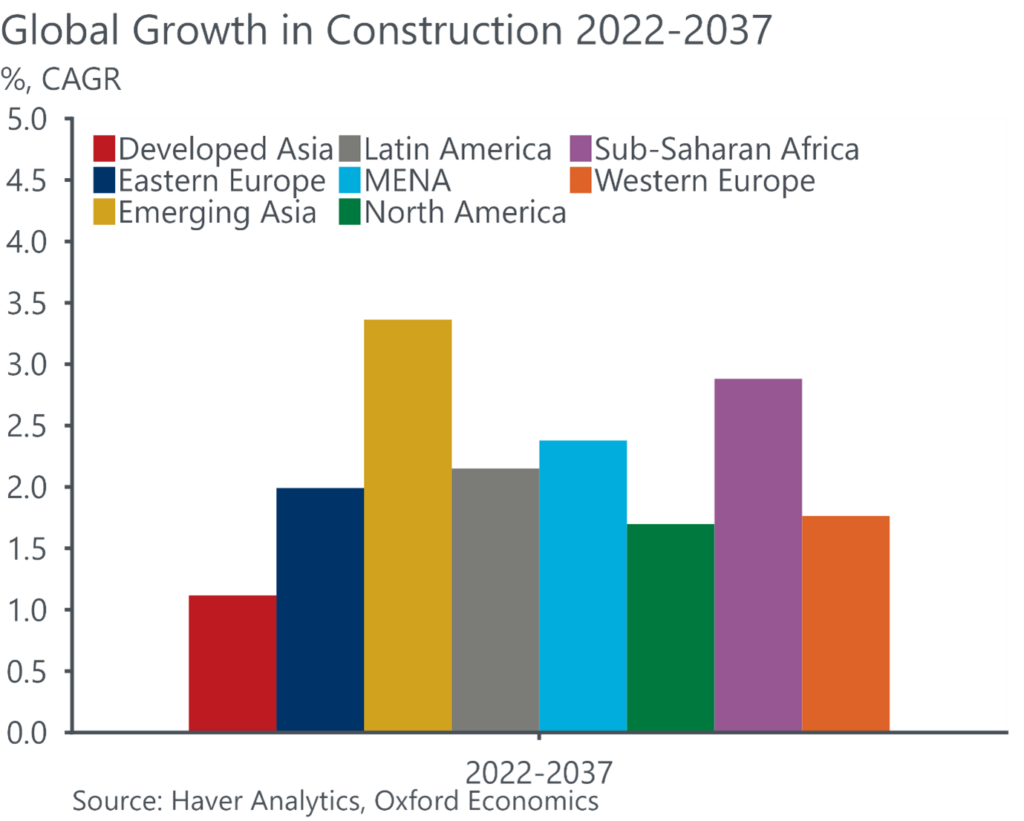

Emerging Asia to lead construction growth

Despite the near-term challenges, the outlook for Asia construction over the next 15 years looks strong. In our recently released Global Construction Futures report, produced in partnership with Aon, we find that the Emerging Asia region will be the fastest growing construction market over the next 15 years. The region is home to the top four fastest growing national construction markets – the Philippines, Vietnam, Indonesia, and Malaysia. Malaysia’s growth is very much a Covid-recovery story, as activity plunged when covid-induced labour shortages caused widespread project delays. Activity levels are set to recovery quickly as migration patterns normalise. Growth in the Philippines, Vietnam and Indonesia will be much more persistent, driven by strong population growth, rapid urbanisation, and private sector support.

Construction activity in India and Bangladesh is also expected to outpace Developed Asia, the Americas, Europe, MENA and Sub-Sahara Africa through to 2037, driven by robust population growth and continued urbanisation. India is expected to be the fastest growing major construction market and is forecast to surpass Germany to become the third largest market globally by the end of the decade. India is now anticipated to be the most populated country in the world and will reach 1.5 billion by 2030. While Bangladesh’s population is not expected to reach the same dizzying heights, Bangladesh’s increasing urbanisation will spur activity growth.

However, challenges remain…

Following the recent International Monetary Fund (IMF) approval of credit to Bangladesh, the IMF has highlighted Bangladesh’s need to substantially invest in human capital and infrastructure in order to achieve its aspiration to reach upper-middle income status by 2031. Given the large requirement for building and infrastructure in the region, foreign investment remains a key to the success of these projects. However, this remains challenging and is a key risk for the construction outlook. Indonesia has had difficulties in attracting investor interest for the re-location of its capital city to Nusantara, with the completion of the first phase of the project likely pushed out from its 2024 deadline.

Legislative red tape has been a significant barrier for investors into the region in recent history. However, the region continues to improve its ‘ease of doing business’, with a host of incentive schemes and programs to attract both foreign and domestic investors. These include Indonesia’s Indonesia-Australian Comprehensive Economic Partnership Agreement (IA-CEPA), the Philippines’ 2022 Strategic Investment Priority Plan (SIPP) and Vietnam’s implementation of Resolution No.43 (R43) and the passing of Decision 667 whichlooks to promote foreign investment.

Download Report: Global Construction Futures

Fill out the form to download the executive summary of Global Construction Futures.

To learn more about the Global Construction Futures report, pelase visit here.

Author

April Skinner

Senior Economist, Asia Construction

Nicholas Fearnley

Head of Global Construction Forecasting

You might be interested in

Service

Australian Infrastructure Construction

Forecasts and analysis of civil infrastructure and heavy industry investment across Australia.

Find Out More

Service

Insights on Australian Maintenance Forecasts

Forecasts of maintenance activity and tracking of maintenance contracts in Australia and New Zealand.

Find Out More

Service

Australian Mining Commodity Price Forecasts

Analysis and forecasts of activity at all stages of the mine lifecycle by commodity.

Find Out More

Service

New Zealand Construction Market Analysis

Insight into the building and construction industry throughout New Zealand. Using Oxford Economics Australia's established methodology, the New Zealand Forecasting Service provides detailed overviews of historical trends as well as future prospects for building activity.

Find Out More