Fears of a US recession are overdone

- US economy is in transition, but a recession isn’t an immediate threat but the Federal Reserve needs start cutting interest rates.

- While weaker-than-expected US labour market data have caused some investor anxiety, we believe these fears are misplaced.

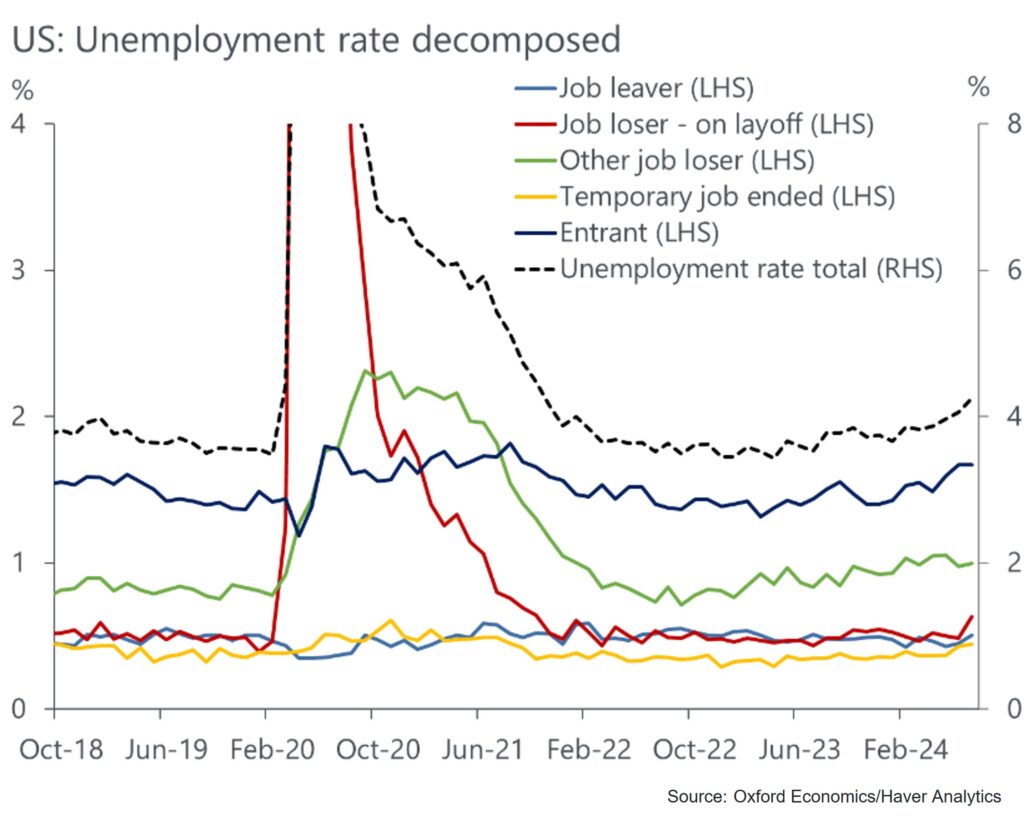

- The recent increase in the unemployment rate is less threatening than it appears as it is mostly attributed to a rise in temporary layoffs and a increase in labor supply, reducing the odds that a negative reinforcing cycle of unemployment, income loss and job losses takes hold.

There have been mixed messages on the US economy, but we believe worries about the durability of the expansion are premature and overdone. Real GDP bounced back and real final sales to domestic purchasers, the engine of the economy, increased in Q2. Real final sales to domestic purchasers have risen by at least 2% at an annualized rate for six consecutive quarters.

While layoffs remain low, the unemployment rate is rising because hiring is not strong enough to absorb all new native- and foreign-born labor force entrants. The rise in the unemployment rate has been welcomed by the Fed and Q2 GDP supports its view because the rebalancing in the labor market is not significantly undercutting real final sales to domestic purchasers – the engine of the economy. Still, higher joblessness should be closely watched.

The nonlinear nature of unemployment is a risk because it tends to rise slowly, then rapidly. This is likely on the Fed’s radar, but it may find some solace that unemployment, at least recently, has been more attributed to a rise in labor supply rather than layoffs.

Less threatening than it appears

The recent increase in the unemployment rate doesn’t pose a significant threat to our near-term forecast for the economy or growth in real consumer spending. The worries about the rising unemployment rate setting into motion a negatively reinforcing cycle of unemployment, income loss, spending cuts and job losses do not focus enough on why the unemployment rate is rising.

The Sahm rule historically indicates that the economy is in recession when the unemployment rate, on a three-month ma basis, rises 0.5ppts above its low in the prior 12 months. In the July jobs report, it was triggered for the first time in this cycle. A good rule of thumb is that a sustained 0.5ppt increase in the unemployment rate lowers the level of real consumer spending by 0.3% over the next two quarters. However, this rule of thumb likely overstates the hit to spending this time around as the catalyst for the increase in the unemployment rate is less threatening.

Unlock exclusive economic and business insights—sign up for our newsletter today

The unemployment rate has increased mostly because of a rise in labor supply and a surge in those temporarily laid off, especially in July. This is less threatening than when it increases because of permanent job losers – the causal link between a higher unemployment rate and a recession.

There isn’t a golden statistic in gauging in the health of the economy and the unemployment rate has its flaws. We put more stock in the prime-age employment to population ratio. The prime-age employment to population ratio, which doesn’t garner a ton of attention by financial markets, has been edging higher and is at the highest since 2001 and consistent with a strong labor market.

Historically the prime-age employment to population ratio has had a strong inverse relationship with the unemployment rate. This year this relationship is showing signs of breaking down, with the prime-age employment to population ratio and the unemployment rate both rising. This is further evidence that the rise in unemployment is a supply-side phenomenon but markets, and their expectations for the outcome of the September meeting, hinge on the unemployment rate.

How the Fed is digesting it

Historically, the Federal Open Market Committee has delivered intermeeting cuts and cuts larger than 25bps when there was a clear negative economic shock or when the data were worse than they have been so far. The premise of our forecast is that job growth will recover in August and the FOMC will judge 25bp cuts as a sufficient response to any downside risks. If we are wrong and the August employment report is as weak as the July report, then a 50bp cut would be likely in September.

Financial markets noticeably increased their assigned probability of a 50bps rate cut in September and led to chatter of an intermeeting move by the central bank. Both are overdone and a knee-jerk reaction. Intermeeting cuts by the Federal Reserve have historically occurred when the economy experiences a significant economic shock, and the July employment report doesn’t meet that criteria, even when coupled with the sudden drop in equity prices because corrections are common.

The Fed is aware of why the unemployment rate has risen and these sources are less threatening than if it was driven by a rise in permanent layoffs. The Fed will pay attention to initial claims, as the August employment report will take on greater significance. If the unemployment rate doesn’t reverse some of the recent gain and the composition is more concerning, then the Fed would consider a 50bp rate cut at its September meeting.

For now, we are sticking with our view since the April baseline that the first rate cut would occur in September and be a 25bp cut.

Download the full report for in-depth insights

The analysis and forecasts in this blog are backed by our Global Macro Service, which quantifies the implications of economic and market developments across more than 200 economies. To unlock the power of economic insights, request a free trial by clicking here.

Tags:

Related Reports

US Key Themes 2026: Exceptionalism amid fragmentation

Global Key themes 2026: Bullish on US despite AI bubble fears

US Bifurcated ꟷ Economic backdrop deepens racial disparities