BoJ likely to end zero interest rates in autumn

As expected, the BoJ maintained its policy rate at 0%-0.1% at Friday’s meeting. With more confidence on the ongoing wage-driven inflation dynamics and a strong appetite for policy normalisation, the BoJ looks more likely to end its zero-interest rate policy in the autumn.

What you will learn:

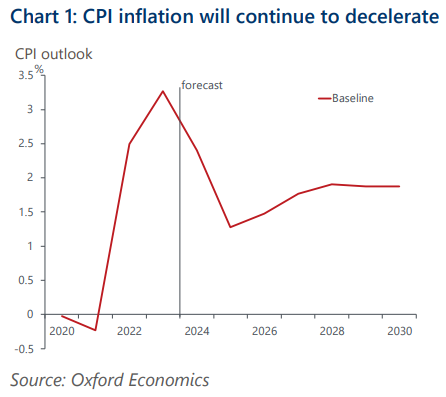

- The median CPI (excluding fresh food and energy) forecast in the Quarterly Outlook Report was unchanged at 1.9% for FY2024 and 2025. The figure for FY2026 was 2.1%, showcasing the BoJ’s confidence that it will achieve the 2% inflation target in coming years.

- The BoJ has increasingly stressed that monetary policy is data dependent. The wage settlement for SMEs at the Spring Negotiation continues to provide upside surprises.

- Assuming the recovery in real incomes and consumption is confirmed in the summer, the BoJ will likely raise its policy rate, arguing that the probability of meeting the 2% target has risen.

- We still project that the BoJ will cautiously raise its policy rate to 1% by 2028. The risk that 1% won’t be reached is also still significant due to the huge downside risks in the medium-term price outlook, especially the sustainability of wage rises and SMEs’ pricing power.

Tags:

Related Posts

Post

Japan’s tariff turbulence to flatten near-term growth

We've cut our GDP growth forecasts for Japan by 0.2ppts to 0.8% in 2025 and by 0.4ppts to 0.2% in 2026, reflecting higher US tariffs and heightened global trade policy uncertainty. We now forecast that Japan's economy will barely grow over 2025-2026 on a sequential basis.

Find Out More

Post

25% auto tariffs especially painful in Japan and South Korea

US tariffs of 25% on all automobile and auto parts will weigh heavily on the Japanese and South Korean automotive sectors. A GTAP analysis suggests Japanese and South Korean automotive production will each shrink by approximately 7%. The impact is larger than suggested by bilateral trade data, because vehicles assembled in other countries before being shipped to the US will also be affected, dampening domestic auto parts production.

Find Out More

Post

‘Liberation Day’ 24% tariff will limit Japan’s growth

The 'Liberation Day' tariffs, together with separately announced higher tariffs on auto imports to the US, will lead us to cut our growth forecast for Japan. The direct impact of the tariffs will end the modest growth we projected in March, and we now think the economy will barely grow in 2025-2026. This initial estimate does not consider the indirect impact from high trade policy uncertainty and retaliation from other economies.

Find Out More