Research Briefing

| May 17, 2024

Evaluating Oxford Economics commodities forecasts against market consensus – Q2 2024

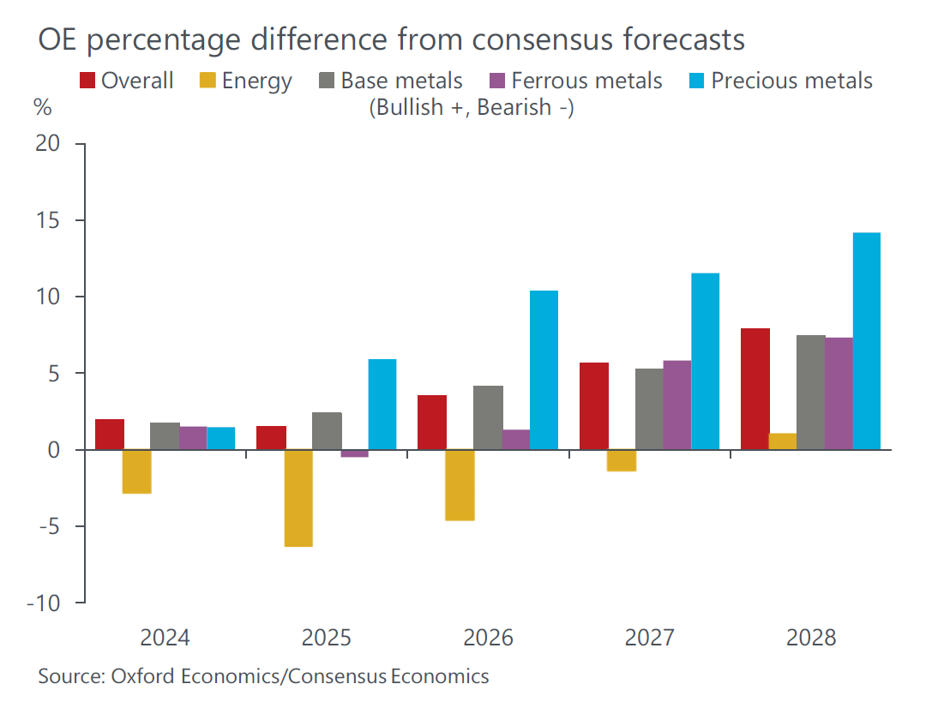

In this document, we present a comparative analysis of our commodities forecasts against market consensus. We also provided the rationale behind our forecasts to help you form a more robust views on the commodities market.

What you will learn:

- Our energy price forecasts are below consensus particularly as we move into 2025, as we are more optimistic on supply than other analysts. Within oil markets, prices are forecast to decline amid OPEC+ production increases and slowing global demand particularly from the gasoline sector, where EVs are making up an ever larger share of road vehicles.

- Our base metals forecasts are above consensus as we anticipate a stronger recovery in industrial production than consensus and therefore more robust metal demand.

- We are more bullish on ferrous metals in the near term again due to our higher industrial production growth forecast for the US and EU.

- Our bullish view on gold and silver prices on the back of very strong structural fundamentals weighs on our overall precious metals view, positioning us well above consensus.

Fill in the form to download the full document. To trial our commodities service, click here.

Tags:

Related Reports

Post

Ukraine-Russia ceasefire changes risk profile for commodities

We assess the implications and risks for our commodity price forecasts against the backdrop of a 'fragile' ceasefire in the Russia-Ukraine conflict.

Find Out More