Hard landing for the Canadian economy will slow inflation to target by late 2024

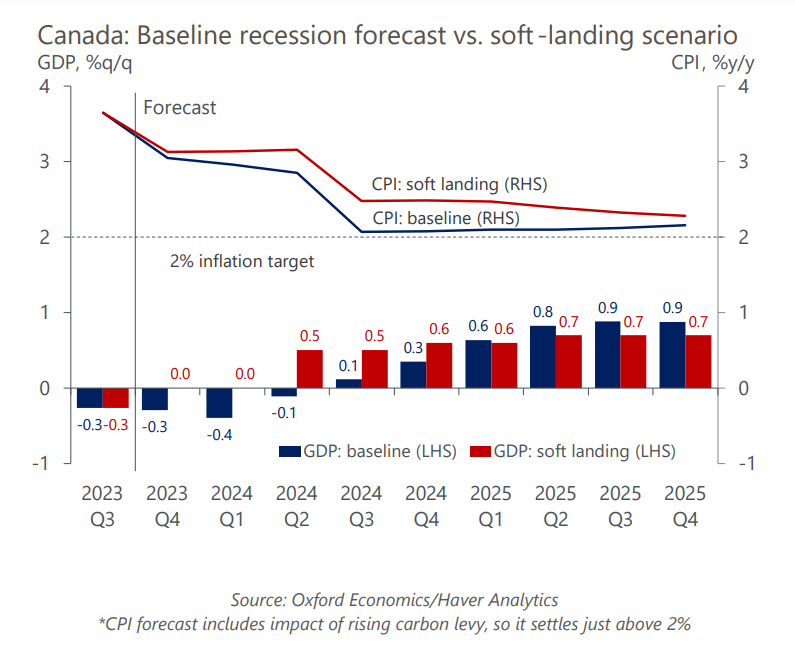

We believe the Canadian economy has slipped into a moderate recession that will create slack, ease price pressures and help bring headline CPI inflation back to the 2% target by late 2024. Moreover, weaker global oil and food prices will facilitate the slowing of inflation this year.

What you will learn:

- In contrast, many other forecasters including the Bank of Canada (BoC) still anticipate a soft landing for the economy. The BoC expects CPI inflation will return to its 2% target towards the end of 2025 – about a year later than our baseline recession forecast.

- We used our Global Economic Model to assess the prospects for inflation under a soft-landing scenario, like the Bank of Canada’s. We find that should Canada’s GDP remain stalled through early 2024 and not contract as we expect, then the unemployment rate would still rise but to a lesser extent and peak at 7% later this year versus 7.5% in our baseline recession forecast. Wage growth would slow more gradually in a soft-landing scenario and inflation would not return to 2% until late 2025.

- Critically, our soft-landing scenario also suggests the BoC would very likely have to end its current pause and hike the policy rate by another 50bps to 5.5% by mid-2024.

Tags:

Related Services

Service

Canada Macro Service

Comprehensive coverage of the Canadian economy, providing clients with all of the information they need to assess the impact of developments in the economy on their business.

Find Out More

Service

City Climate Analysis

In-depth insights into the economic impacts of climate change and mitigation policies on cities and local economies throughout Europe, the US and Canada.

Find Out More

Service

Canadian Province and Metro Service

Data and forecasts for Canadian provinces and metropolitan areas.

Find Out More