China’s overcapacity ‘problem’ in five charts

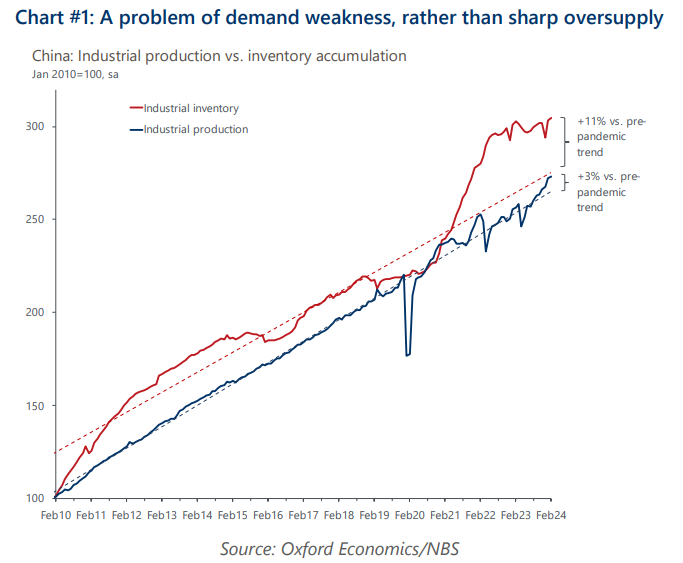

We find emerging, but not overwhelming, macro proof to support the recent geopolitical narrative of excess Chinese goods production that unfairly undercuts global manufacturing competitors on price.

What you will learn:

- Without compelling evidence in the data, there is likely no impetus for authorities to adopt meaningful course-corrective measures to rein in any perceived excess capacity problems zeroed in by Western trading partners anytime soon.

- Obviously, given the soft patch in onshore demand, and a production-driven stimulus approach, China’s industries are likely to exhibit relative cyclical oversupply in the near term.

- Sector-related data suggests that excess capacity risks remain confined within several industries with known idiosyncratic trends at play.

- The contentious ‘new three’ industries underscore China’s export dependency, and global import reliance. Optimists might point to the longer-term global demand fundamentals that support an industrial ramp-up in these areas, although it is unclear if that outweighs the risk of deflation and the associated job losses from persistent unprofitability in pockets of these industries.

Tags:

Related Posts

Post

A reality check on the status of RMB internationalisation

The recent geopolitical shocks and abrupt US policy shifts have heightened concerns about the stability of the dollar-centric global financial system and strengthened the perceived need for diversification.

Find Out More

Post

China and AI underpin stronger global trade outlook

Global trade is set for a stronger-than-expected rebound, supported by lower US tariffs, continued AI-driven investment, and China’s renewed export push. Our latest forecasts show upgrades to both nominal and volume trade growth in 2025–26, even as legal uncertainty surrounding US tariff mechanisms and evolving geopolitical dynamics pose risks to the outlook.

Find Out More

Post

China’s Outbound Recovery: Slowing but Still Rising

Research Briefing China’s overcapacity ‘problem’ in five charts The rebound continues, but slowing demand, economic headwinds, and shifting traveler preferences are reshaping the outlook.

Find Out More