China’s demographic shift poses tough economic and fiscal challenges

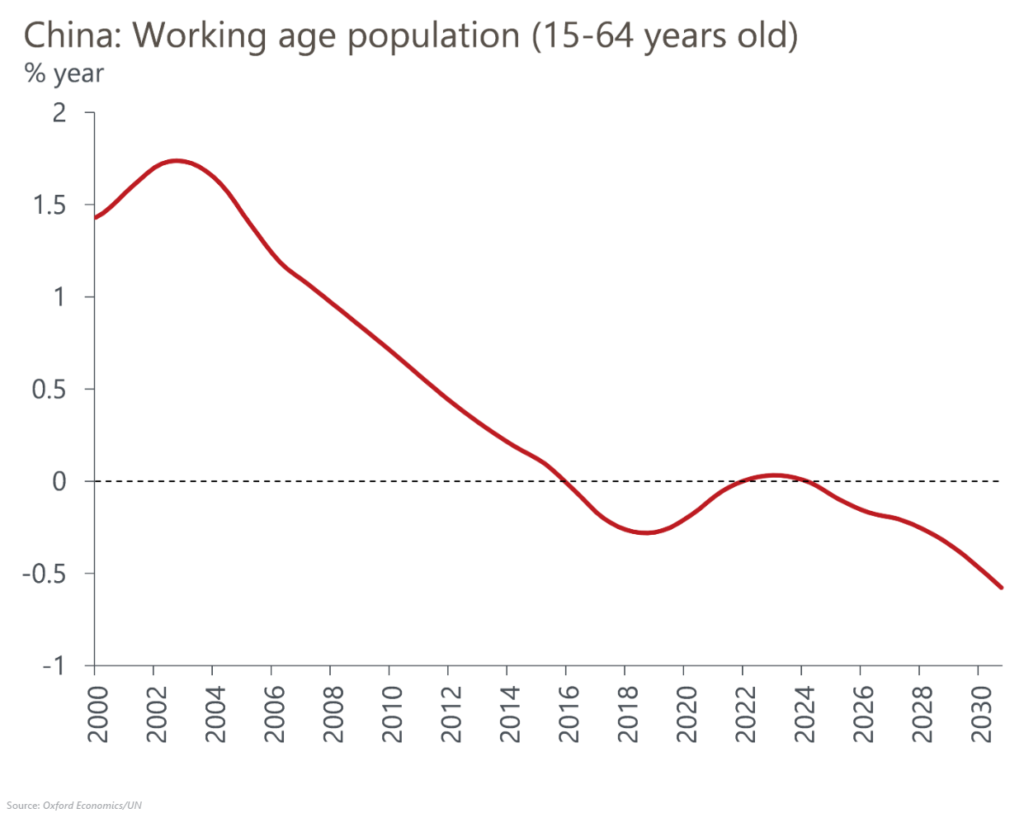

China is undergoing a demographic transition that implies downward pressure on labour supply and economic growth over the coming decades. Based on the latest data from the National Bureau of Statistics, mainland China’s population fell 850,000 to 1.41bn in 2022 – the first decline in 60 years. The number of births fell to a new low of 9.6mn in 2022, down from 10.6mn in 2021, and was outpaced by the 10.4mn deaths recorded in 2022, up from 10.1mn in 2021, partly related to Covid infections.

What you will learn:

- In the near-term, we expect the labour participation rate will recover as the country reopens and activity normalises. But this will not be enough to fully offset the effects of an ageing population on the size of the working-age population, and we expect the decline in labour supply growth will deepen in the coming decades.

- A shrinking labour force will widen the pension gap, weakening the social safety net. This could keep savings rates high, hindering the government’s rebalancing efforts towards a consumer-driven economy. The fiscal implications are also negative, as the fiscal space for a response to any future crisis will be constrained, particularly as local government debt levels are already elevated.

- The worsening demographics will be a drag on growth, leaving the economy reliant on investment and productivity. However, returns on investment are declining, while productivity is being challenged by the international threats of technological decoupling and supply-chain diversification. We forecast China’s GDP growth will slow to an annual average of around 4.5% this decade, from 7.7% per year in 2010-2019.

Tags:

Related Resouces

Post

A reality check on the status of RMB internationalisation

The recent geopolitical shocks and abrupt US policy shifts have heightened concerns about the stability of the dollar-centric global financial system and strengthened the perceived need for diversification.

Find Out More

Post

China and AI underpin stronger global trade outlook

Global trade is set for a stronger-than-expected rebound, supported by lower US tariffs, continued AI-driven investment, and China’s renewed export push. Our latest forecasts show upgrades to both nominal and volume trade growth in 2025–26, even as legal uncertainty surrounding US tariff mechanisms and evolving geopolitical dynamics pose risks to the outlook.

Find Out More

Post

China’s Outbound Recovery: Slowing but Still Rising

Research Briefing China’s demographic shift poses tough economic and fiscal challenges The rebound continues, but slowing demand, economic headwinds, and shifting traveler preferences are reshaping the outlook.

Find Out More