China strategising for a second Trump term

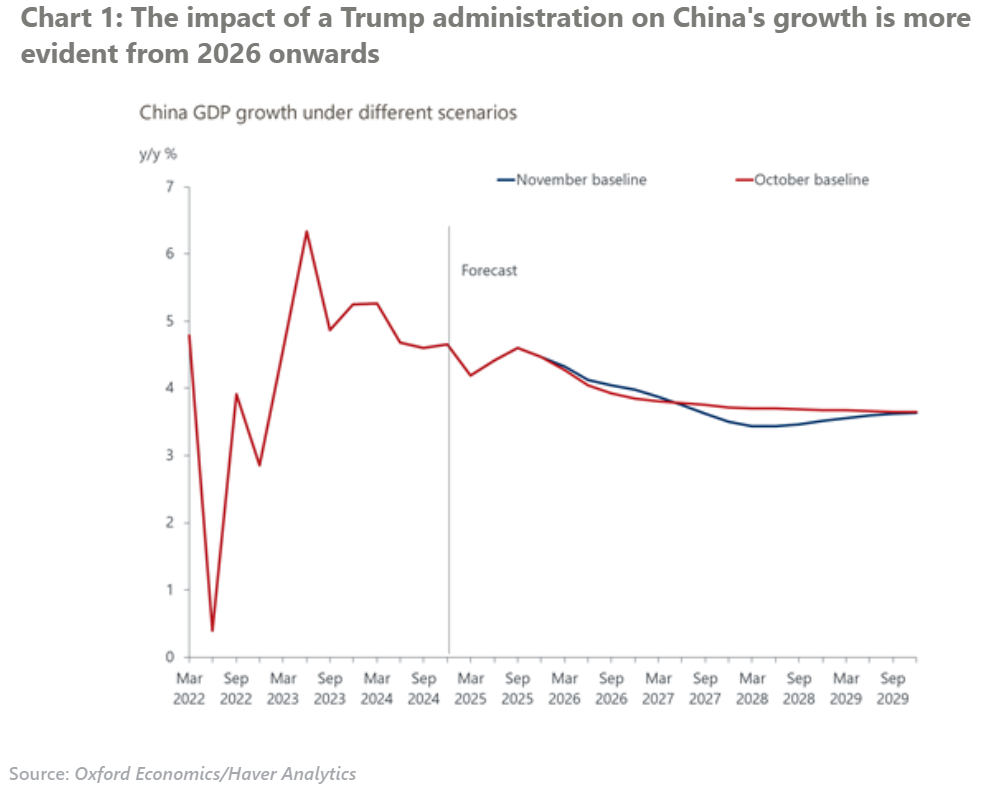

US tariffs under a Trump presidency and a Republican-led Congress are a major concern for China. However, we expect additional US tariffs wouldn’t be implemented until as late as 2026 and the effects could be mitigated early on by expansionary fiscal policy in the US.

What you will learn:

- Our modelling suggests that US tariffs could reduce China’s GDP by a cumulative 0.4ppts over 2027-2029, which would be manageable. However, the magnitude and the timing of tariff increases will affect the ultimate outcome and we believe the risks are skewed to the upside.

- China has developed a versatile set of tools beyond simple tit-for-tat trade retaliation to respond since 2016-2020, when the previous Trump administration imposed the first set of tariff hikes. China could weaken its currency and increase export tax rebates as defensive moves. Restricting exports of essential materials such as rare earth metals, and imposing tariffs on strategic US import sectors are also plausible measures.

- Though not an imminent threat, external uncertainties could require a more forceful domestic response, especially considering the severe downward pressure on China’s economy. In the longer term, China’s industrial policy may become more domestically focused, with a stronger emphasis on industrial competitiveness.

Tags:

Related Services

Post

Which regions are most exposed to the 25% automotive tariffs?

While the automotive tariffs will likely lead to some production being reshored to US plants, they will also raise costs for US manufacturers and households.

Find Out More

Post

Trump tariff turbulence threatens global industrial landscape

Trump has moved swiftly to advance a trade agenda that goes beyond what was promised in the campaign. This will have a major impact on global industrial prospects.

Find Out More

Post

Tracking the impact of US tariffs on spending and prices

Our bottom-up framework of how imports feed into consumer spending identifies where we expect the largest tariff impacts.

Find Out More

Post

How much could trade policy uncertainty hurt the outlook?

If there’s one thing more damaging than tariffs themselves, it’s the sharp rise in trade policy uncertainty.

Find Out More