Research Briefing

| Apr 9, 2024

How inflation eroded governments’ debts and why it matters

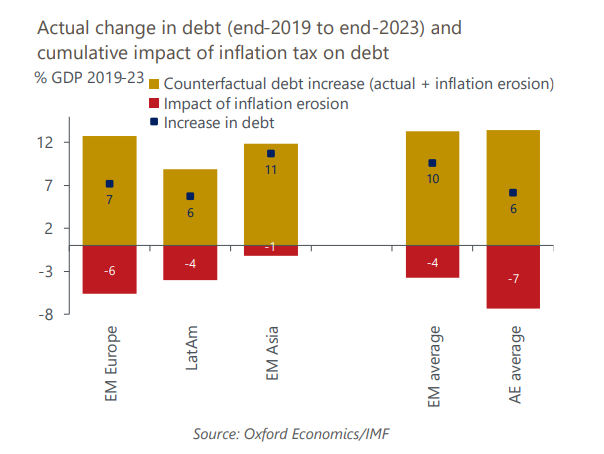

The supply-shocks era represented the first time in a generation where inflation significantly eroded the real value of global public debt. For EMs, the erosion averaged 3.7% of GDP between 2020 and 2023; the average for advanced economies (AEs) was twice that (7.3% of GDP).

What you will learn:

- The inflation tax per unit of debt was similar in EMs and AEs; in each case, real effective interest rates were on average 2.5% lower in 2020-2023 relative to 2019, but the overall impact on inflation erosion was bigger in AEs because debt-to-GDP ratios are higher.

- Inflation erosion was much bigger in European economies given the bigger spikes in inflation. Greece’s erosion of 26% of GDP is extraordinary, exceeding the debt reduction achieved in the 2010s’ crisis period of extreme austerity and debt restructuring.

- The period turned preconceptions upside down regarding the location of safe havens for global bonds, as EM policymakers got ahead of the curve and enhanced credibility relative to advanced economies. Total cumulative returns on average EM government bonds was 1% in the four years after Covid hit, but -12% for AEs. Average returns for safe havens US and Japan were -13%; the average for four riskier sovereigns (Mexico, Brazil, South Africa and Colombia) was +11%.

Tags:

Related Services

Service

Emerging Markets Asset Manager Service

Emerging markets insight and opportunity at your fingertips.

Find Out More

Service

Global Macro Strategy Service

Global insight and opportunity at your fingertips.

Find Out More

Service

Global Asset Manager Service

A complete solution for asset managers who require convenient access to high quality, market-relevant analysis on key global markets.

Find Out More