How the surge in interest rates is crushing UK affordability

We estimate the recent surge in swap rates – a key driver of mortgage rates – means that UK house prices are 37% overvalued based on mortgage affordability. Though other metrics suggest prices are less stretched, we expect the plunge in affordability will cause a sharp drop in new buyer demand and forecast house prices will drop by 10%-15% over the next two years.

What you will learn:

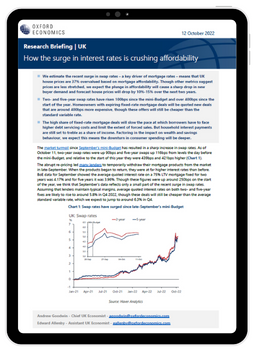

- Two- and five-year swap rates have risen 100bps since the mini-Budget and over 400bps since the start of the year. Homeowners with expiring fixed-rate mortgage deals will be quoted new deals that are around 400bps more expensive, though these offers will still be cheaper than the standard variable rate.

- The high share of fixed-rate mortgage deals will slow the pace at which borrowers have to face higher debt servicing costs and limit the extent of forced sales. But household interest payments are still set to treble as a share of income. Factoring in the impact on wealth and savings behaviour, we expect this means the downturn in consumer spending will be deeper.

Tags:

Related Services

Service

UK Macro Service

Track, analyse, and react to macro events and future trends in the United Kingdom.

Find Out More

Service

European Cities and Regions Service

Regularly updated data and forecasts for 2,000 locations across Europe.

Find Out More

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More