Blog | 14 Nov 2022

Competing on climate: Rewards are there for those who prioritise transition towards a green economy

Bethan Jewsbury

Senior Research Manager, Thought Leadership

Greening the global economy – an Arup / Oxford Economics advisory perspective series

Undeniably, in 2022, sustainability is now mainstream. 89 countries, including the world’s biggest polluters, China, the United States and the EU, have declared net zero targets, covering almost three-quarters of global greenhouse gases. And this shift in sentiment is being reflected in the boardroom too: 86% of companies in a recent Oxford Economics and IBM survey collaboration have signed up to an enterprise-wide sustainability strategy.

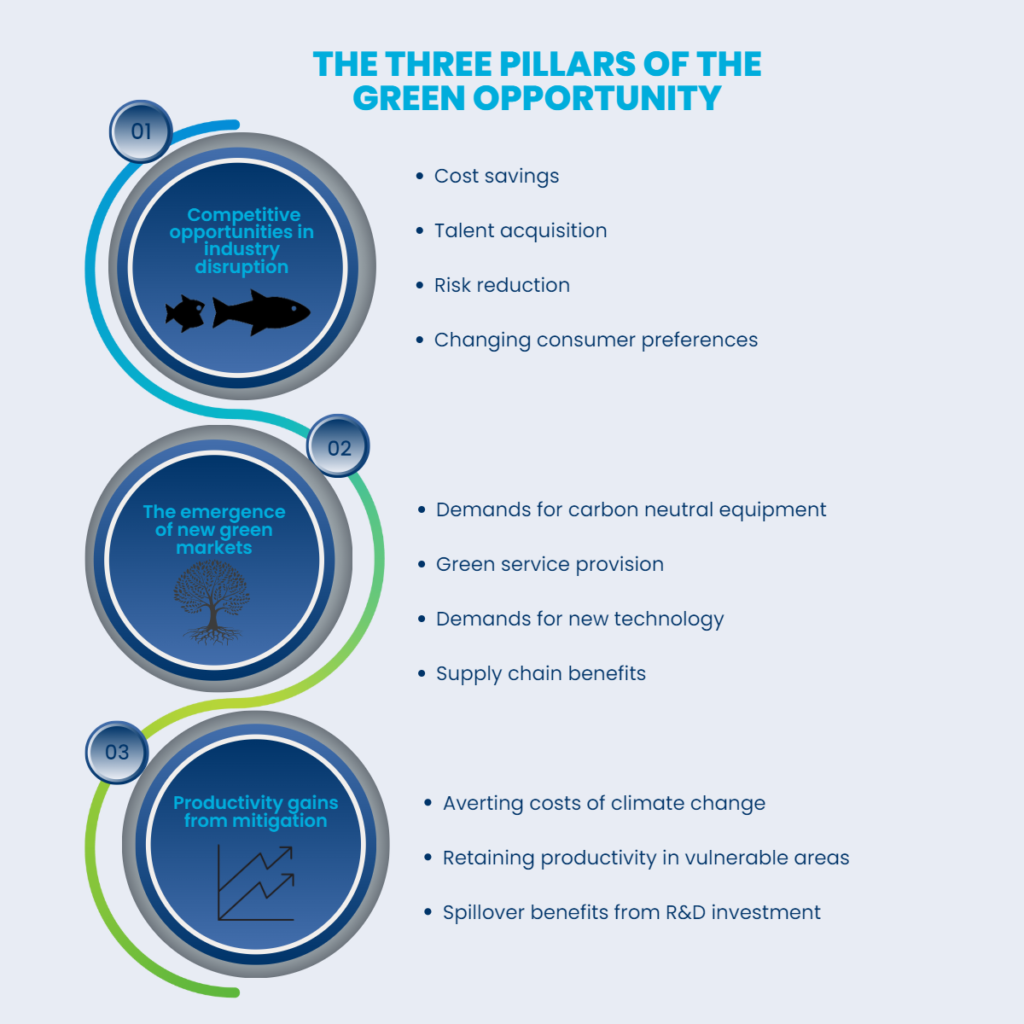

But just as global leaders are under scrutiny to produce a realistic roadmap to reach these national targets, so are businesses. In fact, little more than a third of companies from the same study can say they have taken actions to attain their sustainability goals. A poor understanding of the competitive advantages of going green, as set out in our first blog of the series on the size of the green opportunity, may be preventing companies from seizing the three pillars of green economic opportunity.

The three pillars of opportunity in a green economy

The first pillar of opportunity is growing market share by moving quickly. Climate-conscious consumer spending can be seen across markets as brands with ethically sourced products, services, and practices are thriving. This “eco-wakening” is transforming markets and offering opportunities to increase market share for those who can align with greening values. New sustainable products and services can support businesses through a turbulent economic environment and generate welcome additional revenue streams.

The second is the opportunity to boost business performance. Similar to those of customers, employee expectations have risen sharply in recent years as purpose continues to drive workers. Sustainability has become a differentiator for jobseekers and a talent retainer, as many disregard employment by a non-green enterprise. Increasing operational efficiency and reducing resource use can lead to significant cost savings when the price of materials is inflating across industries.

Third, businesses can reduce risk by mitigating climate change. Proactively converting to green practices and operations allows businesses their own agency and avoids costly fines from intensifying industry and country regulations. Transitioning to green energy sidesteps volatile fossil fuel prices and likely carbon taxations too.

Best practices of successful sustainability leaders

To seize these opportunities, businesses must make the genuine progress that is expected of them from customers, employees, regulators, and investors—because expectations will soon be overtaken by demands for change. They must grant sustainability a seat at the strategy-setting table and build green into the heart of company culture if they are to make meaningful changes with longevity. To understand how to adopt this climate-first mindset, we looked to three key best practices of successful sustainability leaders—a subset who see the highest returns from their comprehensive sustainability strategies—across our research to meet the challenge of net zero emissions by 2050.

First, sustainability leaders swap out exclusively top-down plans in favour of company-wide taskforces to give a voice to the workforce and enable passionate employees across departments to supercharge their sustainability efforts. Instead of solely placing responsibility and budget in the hands of a Chief Sustainability Officer, they develop a system of accountability throughout the organisation, including realistic reporting lines for enhanced buy-in. Building sustainability targets into the annual performance reviews of senior management grounds climate initiatives into day-to-day operations, an essential step to ensure progress against a backdrop of competing business issues.

Second, sustainability leaders invest in hiring and upskilling their workforce with the necessary data management know-how to capture, clean, and analyse the right information for meaningful insights. They treat sustainability not as a regulatory requirement, but as a business opportunity for digital transformation to implement emerging technologies. Many see this disruption as a catalyst for investing in green technologies from cloud to AI to environmental sensors, bolstering the quality and volume of climate data that can strengthen their overall efforts.

Finally, companies must ensure that action on sustainability is taken right through their value chains. Businesses may feel more comfortable focusing on their own operations for green economic improvements, but they must become familiar with their wider business ecosystem if they are to truly limit their impact on the environment. Sustainability leaders develop strong relationships with regulators, customers, suppliers, and sub-suppliers including creating transparent processes, sharing data, and ultimately collaborating to meet joint green goals quicker. Visibility of the value chain is becoming more essential with every year that passes, as without it, businesses cannot possibly mitigate the increasing risk of external climate shocks, and leave themselves vulnerable to severe disruption and regulatory breaches.

The rewards are there

The strategy-setting period has well and truly elapsed. It is now imperative to proactively build sustainability into corporate culture and day-to-day operations to make genuine and long-lasting progress. Companies who manage to close the gap between climate plans and serious action earn themselves the possibility of growing market share, boosting financial performance, and limiting risks. Geopolitical and financial shocks will further test business commitment to the green transition, but the rewards of a greener economy are there for those who can convincingly prioritise it.

This is the second in a series of articles by Oxford Economics that will be released in the run up to the launch of our report, undertaken in conjunction with Arup, on the Green Economy. In the third post, we will explore the broader macroeconomic implications of our 2050 projection — who will pay for the climate transition?

If you would like to read the full paper

click on the button below

Tags:

You may be interested in

Post

Silver, the next generation metal

This report highlights the critical role silver plays in data centres and artificial intelligence (AI), automotive and electric vehicles (EVs), and solar energy photovoltaics (PVs). With these sectors expected to expand significantly over the coming years, we expect future silver demand to be strong.

Find Out More

Post

Key take-aways from COP30

COP 30’s agenda had placed a strong emphasis on countries’ implementation of their emissions reduction target and, for the first time, several workstreams included discussions on unilateral trade policies.

Find Out More

Post

Flooding risks diverge across UK cities, sectors and economies

Climate-linked flooding is becoming more severe, reshaping risks for UK cities, real estate, and local economies. Which areas face the greatest impact—and why?

Find Out More