Ungated Post | 13 Feb 2018

Buy the dip! Market bulls to get a last hurrah as bears sleep on

As winter turns to spring, around the world investors are anxiously watching the present spasm in global equities and bonds and asking themselves whether the bears of the financial markets are finally waking from a long hibernation.

We think not. To us, a correction of the sort seen in recent days was overdue and a jump in volatility along with this sort of adjustment in equity valuations was just a matter of time. The pretext and triggers were, and remain, less important – stretched valuations in equities often find their own triggers for such an upset.

We ended 2017 noting that things had probably been too nice to last (Returns will come with more volatility in 2018 11 Dec, 2017), given that both equities and fixed income had returned most per unit of volatility for a decade, and in a year characterised by global monetary-tightening rather than new stimulus – something markets had allegedly got accustomed to.

And then we began 2018 with a warning that correction risks had risen with equity prices having surged from already high levels and valuations at lofty heights.

But we didn’t think in December or January that a bear market was likely (Is it so good that something must go wrong 21 Dec, 2017). We still don’t.

In fact, we maintain that valuations in expensive markets such as the US will probably get more expensive before a significant bear market takes hold. (Bubble trouble amid a melt-up catch-up 8 Jan, 2018)

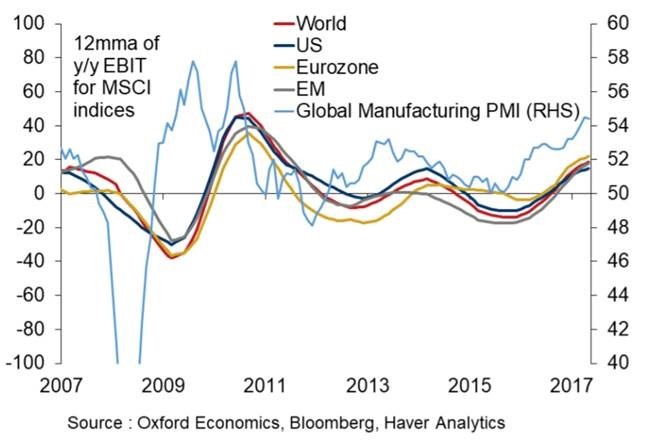

The strong upward momentum in global earnings cycle, fuelled by a strong global industrial cycle and improved global liquidity, isn’t really a backdrop for a large bear market in global equities (see chart below).

The latest earnings season in the US shows signs of acceleration in the growth of equity returns measured by earnings per share (EPS). With 261 S&P500 corporations having reported, average earnings growth of around 15% shows a marked acceleration from the 7.2% earnings growth in Q3 last year.

What is true is that by late last year markets, especially in the US and parts of Asia, had entered the stage of euphoria often seen during extended late-cycle rallies, driven in part by speculation about the impact of tax reforms in the US.

With robust upward EPS cycles and resurgent corporate capital expenditure, we see the current dip in equity markets as representing an opportunity to buy (An opportune dip to buy into 13 Feb, 2018).

We recognise that this is a late-cycle rally, and buying frenzy is unlikely to be as extreme as we have seen since early 2016. Yet with inflation likely to rise only modestly, we see plenty of juice left in the ongoing upswing.

The technical correction in global equity markets has gone some way towards taking out excessive froth from valuations. Forward price-earnings ratios (P/Es) on US and other major equity markets have dropped to early 2016 levels.

Even on US equities we have come off the fence and concluded that it’s likely that despite rich valuations US bulls will have a last hurrah thanks to earnings acceleration and a weaker dollar, in addition to the boost from tax reform.

The “fear of missing out” (FOMO) syndrome will likely pull in retail buyers, given the buy-the-dip crescendo. Japan and core Europe will, in our view, still also be able to turn in superior risk-adjusted returns.

And the weaker dollar is another important consideration. The dollar weakened by a good 8% in trade-weighted terms over the course of 2017, and we expect further weakness this year. Estimates of S&P 500 firms’ overseas sales revenues are now as high as 40 to 50% of total revenues, with the proportion as high as 60% for sectors such as Tech.

Macro fall-out looks marginal

What about the wider economic impact of the market turmoil – and downside risks from any further correction?

We find it unlikely that this market episode will be associated with any sustained economic downturn. (Melt-up-down! Macro consequences 6 Feb, 2018).

The ingredients are inconsistent with that most fearsome of scenarios in which inflation picks up sharply while the economy stagnates. All the tantrums and market episodes of recent years have petered out quite quickly, and our view is that this one will probably take a similar turn – if it hasn’t already.

Even in what we see as the unlikely event of a sustained market slump, the Oxford Economics global economic model suggests that a 10% change in stock prices reduces the level of G7 economies’ GDP by only around 0.3% on average after two years.

Read our macro strategy analysis of the markets’ upset

Tags:

You may be interested in

Post

Oxford Economics enhances its real estate solutions with the addition of MSCI data

Oxford Economics is delighted to announce a significant product enhancement to its Real Estate Economics Service and Global Economic Model, with the addition of MSCI historic real estate index data.

Find Out More

Post

From Floppy Disks to AI: A Fireside Chat with Adrian Cooper, CEO of Oxford Economics

Discover the journey of Adrian Cooper, CEO of Oxford Economics, in shaping the firm into a global leader, along with his insights and vision for the future in an exclusive interview.

Find Out More

Post

Oxford Economics introduces new Global Tech Spend Forecasts

Oxford Economics is excited to announce the launch of the Global Tech Spend Forecasts service, offering the most reliable forecasts on enterprise IT spending across 35 industries and 25 countries, with forecasts out to 2050.

Find Out More