Blog | 24 Jan 2022

Good things come to those who wait: The renewed importance of long-haul travel

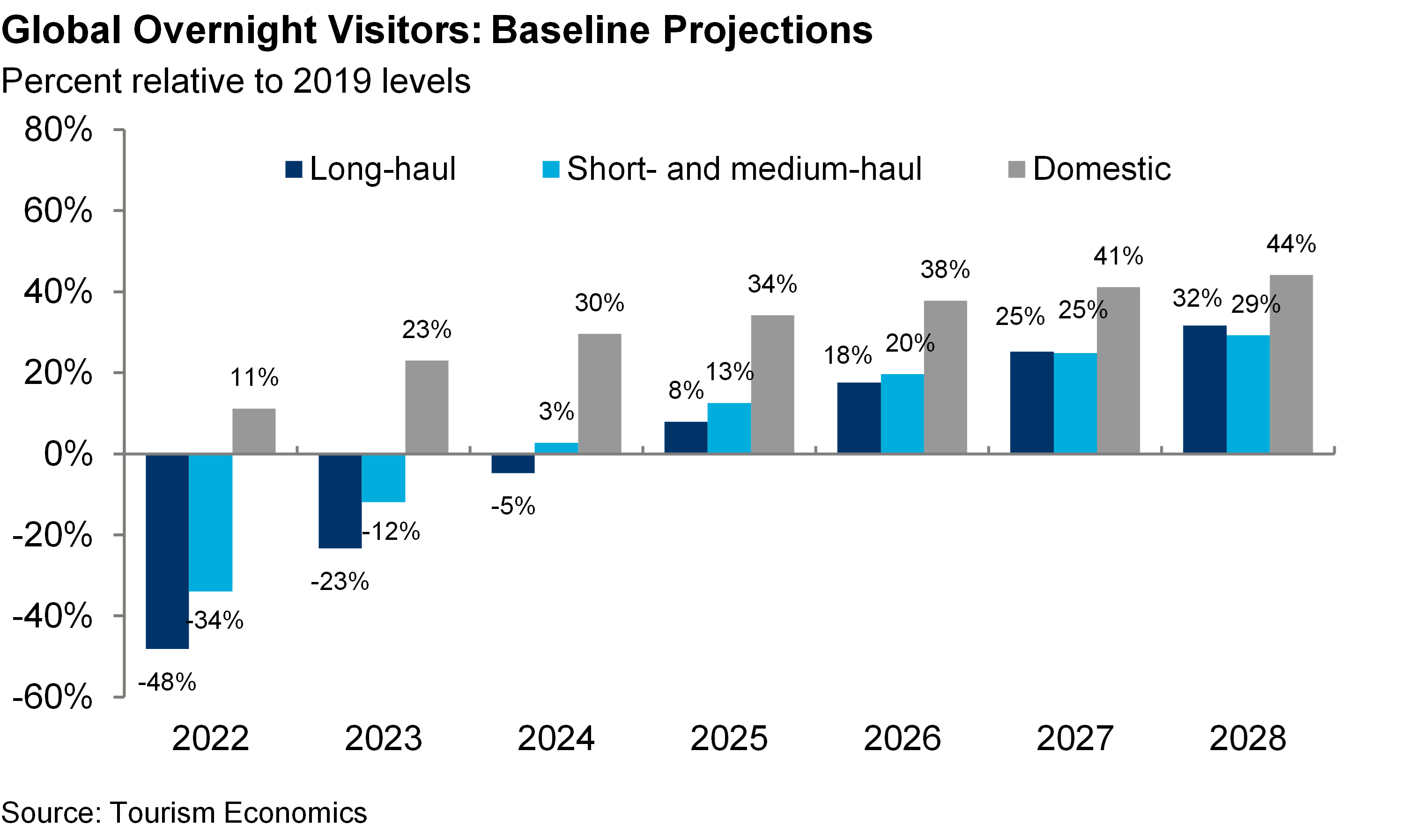

The recovery in international travel is expected to begin in earnest this year, notwithstanding the risks posed by the emergence of the Omicron variant. Baseline projections are for global international arrivals in 2022 to recover to around 40% below 2019 volumes, following a trough of around -70% in 2020-21. The pace of recovery, however, will vary across regions and the haul (i.e., distance) of the travel taking place.

Domestic travel will be the first to recover, following some clear improvements in 2021, followed by short-haul international tourism. The recovery of long-haul travel—trips between, rather than within, major regions—is to recover more slowly. Long-haul tourism played a key role in driving growth in international travel in the years leading up to the pandemic, generally outpacing that of shorter-distance travel and with the long-haul share of all international trips peaking at just under 22% in 2019. This begs the question: When can we expect long-haul travel to return to its pre-pandemic prominence?

In the near term long-haul will lag the prominence of other forms of travel, due to the relatively higher costs associated with these trips and uncertainty of airline routes. Indeed, long-haul trips are projected to remain 48% below 2019 volumes in 2022, and account for only 18% of all international trips. However, later in the decade long-haul travel will reclaim its prominence in driving international tourism. The long-haul share of all international visitors is expected to exceed the pre-pandemic peak from 2027 onwards, and volumes of long-haul visitors will exceed 2019 levels by 32% in 2028 (stronger growth than that for short- and medium-haul trips over the period).

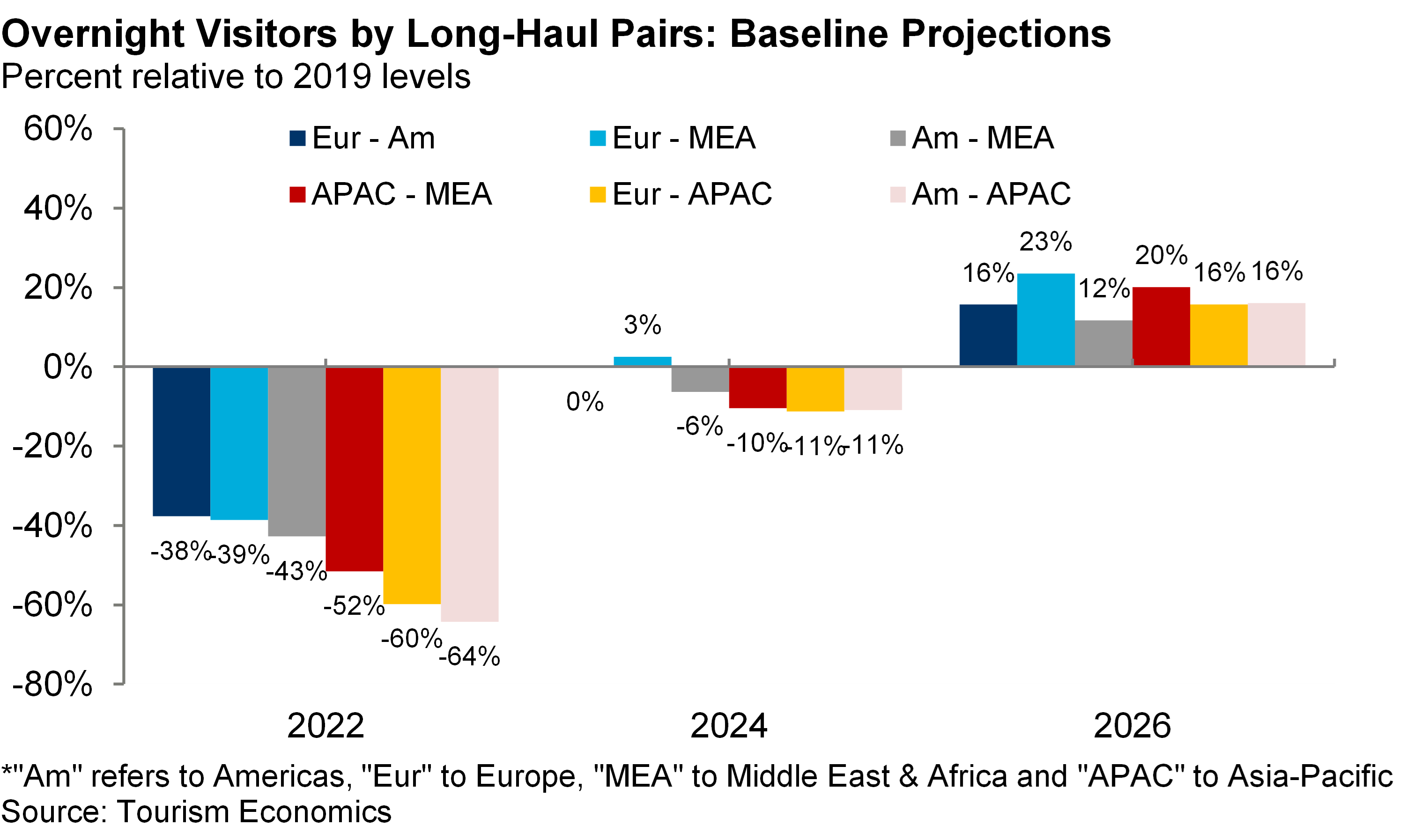

During this rebound to prominence, the pace of recovery among different long-haul routes will vary significantly. Transatlantic travel is expected to see the strongest recovery this year, driven by travel between North America and Western Europe. This is due to a combination of the relatively short distance compared with other long-haul routes (with only a single flight required in many cases) and the willingness of most of the countries involved to ease restrictions relatively early and to “learn to live with” the virus. The recovery in transatlantic travel is important for broader tourism on both sides of the Atlantic. For instance, pre-pandemic the US accounted for around 30% of long-haul visitors and spending to Europe, while European source markets are even more important to the US, having comprised around half of inbound long-haul travel.

Long-haul travel to/from the Asia-Pacific region (APAC) is expected to see the slowest recovery, due to the more cautious approach among APAC countries to ease restrictions and the longer distances of the travel involved. However, by 2026 recovery in long-haul travel involving APAC is projected to match or exceed that of other routes.

As such, while it will take time to materialise, long-haul travel will return to prominence across the world. This will likely reopen discussions about the management of large volumes of visitors, but given the benefits from the associated higher spend and accessing new markets it will be worth the wait.

Tags:

You may be interested in

Post

Oxford Economics announces a leadership transition for the next phase of growth

Oxford Economics, the world’s leading economic forecasting and advisory firm, announced today the appointment of Innes McFee as its new Chief Executive Officer, effective 4th December.

Find Out More

Post

Oxford Economics launches enhanced Real Estate Economics Service

Oxford Economics is pleased to unveil its enhanced Real Estate Economics Service, now covering 100 global cities.

Find Out More

Post

Oxford Economics Acquires Majority Stake in Alpine Macro

We're excited to share that Oxford Economics has acquired a majority stake in Alpine Macro, a prominent global investment research firm based in Montreal, Quebec, Canada.

Find Out More