Bank of Japan resumes rate normalisation, cautiously

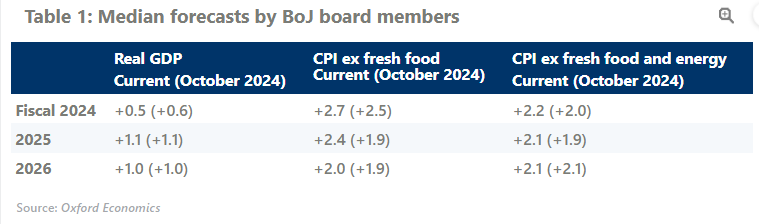

The Bank of Japan raised the policy rate by 0.25ppts to 0.5% at Friday’s meeting, as we expected. We maintain our call that the central bank will hike the rate again to 0.75%, most likely in July after the outcome of the Spring Wage Negotiation is confirmed, especially for small firms.

What you will learn:

- The BoJ expects a strong wage settlement this year comparable to 2024. We project wage growth of around 4.5% (5.1% in 2024), but risks are tilted to upside. We believe that SMEs will generally manage to follow the wage increases set by leading large firms this year, though risks remain.

- Real income and consumption still lack buoyancy as inflation has stuck around 3% due to supply-side factors, including the impact of yen depreciation. The BoJ expects inflation to decline and stabilize at 2% but a weaker yen could hamper the process. Inflation could stabilize at less than 2% if the pass-through of wage rises to prices fails to gain traction.

- Although the next hike will very likely take place this year, the impact of the yen price and domestic politics makes the timing uncertain. Discussions on the neutral and terminal rates will also increasingly gain attention. We still expect the BoJ will end rate hikes after reaching 1% – our estimate of the neutral rate – in the spring or summer of 2026.

Tags:

Related Posts

Post

25% auto tariffs especially painful in Japan and South Korea

US tariffs of 25% on all automobile and auto parts will weigh heavily on the Japanese and South Korean automotive sectors. A GTAP analysis suggests Japanese and South Korean automotive production will each shrink by approximately 7%. The impact is larger than suggested by bilateral trade data, because vehicles assembled in other countries before being shipped to the US will also be affected, dampening domestic auto parts production.

Find Out More

Post

‘Liberation Day’ 24% tariff will limit Japan’s growth

The 'Liberation Day' tariffs, together with separately announced higher tariffs on auto imports to the US, will lead us to cut our growth forecast for Japan. The direct impact of the tariffs will end the modest growth we projected in March, and we now think the economy will barely grow in 2025-2026. This initial estimate does not consider the indirect impact from high trade policy uncertainty and retaliation from other economies.

Find Out More

Post

Japan’s on course for July rate hike, but risk of June increases

The Bank of Japan (BoJ) kept its policy rate at 0.50% at Wednesday's meeting, as expected. Despite a marginally higher increase in pay than last year at the first round of the spring wage negotiations, our baseline view is for the BoJ to hike its policy rate only gradually due to concerns about the capacity of small firms to raise wages and the lacklustre rate of consumption.

Find Out More