Asia-Pacific: A modest 2024 for consumer spending in APAC cities

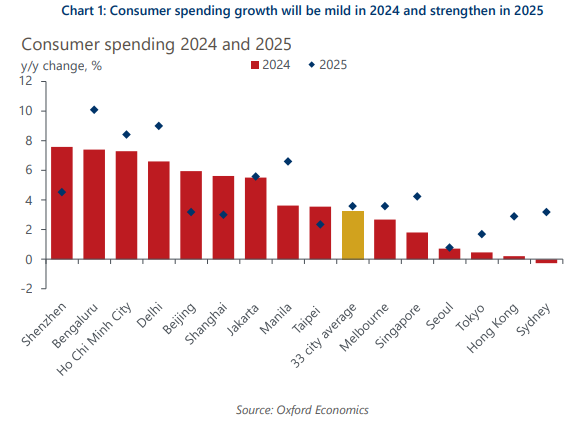

We forecast GDP growth in APAC cities will slow in 2024, falling to 3.3% on average. Persistent inflation and increased slack in labour markets will weigh on incomes, and so, on consumer spending growth. Consumers’ risk aversion, as reflected by low levels of consumer confidence, further point towards a soft year for APAC cities in terms of consumer spending. 2025 should mark a return to faster growth as the above-mentioned effects fade and tailwinds in the global economy strengthen.

What you will learn:

- Inflation has dropped more slowly than initially anticipated in several APAC cities, including Sydney and Seoul. We expect that continued price pressures in these cities will weigh on consumer’s spending power throughout 2024.

- Slower economic growth will likely translate into increased slack in the labour markets of several APAC cities. We forecast that unemployment will increase in places like Singapore and Sydney, leading to negative real income growth and slower growth in consumer spending.

- Low consumer confidence across APAC cities provides further support to our view of a modest year for consumer spending in the region’s cities. We think consumers will take a risk-off approach this year and generally stay away from big-ticket discretionary spending.

Tags:

Related Posts

Post

Opportunities in Singapore could mitigate hit from US trade barriers

The slew of tariff proposals coming out of the US has added much uncertainty to the highly export-reliant Singapore economy. Given its status as a major shipping hub, potential gains from trade rerouting will probably offset some of the negative impacts of increased tariffs. The upshot is that although Singapore's prospects are dimmed, they remain relatively promising.

Find Out More

Post

The Economic Impact of the On-demand Service Industry in Indonesia

This report examines the contributions of the on-demand service industry to Indonesia’s economy, quantifying its economic impact and highlighting the socio-economic value the industry creates for gig workers and small businesses.

Find Out More

Post

The Economic Impact of Grab in Singapore

This report examines Grab’s contributions to Singapore’s economy, quantifying its economic footprint and highlighting the platform’s contribution to the digital economy, and the socioeconomic opportunities it creates for gig workers and small businesses.

Find Out More