Dovish MPC signals a summer rate cut is likely

The Monetary Policy Committee voted to keep Bank Rate at 5.25% at May’s meeting, but it also sent a clear message that a summer rate cut is likely. This could come as soon as June if data on pay and inflation data come in at, or below, expectations.

What you will learn:

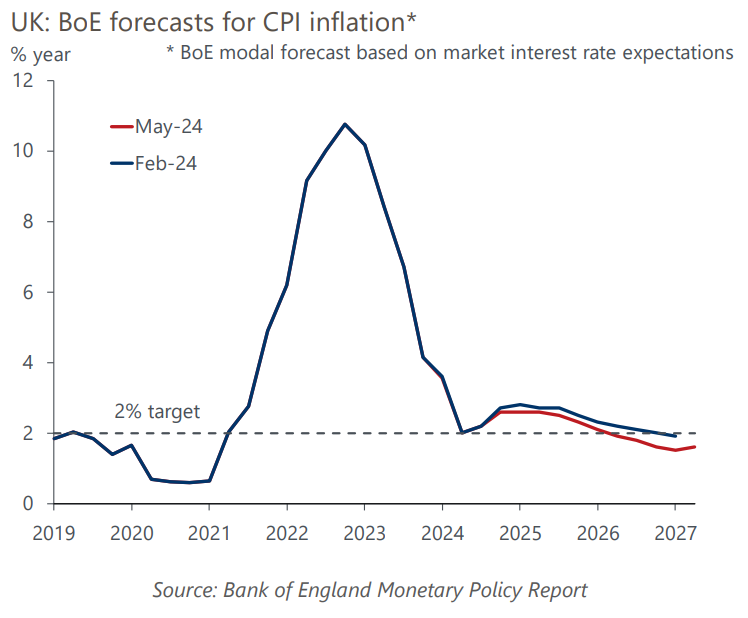

- Three points underpin the MPC’s dovish message. Deputy Governor Dave Ramsden voted for a rate cut for the first time. The MPC’s new forecasts showed inflation below target from two years out. And the minutes included new language around the timing of the first cut, referring to considering “forthcoming data releases”. Previously it had not indicated a timeframe.

- The MPC has confirmed our long-held view that the April data for pay growth and services inflation will be key – both will be available before the next MPC meeting on June 20. Whether the first cut comes in June or August remains finely balanced.

- For the time being, our central forecast remains a first cut in June, and a total of 75bps of rate cuts this year. But we will revisit our rate call when the April inflation data is published on May 22.

Tags:

Related Posts

Post

Policymakers singular focus adds to rate cut uncertainty

Our baseline forecast for policy rates is consistent with central bankers continuing to focus almost exclusively on inflation. Their laser-like inflation focus and higher-for-longer bias are understandable after such a large and sustained inflation overshoot. But once inflation is firmly back at target and this bias reverses, it will eventually be a key source of downside risk to our policy rate forecasts.

Find Out More

Post

United States: Look for a low-confidence vote from the Fed

The Federal Reserve will likely signal next week that its confidence that inflation is on a sustained path to 2% has been diminished and that it is prepared to leave interest rates at current levels until it sees clear signs disinflation is back on track. We pushed the first rate cut in our baseline to September and reduced the number of rate cuts in our forecast for 2024 from three to two.

Find Out More

Post

Eurozone: Why food prices are a channel for more frequent supply shocks

More frequent adverse supply shocks mean eurozone inflation is likely to be more volatile and possibly higher on average in the future. Food prices are a key channel through which these global shocks will be transmitted, according to our analysis. We provide a quantitative assessment of the impact of a wide range of supply shocks on eurozone inflation.

Find Out More