Blog | 28 Jan 2025

How will the new administration’s policies affect US metros in 2025?

Barbara Byrne Denham

Senior Economist, Cities & Regions

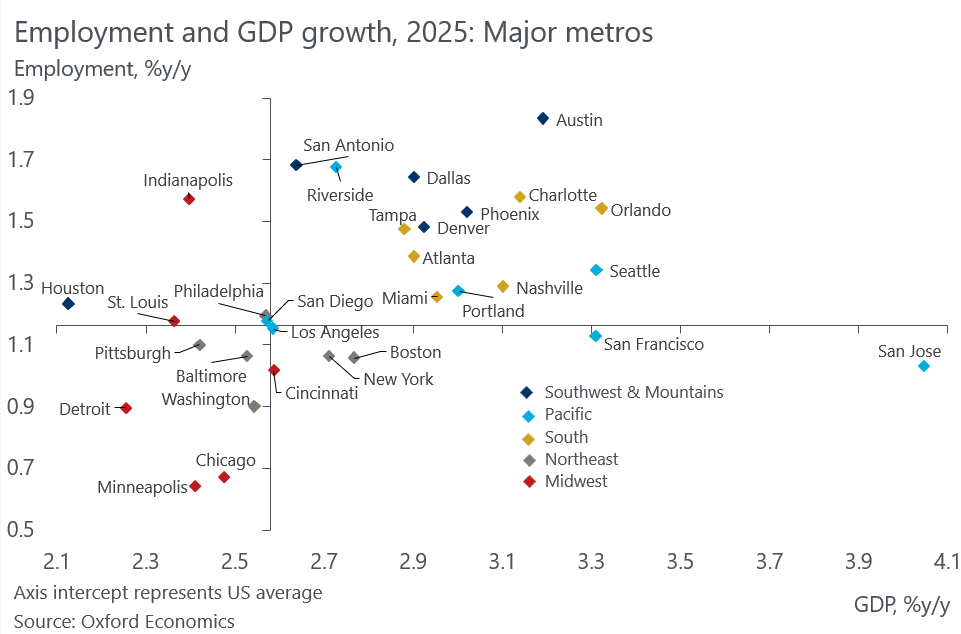

The major policy proposals planned for the second Trump administration will have mixed implications for the US economy in 2025 and beyond, and the impacts on metro areas will vary significantly. We forecast robust GDP growth across the largest 50 metros in 2025 following a healthy yet disparate 2024. Fiscal stimulus via an extension of the 2017 tax cuts will boost consumer spending next year, generating higher GDP growth for half the metros. We forecast lower job growth in 2025, however, due to weak demographics and fewer healthcare job gains.

Each of the largest 50 metros are forecast to see GDP growth again in 2025. Fueled by their tech sectors, San Jose, Orlando, Seattle, San Francisco, and Austin are forecast to lead GDP growth in 2025. Houston, Detroit, St. Louis, Indianapolis, and Minneapolis are expected to trail.

Following a rough Q4 2024 hampered by two hurricanes and the Boeing strike, we anticipate that all the top 50 metros will add jobs in 2025. Yet fewer than half will see healthier job growth in 2025 than in 2024. Austin, San Antonio, Riverside, Dallas, and Charlotte are forecast to lead growth. Minneapolis, Chicago, Detroit, Washington, and Cincinnati will trail. Construction job growth differentiates the fast-growing metros from the slow-growing ones.

Author

Barbara Byrne Denham

Senior Economist, Cities & Regions

+1 (646) 503 3061

Barbara Byrne Denham

Senior Economist, Cities & Regions

New York, United States

As a senior economist at Oxford Economics, Barbara brings a seasoned approach to the study of US cities. She works in Oxford Economics’ division of Cities and Regions analysis where she leads in writing reports on US metros. Prior to joining Oxford Economics, she worked six years for Moody’s Analytics REIS where she did similar work and wrote a number of white papers covering metro-level analyses including the Impact of the Tax and Jobs Act on Commercial Real Estate; Amazon HQ2, a Scoring Analysis; and the Economics of College Towns. Barbara’s work is frequently cited by the Wall Street Journal, New York Times, Crains New York Business and numerous other publications.

Prior to working at Moody’s, Barbara worked more than 20 years at various commercial real estate firms including Jones Lang LaSalle and Eastern Consolidated where she focused on writing market reports and white papers.

Barbara holds a bachelor’s in business administration from the University of Notre Dame and is a Ph. D. candidate in Economics from New York University.

Tags:

You may be interested in

Post

Which regions are most exposed to the 25% automotive tariffs?

While the automotive tariffs will likely lead to some production being reshored to US plants, they will also raise costs for US manufacturers and households.

Find Out More

Post

Housing affordability lowest in Greek, Danish, and German cities

House prices across Europe have soared over the past decade, especially in cities. During this time, incomes in Europe have not kept pace with house price hikes on average, squeezing the purchasing power of homebuyers in many European cities.

Find Out More

Post

Parsing US federal job cuts by metro

Cuts to the Federal government workforce, which we estimate to be 200,000 in 2025, will have a modest impact nationally, but more significant implications for the Washington, DC metropolitan economy as it accounts for 17% of all non-military federal jobs in the US.

Find Out More