China sectoral implications of Trump 2.0

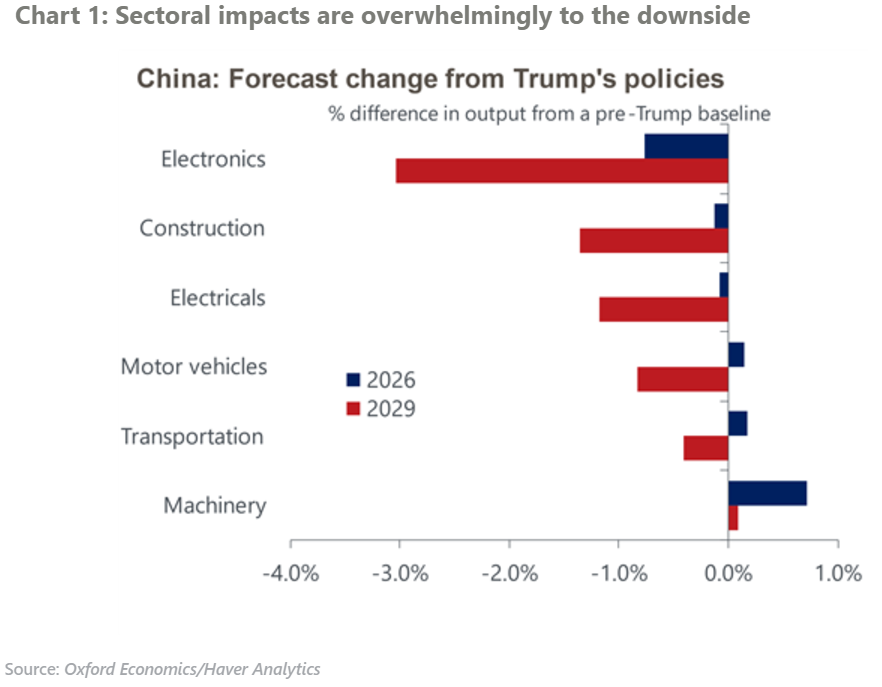

The incoming Trump administration’s trade policies will have significant impacts on China’s sectoral outlook. There will be a small near-term boost to Chinese output prior to the introduction of tariffs owing to a frontloading of orders. However, the long-term impact will be overwhelmingly negative on Chinese industrial activity.

What you will learn:

- Chinese authorities will use fiscal and monetary policy to support the economy, particularly focusing on the property and construction sectors. However, declines in private investment and lower exports to the US will ultimately outweigh the expected fiscal and monetary offsets.

- Supply chains will be disrupted as firms seek to reposition their operations away from China to avoid tariffs. This is particularly true within the automotive and machinery sectors where parts are often traded cross-border multiple times before final assembly. This disruption will be felt most significantly in China, but the impact will be global owing to China’s centrality in global manufacturing.

- The high-tech electronics sector will be amongst the hardest hit. Advanced production will likely migrate to regional peers such as Japan, South Korea, and Taiwan, while lower value-add activities will move towards ASEAN nations. In addition, export restrictions will likely stem the flow of knowledge, hitting productivity and eroding Chinese high-tech competitiveness.

Tags:

Related Posts

Post

Eurozone: Euro will cushion, but not offset, the tariff impact

Despite the recent appreciation, our forecast still sees a weaker euro versus the US dollar compared to our pre-US election baseline. We think this will partially mitigate the adverse growth impact of tariffs. But extra-Eurozone exports have become less sensitive to a weaker euro over time, so currency depreciation cannot be relied on to offset the adverse impact of price shocks on Eurozone exports.

Find Out More

Post

Trump tariffs will cut UK growth as global demand weakens

The imposition of larger-than-expected tariffs on US imports will lead us to cut our UK growth forecast. Our new baseline will likely put GDP growth at just below our current forecast of 1% for this year and close to 1% for 2026, from the previous 1.5%.

Find Out More

Post

‘Liberation Day’ impacts to prolong the EU industrial recession

The Trump administration's imposition of a blanket 20% tariff on EU imports, in addition to the wide-ranging tariff increases imposed elsewhere, is set to weigh on European manufacturing and prolong the industrial recession.

Find Out More