FOMC – Time is on my side

The biggest surprise from the outcome of the Federal Open Market Committee meeting had nothing to do with interest rate policy or changes to the post-meeting statement, but rather a change to quantitative tightening. The Federal Reserve announced that it will slow the pace of QT next month, as expected, but the $25 billion cap on Treasuries is lower than markets anticipated.

What you will learn:

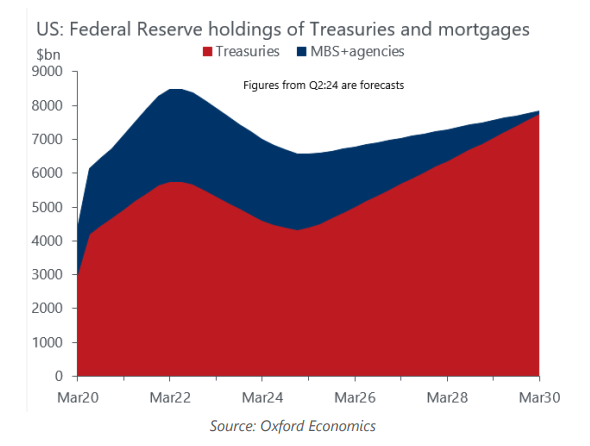

- The Fed did not play its hand on when it expects QT to end but it wanted to start this process sooner rather than later to reduce the odds of a repeat of the September 2019 repo market crisis. The lower cap on Treasuries does not have significant implications for the forecast, but we will factor this into our upcoming May baseline. We still expect that, overtime, the Fed is going to aim to return its balance sheet to be mostly Treasury securities (Chart 1).

- The post-meeting press statement acknowledged the obvious – a “lack of further progress” toward the Fed’s 2% objective. The statement noted that the risks to achieving its employment and inflation goals have moved toward a better balance over the past year, suggesting that the door is not closed on rate cuts later this year. However, inflation data needs to cooperate.

- We do not expect the hotter-than-anticipated m/m gains in consumer prices in the first quarter to be the norm for the rest of the year. Some of the gains in consumer prices were attributed to residual seasonality and idiosyncratic factors, including a jump in motor vehicle insurance, which will not be duplicated. Housing inflation remains a thorn in the Fed’s side, as it has remained stubbornly high. Based on market rents, it will take longer for housing inflation to roll over, but it is coming. Housing is less of a factor in the Fed’s preferred measure of inflation, the PCE deflator.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More