Ignore US gold imports, net trade is weak but not disastrous

The nominal goods trade deficit was at its widest in January, signaling businesses had front-loaded goods shipments ahead of new and potential tariffs from the Trump administration. However, the $34.6bn surge in imports has some intricacies, which will ultimately blunt the negative impact on Q1 GDP growth.

What you will learn:

- Our trade nowcast estimates net trade will subtract 2ppts from GDP growth in Q1. The recent rise in gold investment assets was excluded from our nowcast because the Bureau of Economic Analysis doesn’t include it in its GDP calculation. This will still contribute to weaker GDP growth in Q1 than in prior quarters, though noticeably less than the 3.6ppt drag if gold was included.

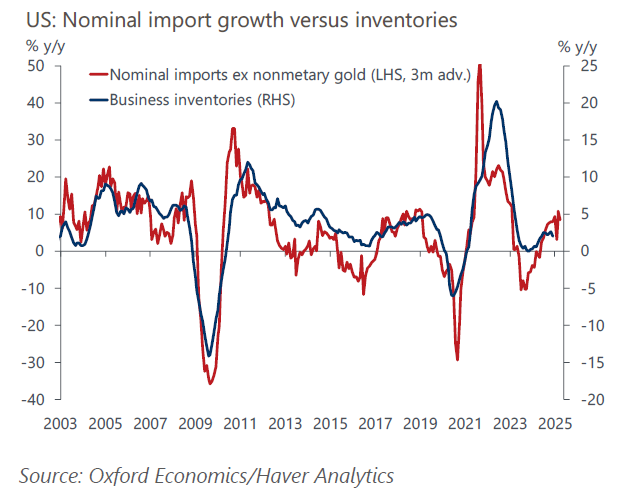

- Slower headline GDP isn’t an omen for a recession, as some of the impacts will balance out in future quarters. Many of these imports will make their way into inventories, offsetting some of the negative contribution to growth from imports, and there will be payback from front-loading in the future as import levels decline alongside bloated inventories.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More

Service

Global Commodity Service

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More