Beijing’s new industrialisation gamble – will it pay off?

Beijing’s reinvigorated support for manufacturing is quite the economic gamble. With property still in the doldrums and the post-Covid services recovery having largely run its course, the rationale is that manufacturing could minimise the risk of a broader activity slowdown.

What you will learn:

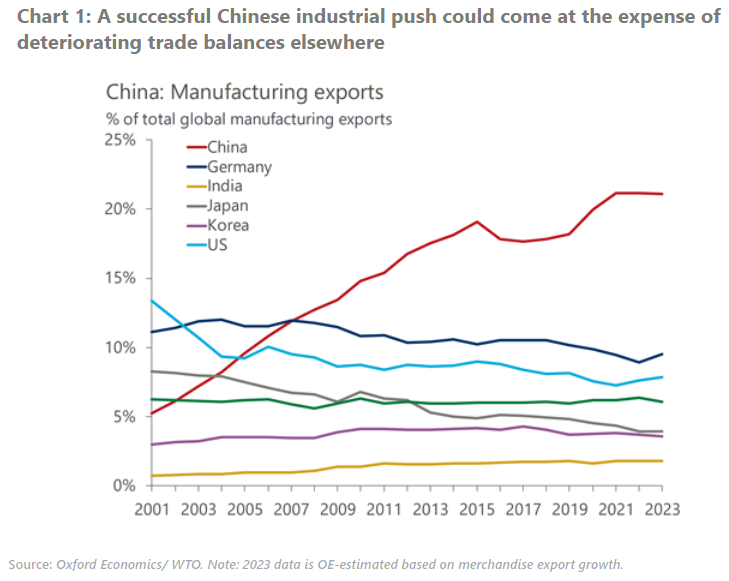

- But as demand remains tentative onshore, the natural and consequent reliance on an export-led growth strategy could worsen trade balances elsewhere, triggering more severe protectionism in retaliation. Already, momentum on that front is building across the US, EU and parts of emerging markets.

- This time around, state-favoured industries, including science, high-tech, and green sectors, have been the main beneficiaries of local lending activity, successfully translating the increased funding into increased productive capacity. In some of these industries, such as renewables and batteries, overcapacity has become an increasing risk, adding to disinflationary pressures.

- Still, macro data suggests China’s manufacturers remain highly export competitive. They are chiefly competing with regional or advanced economy peers in key export markets, reflecting an impressive range of product and cost competitiveness across the supply chain, particularly in niche areas like electronics.

- The other key difference in the current industrial policy push is that there’s likely much less upside now than in previous cycles for foreign multinationals and exporters of inputs into China’s manufacturing.

Tags:

Related Services

Post

Tariffs 101: What are they and how do they work?

Tariffs are taxes imposed by a government on goods and services imported from other countries. Think of tariff like an extra cost added to foreign products when they enter the country. They’re usually a percentage of the price of the goods, making imported items more expensive compared to domestically produced good

Find Out More

Post

Global Scenarios Service – Heightened Tensions

This quarter’s scenarios quantify key risks to the global economy. These relate primarily to trade protectionism and other geopolitical tensions, structural weakness in the Chinese economy, the stance of monetary and fiscal policy, and financial market conditions.

Find Out More

Post

U.S. dollar strength to remain; Fed to hold interest rates until December

Innes McFee, Managing Director of Macroeconomic and Investor Services at Oxford Economics, discusses the outlook for the U.S. dollar and adds that tariffs will be a “negative” for the U.S. economy.

Find Out More