Can Indian manufacturing capitalise on US-China tensions?

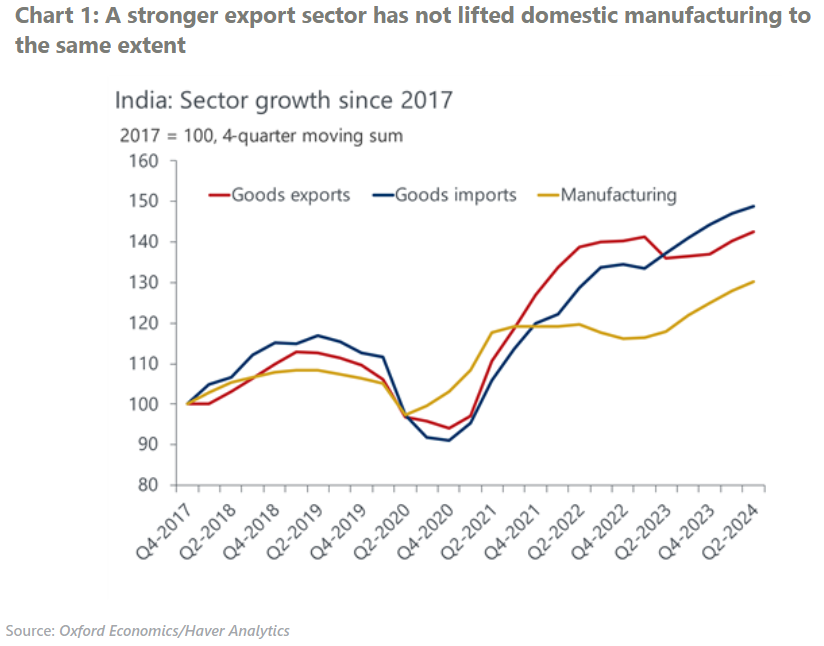

India has benefited from US trade rerouting away from China since 2018, albeit to a much lesser extent than some of its Asian peers. India’s export strengths largely lie in sectors of the ‘old economy’, where growth potential is limited and competition is fierce. We estimate that the US-China trade war so far has improved India’s export prospects only to a limited extent, dashing hopes that an escalation of the conflict could boost the lagging manufacturing sector.

What you will learn:

- India has also made substantial advances in electronics, a higher value-add sector and the US’s second-largest import market, where the cut in ties with China has been especially pronounced.

- Our simulations suggest that China’s share may plummet even further. But India’s neighbours have a strong competitive advantage that will be difficult to catch up with given persistent gaps in infrastructure, human capital levels, and wider ease of doing business.

- Perhaps more worrying is that exports have risen largely in tandem with components imports from China, leaving little value added domestically. Plus, India could itself become a target of protectionist measures by the US due to the large share of Chinese components in Indian products.

- What’s more, India has so far not been able to attract a notably greater portion of global foreign direct investment, even as FDI flows to China plummeted. Chinese firms have also sought to increase their footprint abroad. But structural investment barriers and political resistance will likely keep capital inflows limited.

Tags:

Related Posts

Post

Tariffs take a toll despite easing trade hostilities

Global tradeflows remain under pressure despite easing tariff tensions. Recent US–China agreements reduce select import taxes and support China’s 2026 outlook, yet US imports continue to fall and supply chains pivot toward Asia and Europe. Containerised trade is set to expand, while bulk shipments soften alongside weaker industrial demand.

Find Out More

Post

Global trade is losing momentum

Trade disruptions spread across autos and pharma sectors, with EU tariff exemptions giving Europe a competitive edge amid global slowdown.

Find Out More

Post

Why have China’s exports held up so well under higher US tariffs?

China's exports have adapted, rather than retreated, under higher US tariffs. It will be difficult for businesses and consumers to decouple from Chinese exports or China-linked supply chains.

Find Out More