China coastal tech exporters vulnerable to new Trump tariff

The United States has introduced an additional 10% levy on Chinese imports as part of the opening round of the Trump 2.0 tariff regime. While certainly not as severe as some of the tariff threats made against China by President Trump in the run up to his inauguration, we nevertheless expect the additional tariffs to affect the country’s economic performance—with coastal tech manufacturing hubs particularly vulnerable.

What you will learn:

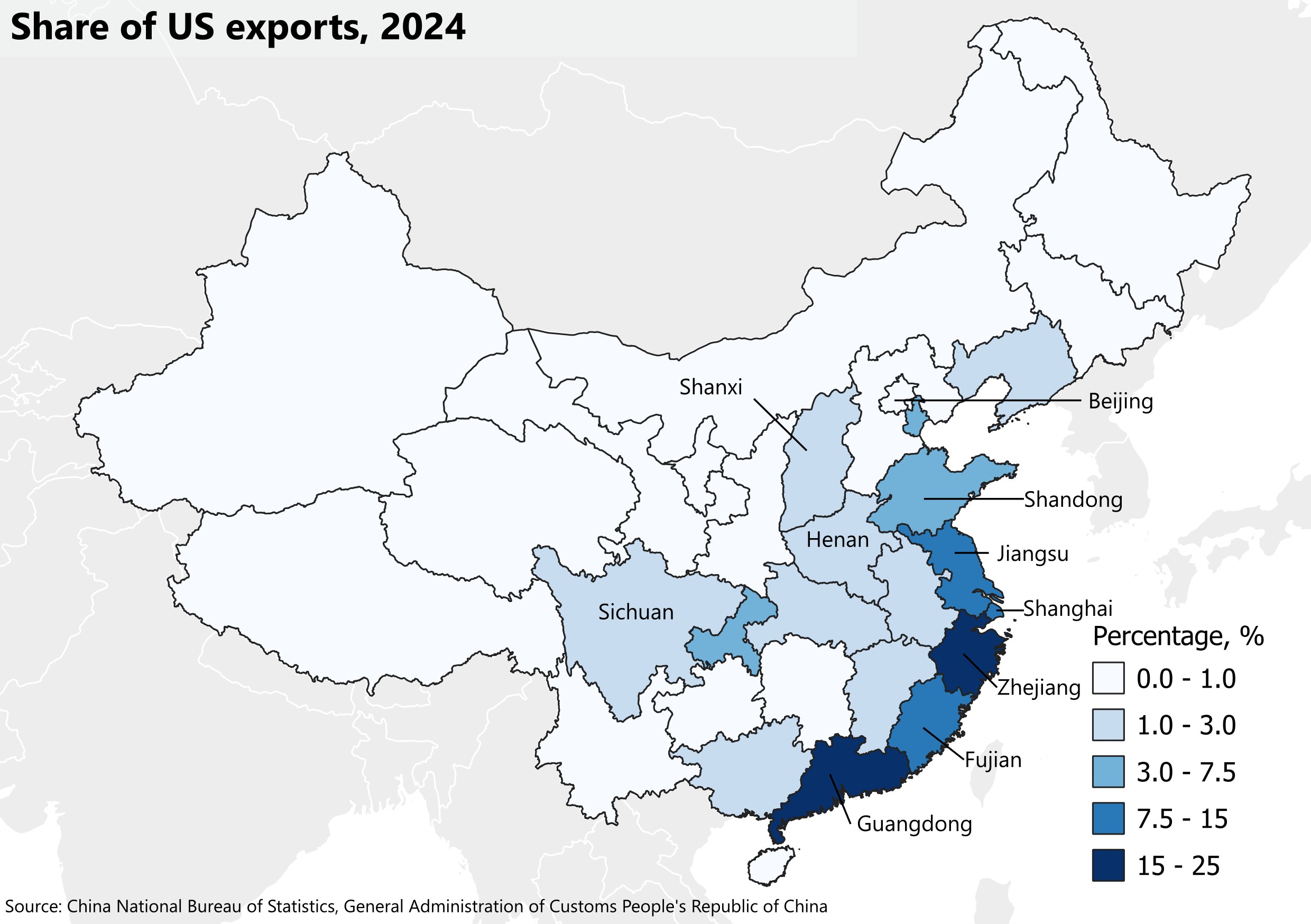

- Given the catch-all nature of the new tariff, manufacturers across goods categories and regions will likely feel the short-term pinch on production from lower US demand. However, the provinces and cities most vulnerable will be those with manufacturing bases that have higher concentrations of the largest and most important US-bound export categories, particularly electronics and apparel.

- This includes the coastal provinces of Guangdong, Jiangsu, and Zhejiang, the three largest exporters to the US and which combine to account for over 50% of all China’s exports in electronics. The central provinces of Henan, Shanxi, and Sichuan, where the US accounts for as high as 30% of all exports from those regions, are also vulnerable, as are specialist export manufacturing cities, such as “iPhone city” Zhengzhou.

- In the long term, an additional concern for China’s key export-manufacturing regions will be the hastening of supply chain diversification. Producers in China have already come under intense cost competition from cities in India and elsewhere in Asia in recent years, and new and entrenched tariffs could hasten business plans to diversify supply chains away from China. This would be a hit to cities and provinces, not only by affecting production and jobs, but also in terms of the flow of knowledge and Chinese tech competitiveness.

Tags:

Related Services

Post

All US metros worse off from recent tariff announcements

President Trump's recent tariff announcements, and the global response, have meant a fast-changing policy landscape with significant effects on our global, national, and subnational outlook.

Find Out More

Post

US tariffs drag on growth prospects for Asian cities

Cities and regions where we expect the largest downgrades to GDP growth over 2025–2026 are those with higher concentrations of economic activity in export manufacturing—especially those facing targeted US tariffs and those vulnerable to the second-round effects of lower global demand. Lower global trade and industrial activity will also affect regional logistics and transport hubs.

Find Out More

Post

Which regions are most exposed to the 25% automotive tariffs?

While the automotive tariffs will likely lead to some production being reshored to US plants, they will also raise costs for US manufacturers and households.

Find Out More