FOMC preview – Humility setting in

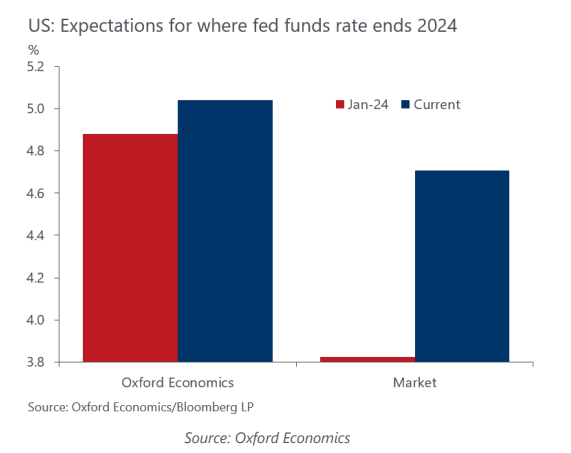

Odds are that there will not be anything from the upcoming meeting of the Federal Open Market Committee that would alter our baseline forecast for the first rate cut to occur in September, followed by another cut in December. We recently revised our forecast for the fed funds rate and, given the incoming data on inflation, risks are weighted toward fewer cuts this year.

What you will learn:

- The Fed’s data dependence increases the uncertainty in the forecast for the path of monetary policy as any deviation in inflation from the central bank’s expectation could give it pause. Humility in forecasting what the Fed will do is clear as we had to tweak our forecast and markets have gone through a significant repricing of their expectations.

- During his post-meeting presser, Chair Jerome Powell will be grilled about inflation and its implications for interest rates. There could be some questions about whether the Fed would consider raising interest rates. Odds are Powell would stick with the Fed’s mantra that monetary policy is flexible and will respond as appropriate.

- The Fed could use its May meeting to announce plans to begin tapering quantitative tightening. The central bank wants to start this process sooner rather than later, reducing the odds of a repeat of the September 2019 repo market crisis, when overnight rates spiked, surprising the Fed, which believed that there were ample reserves in the system until the market proved otherwise.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More