FOMC minutes – Hawks flap wings but do not shift policy

The minutes from the April 30-May 1 meeting of the Federal Open Market Committee were uneventful, which is not surprising as they reiterate the recent communication from Federal Reserve officials. Therefore, they do not warrant a change to our baseline forecast or subjective odds around the near-term path of monetary policy. The forecast has two rate cuts this year and one 25bps cut at every other meeting next year. This forecast is contingent on inflation following our script. The risks toward our forecast for inflation are weighted toward it being stickier, which would keep rates high for even longer than we anticipate.

What you will learn:

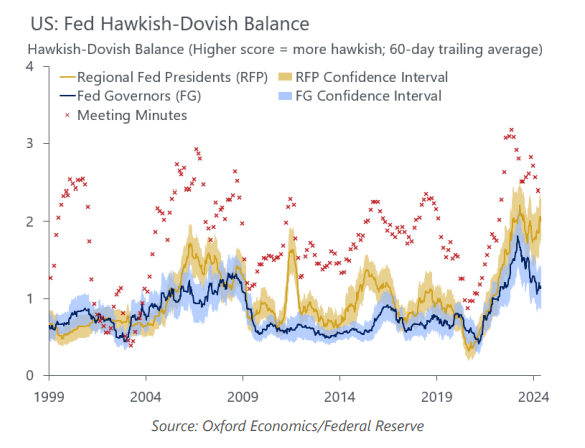

- The Fed is waiting for a string of data that strengthens its confidence that inflation is on sustained path toward its 2% target, but this has not occurred this year. The lack of confidence has caused the Fed to delay cutting interest rates, but discussion of potentially raising interest rates was scant in the minutes.

- Like us, Fed officials anticipate inflation to moderate through the remainder of this year and the minutes provided a laundry list of reasons, including restrictive monetary policy, disinflation in rental inflation, stronger trend productivity growth, and gains in labor supply via immigration. Immigration was referenced less in these minutes than in the previous one.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More