Asia Pacific: US-China trade tensions may benefit ASEAN

The risk of higher trade tensions, and its subsequent implications on trade policy, is high. The upcoming US presidential election this November has the chance to spark an escalation of a global trade war if former President Donald Trump returns to the White House. However, even without the former president returning, tariff risks to ASEAN economies are rising, particularly through anti-dumping tariffs.

What you will learn:

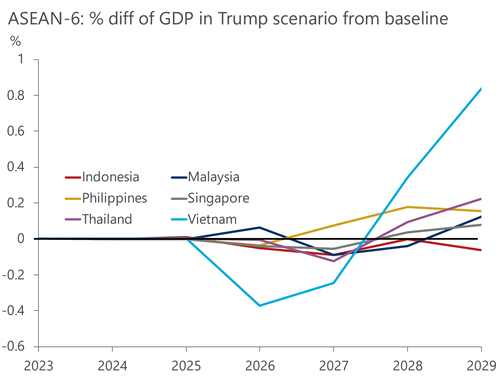

- Higher US-China trade tensions present risks to Southeast Asian (ASEAN) economies. In our “full-blown Trump scenario”, we expect lower real exports and economic growth, and weaker ASEAN currencies against the US dollar. However, trade diversions may help mitigate the initial fallout.

- Higher tariffs on China and elsewhere affect ASEAN in three ways. First, linked value chains mean lower demand for Chinese goods will impact ASEAN exporters supporting Chinese producers. Second, lower global growth will weigh on external demand and third, ASEAN goods that directly compete with Chinese goods as substitutes will become relatively cheaper for US consumers.

- On balance, we think that the effects of trade substitution and trade diversion will outweigh the hit to growth. But this will likely take time.

- We believe a downside risk to growth that wasn’t modelled as an assumption in the scenario is the increasing likelihood of anti-dumping tariffs from the US on ASEAN economies.

- The scenario points to higher inflation in the US relative to the baseline forecast. This likely means a higher policy rate from the US Fed, resulting in a stronger US dollar and in turn, weaker ASEAN currencies.

Tags:

Related Services

Post

Cyclical recovery in Asia and Europe boosts global enterprise spending

Global spending on technology products by businesses and governments will grow 5.8% in 2025, adjusted for inflation and currency movement, which is over twice the pace of GDP.Manufacturers in Asia have led a global recovery in electronics after the slowdown in 2023. As a result, the devices spend will be a leader in enterprise technology going into 2025, with internet & cloud and IT services not far behind.

Find Out More

Post

After the presidential debate, the US election remains a toss-up

Though Vice President Kamala Harris' chances of winning the election have improved since her debate with former President Donald Trump, we aren't changing our subjective odds for the outcome of the 2024 presidential contest.

Find Out More

Post

Growth may slow, but the consensus looks too weak

The UK grew at an above-trend pace in H1 2024, but we don't expect this to be sustained over the next couple of years. However, we are more optimistic than the consensus. Our forecast that GDP will grow by 1.7% next year is based on the notion that consumers will finally shed their caution and make a stronger contribution to growth.

Find Out More

Post

Asia Pacific: Summertime blues foreshadow the slowdown

Four themes have dictated Asia's macroeconomic outlook over the summer and are likely to continue to exert an influence over the rest of the year and into 2025, in our view.

Find Out More