Blog | 29 Jul 2024

Economist’s notebook: How much is a Paris Olympic gold medal worth?

Diego Cacciapuoti

Economist

Contrary to their name, Olympic gold medals are not made entirely of gold.

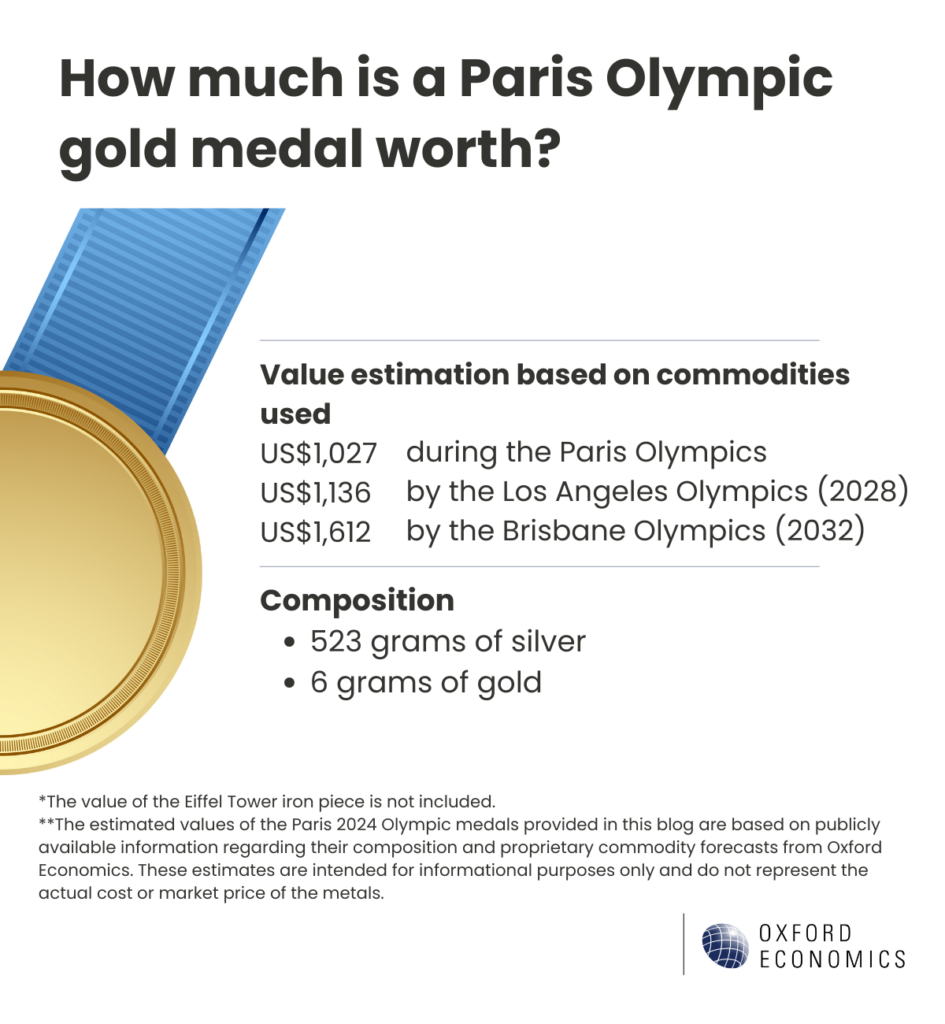

This year at the Paris Olympics, the gold medals consist of 523 grams of silver, coated in 6 grams of gold. Silver medals, on the other hand, weigh 525 grams and are made of pure silver, while bronze medals weigh 455 grams and are made of copper, tin and zinc. That’s not the only surprise. This year’s Olympic medals will depart slightly from their historical tradition, with the Paris Olympic medals including an iron piece from the Eiffel Tower, on top of their usual composition.

The value of 2024 Paris Olympics medals

While the value of the Eiffel Tower iron piece is priceless, the commodities used to create the Olympic medals have specific prices. Excluding the value of the Eiffel Tower iron piece, which will be placed in the centre of each Olympic medal, we estimate that the value of each gold medal during these Olympic Games is more than a thousand USD – specifically US$1,027, while silver and bronze medals are worth US$535 and US$4.6, respectively.

With precious and industrial metals markets so buoyant, however, winning an Olympic medal this year should yield considerable investment value, besides the eternal glory associated with securing a podium spot.

In fact, we estimate that by the next Olympic Games these medals will be worth considerably more. By 2028, during the Los Angeles Olympics, the gold medals will have increased to US$1,136, while silver medals will be US$579 and bronze medals will be US$5.2. By the 2032 Brisbane Olympics, the medals will be worth US$1,612, US$608 and US$6, respectively, so winning athletes this year should secure a real deal!

Prices of some commodities will go faster, higher and stronger

The rising value of these medals can be attributed to the increase in precious and industrial metals. Forecasts from our Global Commodity Forecast Service reveal that both precious and industrial metal prices will rise considerably in the future, as their fundamentals look as bright as ever.

Gold: We have been consistently vocal about gold’s upside potential this year due to its strong fundamentals. Solid structural demand forces, such as demand from emerging market central banks and Chinese consumers, have created a very supportive environment. Going forward, we anticipate strong fundamentals to push gold prices higher, with strong demand from central banks and the People’s Bank of China representing the main bullish structural demand force. As a result, we expect in our baseline for gold prices to trade above US$2,640/oz by 2028, and by 2032 US$2,865/oz.

Silver: Recent market sentiment on silver has been extremely volatile, with prices rallying, boosted by hopes of Fed rate cuts and a pickup in industrial activity, before correcting lower earlier this month. The industrial production outlook affects silver considerably more than gold due to its larger industrial usage, and brighter industrial production expectations led silver prices higher. While we agree with this bullish view that global industrial production will recover over the rest of this year and next, we think markets got ahead of themselves and pricing on the metal rose beyond fundamentals, with investors being excessively bullish. As a result, we anticipate silver prices will move sideways during the rest of the year, but they are still expected to appreciate to US$31.27/oz by 2028 and to US$32.83/oz by 2032.

Copper: We project copper prices will average US$9,300 per ton this year. Prices corrected in June but have risen close to US$10,000 per ton in early July. Prices will remain volatile but should trade closer to and average US$9,500 per ton over the rest of this year as high inventory levels constrain and cap any further price rallies. We expect prices to correct lower and average US$9,490 per ton in Q3 and grow gradually again from Q4. We expect more meaningful quarterly price growth in 2025, increasing by 5% y/y as industrial production strengthens. Also, increasing structural drivers will lift demand with robust production of EVs and renewables in China and other key regions, which will drive copper prices to US$11,051/tonne in 2028.

The International Copper Study Group forecasts new mine capacity growth of 4.3% between 2023-2025, keeping the market supplied and as new refinery capacity is set to grow by 5% as well. Yet, the supply outlook is more challenging between 2026-2027 as we don’t anticipate any new major mines apart from smaller ones. Consequently, with demand rising at a fast clip, we see prices averaging US$12,898 per tonne by 2032.

Zinc: The zinc market was in a large surplus in the first four months of 2024. Current high zinc prices are hard to justify due to the large surplus. However, zinc mining contracted by 3.2% y/y in Q1, which has driven treatment charges to low levels and increased investor bullishness. Demand will improve, but we think this has already been priced in and so we forecast a gradual decline as high prices encourage closed capacity to come back online. Zinc demand is heavily linked to steel and construction activity, which will slowly improve this year and pick up next year as advanced economy interest rates are cut. We forecast zinc prices to average US$2,863 in 2028.

Tin: Tin prices have surged this year as supply from Indonesia and Myanmar has been disrupted and demand is linked heavily to electronics, one of the fastest growing sectors. We think prices have risen too quickly and will fall over H2, but will remain high as supply disruption eases while demand continues to rise. We think tin prices will average US$33,834 per ton this year.

As we wrap up our exploration of the commodities markets and turn on the TV for some Olympic Games, it’s clear that commodities continue to play a pivotal role in the global economy, from crafting medals to building a stadium.

Just as athletes dedicate years of training to achieve excellence, our team commits to providing you with insightful analysis. This light-hearted look at the intersection of sports and commodities is just one of the many ways we aim to make complex economic trends more accessible. So, as you cheer for your favourite teams and marvel at the feats of strength and endurance, remember that the metals and materials behind the scenes are just as crucial. Here’s to winning strategies and gold medal insights in both arenas!

The analysis and forecasts in this blog are backed by our Global Commodity Forecast Service, which offers insights into how shifts in market fundamentals—ranging from geopolitical tensions to monetary policy easing—could shape the commodities outlook. To make the most of our expert insights for your own analysis, request a free trial by clicking here.

To read more about the economics of the Olympics, please click here.

Disclaimer: The estimated values of the Paris 2024 Olympic medals provided in this blog are based on publicly available information regarding their composition and proprietary commodity forecasts from Oxford Economics. These estimates are intended for informational purposes only and do not represent the actual cost or market price of the metals. The values are speculative and should not be used as a definitive guide for investment or financial decisions.

Subscribe to our newsletter

Economics is everywhere. From central bank’s rate cut to impacts of Olympics, our passion for economics gives us a unique view of the world, as well as its challenges and opportunities. For over 40 years, we provided timely economic and business insights to our clients, helping them grasp the impact of key events on their operations and planning.

Subscribe to our newsletter to get our insights straight to your inbox. Additionally, you can check ‘Talk to us’ box to have our team contact you about a free trial of our services and how we can support you.

Author

Diego Cacciapuoti

Economist

Diego Cacciapuoti

Economist

London, United Kingdom

Diego is part of the Industry team where he contributes to the forecasting and monitoring of commodities and he is responsible for the monthly precious metals and agricultural price forecasts. Prior to joining Oxford Economics, Diego gained work experience at Record Currency Management and completed an MPhil in Economics at the University of Oxford. Diego is fluent in English, French, and Italian

Stephen Hare

Lead Economist

Stephen Hare

Lead Economist

London, United Kingdom

Stephen is part of the Industry team where he is responsible for the extraction sector forecasts and contributes to the monthly commodity price forecasts for iron and steel. Stephen joined Oxford Economics in January 2018 after completing his MSc in finance and econometrics at Queen Marys University of London.

Tags:

You may be interested in

Post

France’s debt burden is set to become much heavier

By 2035, we expect France’s public debt to approach 125% of GDP, up from 113% in 2024 and among the highest in advanced economies. Given the current political impasse, meaningful fiscal consolidation is unlikely before the 2027 presidential election. Even after that, we expect it to be gradual, keeping debt on an upward path and France's vulnerability to shocks elevated.

Find Out More

Post

Another French government falls – snap elections loom

The abrupt fall of the French government today will increase pressure on President Emmanuel Macron to dissolve the National Assembly and hold snap elections to try and break the deadlock. We think this is now the most likely scenario.

Find Out More

Post

Imminent French government collapse means deficit will stay high

France's fragile coalition government looks set to lose a confidence vote scheduled on September 8. Consequently, Prime Minister François Bayrou's deficit target of 4.6% of GDP now seems dead in the water, and the next government's target will likely be much more modest, confirming our view that France cannot undertake meaningful fiscal consolidation in the current fractured political environment.

Find Out More