Research Briefing

| Jul 26, 2024

Closing our short SEK trade to capitalise on the Scandi FX sell-off

As we head into the summer recess where central bank meetings are few and far between, we capitalise on seasonal illiquidity and the extraordinary sell-off in Scandinavian FX by closing out our long EURSEK trade, opened in May. Our view was primarily driven by our more aggressive rate forecast than the consensus. As of today, however, the market has moved in our direction.

What you will learn:

- We expected a bout of SEK weakness following the Riksbank rate cut in the spring, but we think the recent sell-off is overdone, and we close our long EURSEK trade, opened in May.

- With the worst now behind us, we now think rates are unlikely to re-price lower. We are less sanguine than the market’s expected 150 bps of cuts over the next year – the steepest cutting cycle in G10, bar New Zealand – and we remain underweight Swedish bonds in our fixed income allocations.

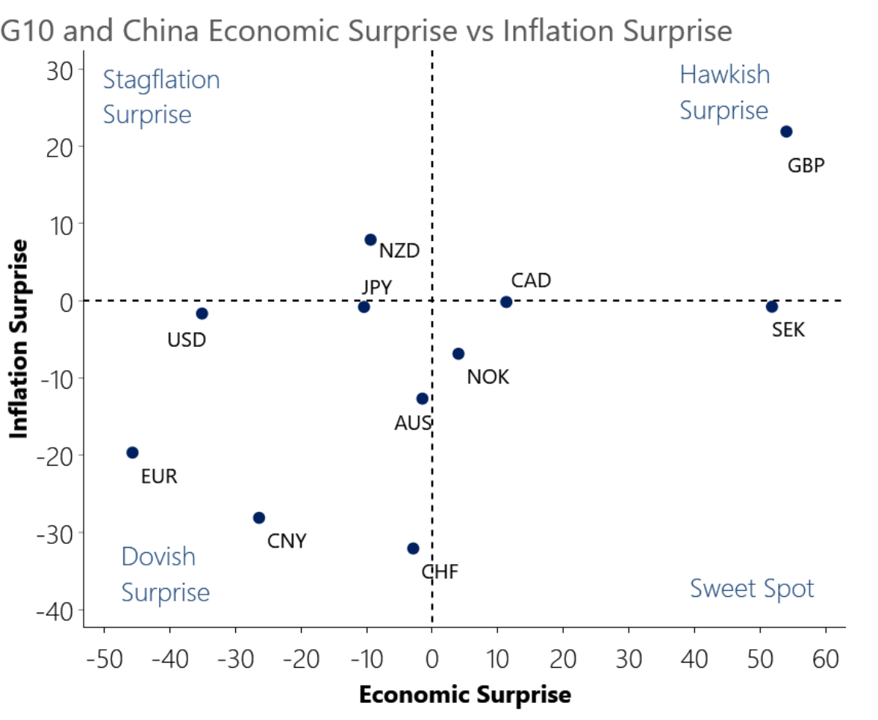

- Our FX scorecard does not show a low ranking for SEK, based on valuation drivers in particular, and we think it opportune to close our short SEK position for a modest profit.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

We think the environment of strong US demand coupled with still ample global liquidity, should be positive for US risk assets.

Read more: Strategy Key Themes 2025: Opportunities amid heightened uncertainty

Gold rush will lose steam, but still a good strategic bet

We close out our tactical long position on gold that we re-opened in July 2024. Still, we remain bullish on a strategic horizon.

Read more: Gold rush will lose steam, but still a good strategic bet

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers