Housing has become less affordable across all US metros

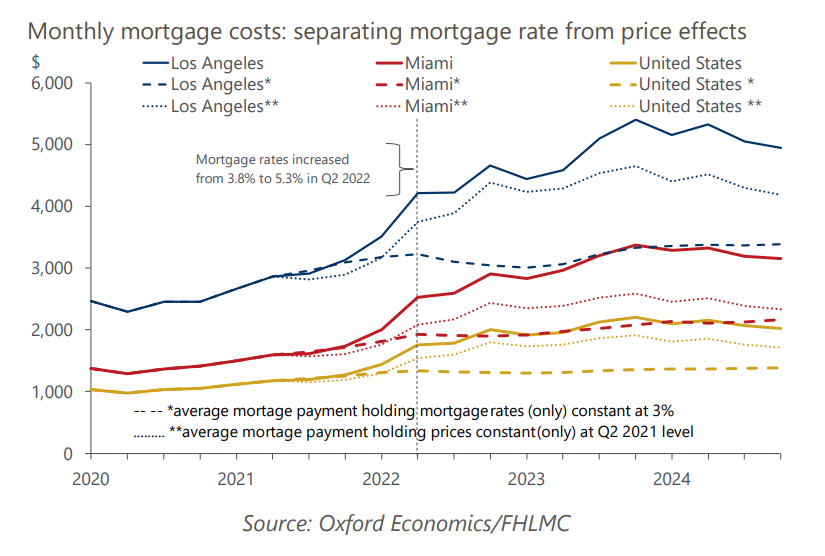

Housing affordability has dropped significantly over the last five years in every major metro as house prices soared and mortgage rates nearly doubled. A household needed to earn an annual income of $107,700 to afford a new single-family home and pay both property taxes and home insurance costs in Q3 2024, nearly twice the household income required to afford the equivalent housing costs in Q3 2019. Only one-third of US households earned enough to afford a home as of last quarter, far fewer than the nearly two-thirds of US households able to do so five years prior.

What you will learn:

- The least affordable metros were San Jose, San Francisco, Honolulu, Los Angeles, and San Diego, where fewer than 15% of households earned enough income to afford their respective housing costs in Q3 2024. Five years ago, one-quarter to one-third of households in these metros were able to afford their respective housing costs.

- Metros that saw the biggest drop in affordability include many in Florida as well as others with a large retirement community such as Tucson and Myrtle Beach.

- Of the largest 50 metros, the more affordable ones were mostly in the Midwest: Cleveland, Louisville, Detroit, and St. Louis, as well as Oklahoma City and Memphis, where the income required to cover housing costs ranged from $64,600 to $75,300. Close to half the households in these metros earned this much or more. The most affordable metros across the US were Decatur, IL; Cumberland, MD; Youngstown, OH; Charleston, WV; and Elmira, NY, where nearly two-thirds of households could afford median priced homes.

Tags:

Related Services

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

City Scenarios Service

Assess the impact of risk scenarios on cities and regions. Our service provides a baseline forecast and three alternative scenarios for a broad range of economic and demographic indicators for each location.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More