Eurozone: Pension system sustainability hinges on unpopular reforms

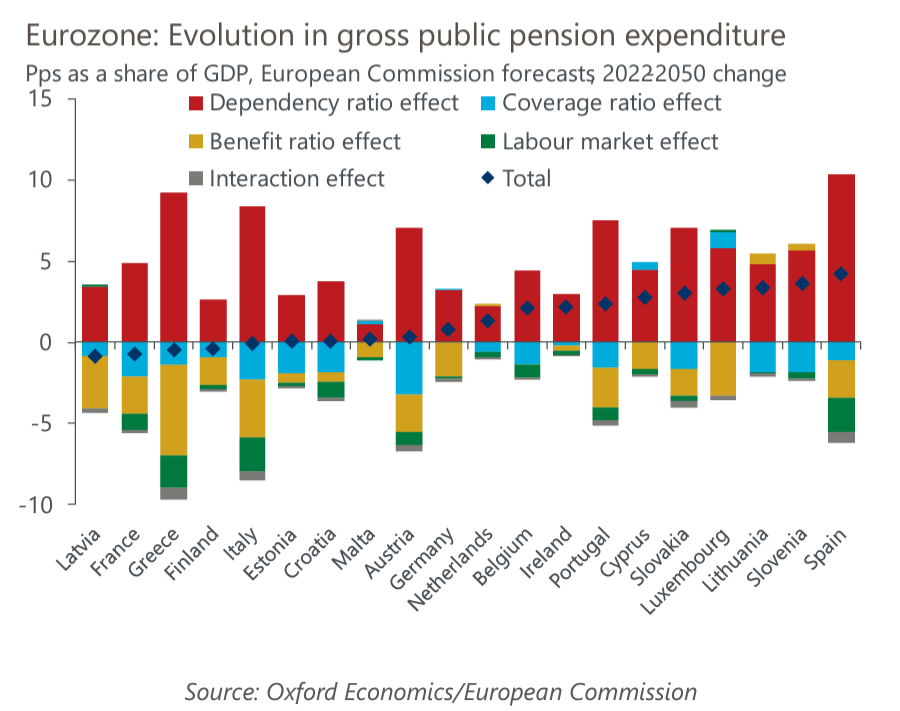

Increased spending to meet the needs of an ageing population jeopardises the sustainability of Europe’s public pension systems, based on current legislated measures. A better balance hinges on governments continuing with structural reforms and implementing those planned to ensure precious resources for public policies are not eaten away by pensions. The risks for debt and growth would be considerable if reforms are repealed due to their unpopularity.

What you will learn:

- Spain’s outlook is the most dire, as its net expenditure is projected to increase the most – more than 4ppts of GDP. We are sceptical that comprehensive new legislation enhancing the sustainability of its pension system will be implemented, given previous reforms have been reversed. The risks to public finances are also acute in Slovenia, Slovakia, and Luxembourg.

- Meanwhile, pension spending in Portugal, Belgium, Ireland, Cyprus, and Lithuania is projected to rise significantly, but we think that their outlooks are less problematic. The relatively benevolent projections for Italy and Greece hinge on past reforms, which should counter grim demographics. However, this does not imply optimal sustainability in these high-debt countries.

- Southern Europe is where scaling back reforms would harm the most. Not only would a lower retirement age drive up government spending due to more retirees, but also hamper growth prospects by restricting the labour force, compounding the impact of ageing.

Tags:

Related Services

Post

Eurozone: Hopes of a strong consumer rebound fade

Hopes of a consumer spending recovery becoming the driving engine of eurozone growth in 2024 have not materialised. Private consumption growth is still unspectacular, mirroring the tepid momentum of the wider economy. Consumption growth will remain unspectacular at 0.8% this year and 1.5% in 2025.

Find Out More

Post

Eurozone: Why the GenAI labour market transition might not be seamless

We think generative artificial intelligence could add as many as 1.2 million jobs to the eurozone labour market by 2040. But the impact will be highly uneven across roles and sectors, making government action and structural reforms keys to mitigating the downside risks.

Find Out More

Post

Implications of the US Election on Europe

As campaigning in the US election comes to a close, we look at the potential implications of victory by each candidate on the Europe, focusing on foreign affairs, economics and security risk.

Find Out More

Post

European industry will bottom out and recover…eventually

European industry is still in the midst of an almost two-year recession, but we believe that the end is increasingly in sight.

Find Out More